Have you ever wondered what would happen to your nonprofit if a disaster struck tomorrow? Whether it is a volunteer accident, property damage from a storm, or a cyber breach compromising sensitive data, unexpected risks can quickly derail your mission.

You are doing incredible work for your community. However, without the right Nonprofit Insurance in Texas, all of that effort could be jeopardized.

It is easy to feel lost in a sea of information. You might wonder, “Where do I even start?” You may have scrolled through countless articles or asked for advice, only to feel more confused.

Here is the good news: you do not have to navigate these challenges alone. At Thumann Insurance Agency, we have been helping Texas nonprofits for nearly 30 years. We know exactly what you need to keep your organization safe, compliant, and ready for whatever comes next.

In this guide, you will learn:

-

The essential insurance policies every Texas nonprofit needs.

-

How to safeguard your nonprofit against common risks.

-

What factors influence nonprofit insurance costs.

-

Why Texas-specific insurance coverage is critical for your organization.

Let us walk you through the simple steps to protect your nonprofit so you can focus on your mission.

What Does Nonprofit Insurance Look Like for Texas Organizations?

Nonprofit insurance isn’t a one-size-fits-all solution. It is a tailored bundle of policies designed to protect mission-driven organizations from financial setbacks.

Nonprofits in Texas face unique risks. You likely deal with tight budgets, reliance on volunteers, and the potential for unexpected events like severe weather, public interactions, and fundraising risks.

Organizations in cities like Dallas, Austin, and Houston are particularly vulnerable to Texas-specific issues such as hailstorms, floods, or hurricanes. Because of this, they rely heavily on general liability, property insurance, and event coverage.

For example:

-

A community center in McKinney might need protection for volunteers working at a youth event.

-

A shelter in Plano could require flood coverage due to nearby river risks.

Without the right insurance, nonprofits risk major setbacks from these challenges. This ultimately hinders their ability to continue their work.

In Texas, nonprofits come in many forms, from youth programs to animal rescues, churches, and food banks. Each faces its own set of risks.

Common Nonprofit Types in Texas Include:

-

Community support and youth mentoring programs.

-

Churches and faith-based gatherings.

-

Educational foundations and arts or culture organizations.

-

Shelters, food banks, and animal rescues.

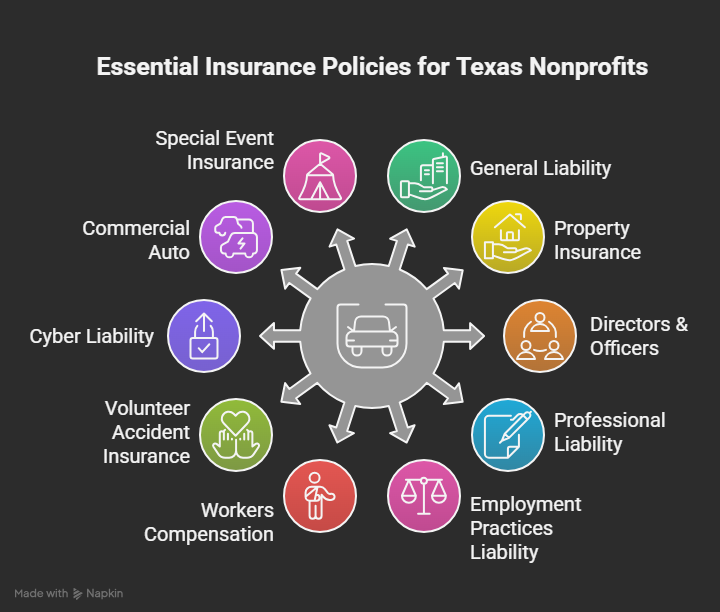

Which Essential Insurance Policies Does Every Texas Nonprofit Need?

Nonprofits in Texas face various risks, from property damage to volunteer injuries and cyber breaches. Below is a step-by-step breakdown of the core insurance policies every nonprofit should have to mitigate these risks.

1. General Liability Insurance

General liability insurance is vital for all nonprofits. It covers your organization for bodily injury or property damage that happens during a program or event.

For example, if a volunteer trips at a community event, this insurance helps cover legal and medical costs. For most nonprofits, $1,000,000 in general liability coverage is necessary to ensure full protection.

The cost for this policy typically ranges from $300 to $1,500 annually, depending on the size and nature of the nonprofit. To learn more about how this compares to other business protections, check out our in-depth look at general liability insurance for businesses. It's a must-read if you're weighing options and want to avoid costly gaps in coverage.

2. Property Insurance

In Texas, unpredictable weather is a reality. Hailstorms in Dallas-Fort Worth and hurricanes on the Gulf Coast can cause extensive property damage.

Property insurance ensures your nonprofit’s buildings, equipment, and contents are covered against such risks. If your nonprofit is located in areas prone to severe weather, like Houston or Denton County, this coverage is essential.

Don't overlook related risks; explore our guide on commercial property insurance in Texas to see real examples of how it safeguards assets during storms, ensuring you don't miss out on tailored strategies for your location.

3. Directors and Officers (D&O) Insurance

Nonprofits often rely on a board of directors and executive officers. Directors and officers (D&O) insurance protects these individuals from claims made against them for alleged "wrongful acts" in their roles.

If there is a governance dispute or a decision that goes wrong, D&O insurance ensures your leadership team is protected personally. This is especially important for nonprofits in Frisco and Irving, where community engagement can lead to higher exposure to governance-related risks.

4. Professional Liability Insurance

If your nonprofit offers services like counseling, education, or healthcare, professional liability insurance (also called errors and omissions) is vital. It covers claims of negligence, misrepresentation, or inadequate advice.

For a deeper dive into how this differs from general coverage, our article on general liability vs. professional liability breaks it down clearly and you'll gain insights that could prevent unexpected legal headaches down the road.

5. Employment Practices Liability Insurance (EPLI)

This coverage is vital for any nonprofit with staff. EPLI protects your nonprofit in the event of a lawsuit alleging wrongful termination, discrimination, sexual harassment, or other workplace-related issues.

Nonprofits in areas like Collin County and Garland, where diverse staff and volunteer teams operate, will find this coverage particularly important.

6. Workers Compensation Insurance

In Texas, nonprofits with employees are required to carry workers compensation insurance. This coverage helps pay for medical expenses and lost wages if an employee is injured while on the job.

Note: While volunteers are generally not covered under workers comp, some policies offer volunteer accident coverage, which is crucial for organizations that rely on unpaid help.

7. Volunteer Accident Insurance

If your nonprofit depends on volunteers, volunteer accident insurance provides protection if they are injured during their work. This is vital for organizations with large volunteer bases in cities like Plano, where volunteer-led activities are common.

8. Cyber Liability Insurance

With more nonprofits going digital, cyber attacks are a growing threat. Cyber liability insurance handles data breaches and donor info theft. This is crucial in tech-savvy spots like Austin.

If you're concerned about digital risks, our post on cyber liability insurance: why it's essential reveals eye-opening stats and tips that could save your organization from devastating breaches.

9. Commercial Auto Insurance

For nonprofits using vehicles for transport or deliveries, this covers accidents, damage, and injuries. In areas like Denton and Frisco with rural outreach, it ensures safe operations.

Curious about the differences from personal policies? Our comparison of commercial vs. personal auto insurance highlights key distinctions you'll want to know before hitting the road.

10. Special Event Insurance

Nonprofits frequently hold fundraising events such as galas, races, or festivals. Special event insurance covers accidents, injuries, or cancellations during these events. It ensures that your organization doesn’t bear the financial burden of unforeseen issues.

How Do Coverage Needs Shift Across Texas Regions?

Texas’s vast geography influences the types of risks nonprofits face. This shapes the specific coverage they need. Whether it is the hailstorms in Dallas-Fort Worth or the hurricane season in Houston, nonprofits need region-specific coverage to stay protected.

What Texas-Specific Risks Make Insurance Essential?

Texas’s unique weather and community dynamics make nonprofit insurance a necessity. Nonprofits in the Lone Star State face the following key risks:

-

Weather Extremes: From northern hailstorms and tornadoes to coastal hurricanes and floods, these can damage property and disrupt events making property and event insurance must-haves. If floods are a concern, our guide on do I need flood insurance in Texas explains the hidden dangers and how to prepare, so you won't be caught off guard by rising waters.

-

Public Events: Nonprofits often host public events that increase the risk of injury claims. Having general liability insurance can help cover these potential incidents.

-

Volunteer Operations: Volunteers are at risk of accidents while working for nonprofits. Volunteer accident insurance ensures that medical expenses are covered.

-

Cyber Threats: As more nonprofits collect and store sensitive data online, cyber liability insurance protects against data breaches and theft.

-

Auto Incidents: Many nonprofits rely on vehicles for outreach, and commercial auto insurance covers accidents during transit.

How Does Insurance Solve Common Nonprofit Challenges?

Running a nonprofit involves navigating numerous challenges. Whether it is recovering from property damage, dealing with injuries at events, or handling cyber breaches, nonprofit insurance can provide the protection your organization needs to stay on track.

Here are some common struggles and how insurance helps:

-

Property Damage Straining Budgets: Property insurance helps cover repairs or replacements after unexpected events like storms or fires.

-

Event Injuries: General liability and volunteer accident coverage provide protection for accidents during fundraising or community events.

-

Leadership Claims: D&O insurance shields your organization’s board members and officers from legal claims.

-

Data Breaches: Cyber liability coverage helps protect against the fallout of data theft, a growing concern for nonprofits.

-

Outreach Accidents: Commercial auto insurance ensures coverage for accidents involving vehicles used for outreach or transport.

-

Cancellations: Special event insurance can cover financial losses if an event is canceled due to unforeseen circumstances.

Why Choose Thumann Insurance Agency for Nonprofit Insurance?

Thumann Insurance Agency has been the trusted choice for Texas nonprofits since 1996. With nearly three decades of experience and a 4.9-star client satisfaction rating, the agency simplifies complex insurance needs, offering tailored coverage for organizations of all sizes.

Whether you're a youth center in Dallas or a food bank in Houston, Thumann ensures comprehensive Nonprofit Insurance in Texas protecting your mission, staff, and volunteers.

Here’s why Texas nonprofits choose Thumann:

-

Access to 80+ Carriers: As an independent broker, Thumann offers quotes from top insurers such as Hartford, Travelers, and Progressive, providing competitive rates and customized coverage tailored to nonprofit needs.

-

Local Expertise: With deep knowledge of Texas-specific risks such as hailstorms in Dallas, floods on the Gulf Coast, and hurricanes along the coast Thumann ensures your nonprofit is covered against regional weather events and local regulations.

-

Fast Certificates and Same-Day Quotes: Ideal for meeting grant requirements, policy renewals, or urgent event needs, Thumann helps your nonprofit stay compliant and operational without delays.

-

Comprehensive Nonprofit Protection: From general liability to directors and officers insurance (D&O) and cyber liability, Thumann offers a full range of coverage options to ensure your nonprofit remains resilient in the face of risks.

-

Reliable Claims Support: Thumann’s dedicated agents are there to guide you through the claims process, helping you recover quickly and minimize downtime after a loss, ensuring the continuity of your important services.

With Thumann Insurance Agency, Texas nonprofits receive more than just a policy. They gain a reliable partner who understands the unique challenges nonprofits face, providing clarity, value, and lasting peace of mind.

Frequently Asked Questions About Nonprofit Insurance in Texas

What kind of insurance do nonprofits need in Texas?

Nonprofits in Texas usually need a mix of policies like general liability, property insurance, D&O coverage, workers compensation, and cyber liability to handle various risks. For more on nonprofit structures, see the IRS guide on charitable organizations.

How much does $1,000,000 general liability insurance cost for a nonprofit?

The cost can vary based on your specific needs. However, on average, a nonprofit might pay between $300 and $1,500 per year. This depends on the size and type of the organization.

Does my nonprofit need directors and officers insurance?

Yes, D&O insurance is highly recommended. It protects your board members and officers from personal financial liability related to the decisions and actions they take while leading the organization.

What is the mandatory insurance coverage in Texas for nonprofits?

Texas generally requires nonprofits to carry workers compensation if they have employees. General liability is often required for public-facing events or by venues. However, additional coverage is highly recommended to fully protect the organization.

What is the difference between a nonprofit and a 501c3 for insurance purposes?

A 501c3 is a tax-exempt nonprofit type. Insurance needs are similar, but 501c3 status might open up specific funding or coverage options. Learn more from Wikipedia's page on nonprofit organizations.

Ready to Secure Your Nonprofit's Future?

Protecting your nonprofit with the right insurance ensures that you can continue to serve your community without the worry of unexpected setbacks. Contact Thumann Insurance Agency today to get a personalized quote based on your nonprofit’s needs.

Request Your Free Quote | Call: (972) 991-9100