Have you ever worried about what would happen if a sudden storm ruined your outdoor wedding or if your caterer didn’t show up on the big day? These are common fears. While you can plan every detail, you cannot control the weather or other people. But what if you could protect your investment from these unpredictable risks?

We know how stressful it is to scroll through confusing websites looking for answers. You are not alone, many of our clients felt the same way before finding the right protection. Wedding and special event insurance is the safety net that gives you peace of mind. With Thumann Insurance Agency, we make it simple to secure your special day against the unexpected.

In this guide, you will learn:

-

What wedding and event insurance actually covers.

-

The specific risks in Texas that make coverage essential.

-

How to determine if you need insurance for your event.

-

The costs involved and how to get the best value.

Why Is Wedding & Special Event Insurance Essential in Texas?

Texas is famous for its hospitality, but it is also known for unpredictable weather and busy event seasons. Hosting an event here comes with unique risks. As weddings, festivals, and parties grow in popularity, having reliable insurance is no longer optional, it is a necessity.

Here is why you need protection:

-

Unpredictable Weather: A sunny day in Plano or Frisco can turn into a hailstorm or flood. If weather cancels or moves your ceremony, insurance recovers lost funds. For tips on handling such storms, our guide to spring storms in Texas shares real stories and prep steps you'll wish you knew earlier to avoid disaster.

-

Vendor Reliability Issues: During peak seasons, vendors are overbooked. If a photographer or caterer goes out of business or simply doesn't show up, insurance covers lost deposits and the cost of finding a last-minute replacement.

-

Liability for Guests: Accidents happen. If a guest slips on a dance floor or damages venue property, you could be held responsible. Insurance handles the medical bills and legal costs so you don't have to pay out of pocket.

-

Venue Contracts: As cities like McKinney and Little Elm grow, venues are becoming stricter. Most now require a Certificate of Insurance before they will even confirm your booking.

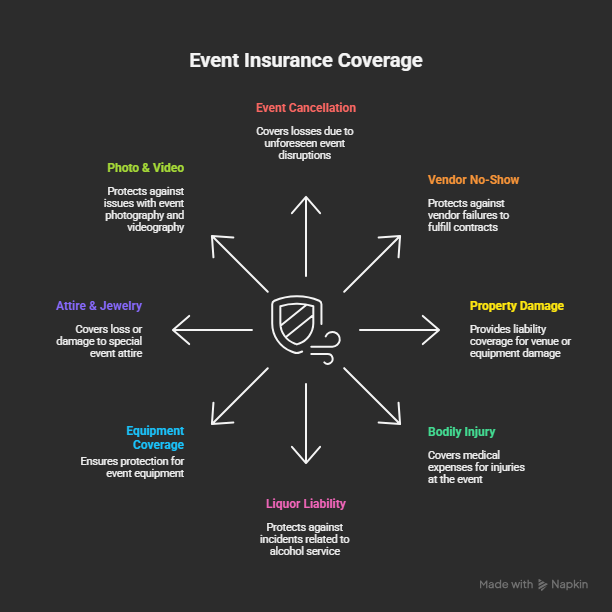

What Specific Protections Does Event Insurance Offer?

Think of wedding and special event insurance as a shield for your budget. It covers the problems you didn't see coming. Here is a breakdown of the key protections:

-

Event Cancellation or Postponement: If you must cancel due to severe weather, serious illness, or a family emergency, this coverage reimburses your non-refundable deposits. If you are planning a celebration later in the year, checking our guide on holiday event insurance Texas is essential for understanding seasonal specific risks.

-

Vendor No-Show Protection: This ensures you get your money back if a key vendor (like a DJ, florist, or caterer) fails to arrive or deliver the agreed-upon services.

-

Property Damage Liability: If you or a guest accidentally damages the venue like breaking a window or staining a carpet—this pays for the repairs.

-

Bodily Injury Liability: This covers medical expenses and legal fees if a guest gets injured during your event.

-

Liquor Liability: If you are serving alcohol, this is critical. It protects you if an intoxicated guest causes an accident, injures someone, or damages property.

-

Equipment Coverage: This protects rented items like sound systems, marquees, lights, and tables from damage, loss, or theft.

-

Special Attire & Jewelry: If your wedding dress or rings are lost, stolen, or damaged before the big day, this coverage pays to repair or replace them.

-

Photo & Video Protection: If the photographer's camera is stolen or the memory cards are corrupted, this compensates you for the loss of your memories.

To see why this is crucial, dive into our post on why you need to say yes to wedding insurance, it's packed with examples that could save your day from turning into a nightmare.

How Do Insurance Needs Vary Across Texas Regions?

Texas is huge, and the risks change depending on where you are. A wedding in the Hill Country faces different challenges than a corporate gala in Dallas.

What Texas-Specific Risks Threaten Your Special Day?

Beyond just weather, there are logistical risks specific to hosting events in busy Texas hubs like Farmers Branch, Mesquite, and Highland Village.

-

Severe Weather Cancellations: Texas storms are sudden. From thunderstorms to tornado warnings, bad weather is the number one cause of event claims.

-

Transportation Delays: Traffic in major metros like Dallas or Austin can cause vendors to arrive late or miss delivery windows entirely.

-

Strict Venue Mandates: Many popular Texas venues will not let you set foot on the property without proof of liability insurance.

-

Alcohol-Related Liability: With the festive culture in Texas, open bars are common. This increases the risk of alcohol-related incidents, making liquor liability a "must-have."

When Should You Purchase Event Insurance?

Timing is everything. Buying insurance too late can leave you unprotected against known storms or existing issues.

-

Buy Early: Ideally, purchase your policy as soon as you put down deposits on your venue or vendors. This locks in your cancellation coverage.

-

The "Cold Feet" Rule: Most policies do not cover a change of heart, so buy insurance to cover external factors, not personal doubts.

-

Weather Restrictions: You typically cannot buy coverage for a storm that has already been named or forecast. Buying early protects you from weather patterns that develop later.

-

Before the Final Payment: Ensure your policy is active well before your final vendor payments are due so your entire investment is secure.

Which Common Disasters Can Event Insurance Prevent?

By securing a policy, you are proactively solving these potential nightmares:

-

Sudden Cancellations: Recovers costs if the event is called off due to reasons beyond your control.

-

Unexpected Bills: Prevents you from paying out of pocket for venue repairs after accidental damage.

-

Vendor Ghosting: reimburses you if a vendor takes your deposit and disappears.

-

Legal Lawsuits: Handles the legal costs if a guest sues you over an injury.

-

Stolen Gifts: reimburses the value of wedding gifts or decorations stolen during the event.

For flood-related worries, check our insights on do I need flood insurance in Texas, it's eye-opening for event planners in risky areas, helping you decide if extra layers are needed.

Why Texas Choose Thumann Insurance Agency for Event Coverage

Thumann Insurance Agency has been the trusted choice for Texas event hosts since 1996. With nearly three decades of experience and a 4.9-star client satisfaction rating, the agency simplifies complex coverages like wedding liability insurance and event cancellation insurance. We ensure complete Wedding & Special Event Insurance Texas, from unexpected vendor no-shows to severe weather disruptions.

Here’s why Texans choose Thumann Insurance Agency for their wedding and special event insurance needs:

-

Access to 80+ Carriers: As an independent broker, Thumann offers quotes from top insurers such as Hartford, Travelers, and Progressive, providing competitive rates and customized coverage for every type of event, from weddings to corporate galas.

-

Local Expertise: Deep knowledge of Texas’ unique risks like Dallas hailstorms, Gulf Coast hurricanes, and the state’s weather-related event disruptions ensures that your coverage is tailored to the specific needs of your venue and event location.

-

Fast Certificates and Same-Day Quotes: Ideal for meeting venue and vendor requirements, our quick certificate delivery helps ensure your event stays compliant and on schedule.

-

Comprehensive Event Protection: From wedding cancellation coverage to liability protection for guests, Thumann offers complete protection for your event, including coverage for weather disruptions, vendor failures, and more.

-

Reliable Claims Support: Our dedicated agents guide you through the claims process, helping you recover quickly and minimize financial losses in the event of unexpected issues, such as cancellations or damages.

With Thumann Insurance Agency, you get more than just a policy. You gain a reliable partner who understands Texas’ unique event challenges and delivers clarity, value, and lasting peace of mind for your wedding or special event.

FAQs About Wedding & Special Event Insurance in Texas

What does wedding insurance typically cover in Texas?

It covers cancellation from weather or illness, vendor issues, venue damage, guest injuries, and liquor accidents. For a broad overview, see Wikipedia's entry on event insurance.

How much does wedding insurance cost for 150 people?

Prices usually range between $150 and $500. The exact price depends on the level of coverage you choose, the location of the event, and whether you add liquor liability.

Do wedding venues in Texas require event insurance?

Yes, most professional venues require it. They usually ask for a Certificate of Insurance (COI) showing proof of General Liability coverage to protect their property.

What does wedding insurance NOT cover?

Policies typically do not cover a "change of heart" (calling off the wedding voluntarily), pre-existing medical conditions, or failure to pay vendors on time.

Is wedding insurance worth it for my Texas event?

Absolutely. For a small fraction of your total budget, it protects thousands of dollars in deposits and saves you from potential lawsuits. It is peace of mind that is worth every penny.

Ready to Protect Your Texas Event? Get Covered Now!

Don't let the unexpected ruin your celebration. Protect your event with Thumann Insurance Agency. Whether it’s a wedding, quinceañera, or corporate gala, we offer tailored coverage to meet your needs.

Get your free quote today!

Call now: (972) 991-9100