Have you ever worried that a sudden ice storm or a missing vendor could ruin the holiday party you spent months planning? In Texas, winter weather is unpredictable. One day it is sunny, and the next, roads are iced over. For event organizers, this uncertainty can turn a joyful celebration into a stressful financial disaster.

Holiday Event Insurance is your safety net. It protects you from the financial costs of cancellations, property damage, and guest injuries. At Thumann Insurance Agency, we help you celebrate with confidence. We handle the "what ifs" so you can focus on the fun.

In this guide, you will learn:

-

Why Texas winter events are at higher risk.

-

What specific protections you need for guests and venues.

-

How risks change from Dallas to Houston.

-

A simple step-by-step guide to getting covered.

Why Is Holiday Event Insurance Crucial for Texas Winters?

Winter in Texas brings holiday cheer, but it also brings unique risks. You are not just dealing with cold weather; you are dealing with unpredictable elements that can shut down a city overnight.

Why is coverage essential right now?

-

Unpredictable Weather: Texas is famous for flash freezes and ice storms, especially in North Texas. These can force you to cancel your event last minute.

-

Larger Crowds & Alcohol: Holiday parties often mean more guests and open bars. This combination increases the chance of accidents, slips, or property damage.

-

Vendor Overload: Caterers and decorators are busiest in December. If a key vendor cancels or doesn't show up, you need a backup plan that doesn't wreck your budget.

Hosting in suburbs like Allen, Prosper, or Frisco? You might feel secure, but venues often demand your own liability policy. Depending only on theirs is risky, exposing you to suits. For winter prep tips, our guide on how to prepare your home for a winter offers strategies you'll want to apply to events too, avoiding common pitfalls that could derail your plans.

What Does a Comprehensive Event Policy Actually Cover?

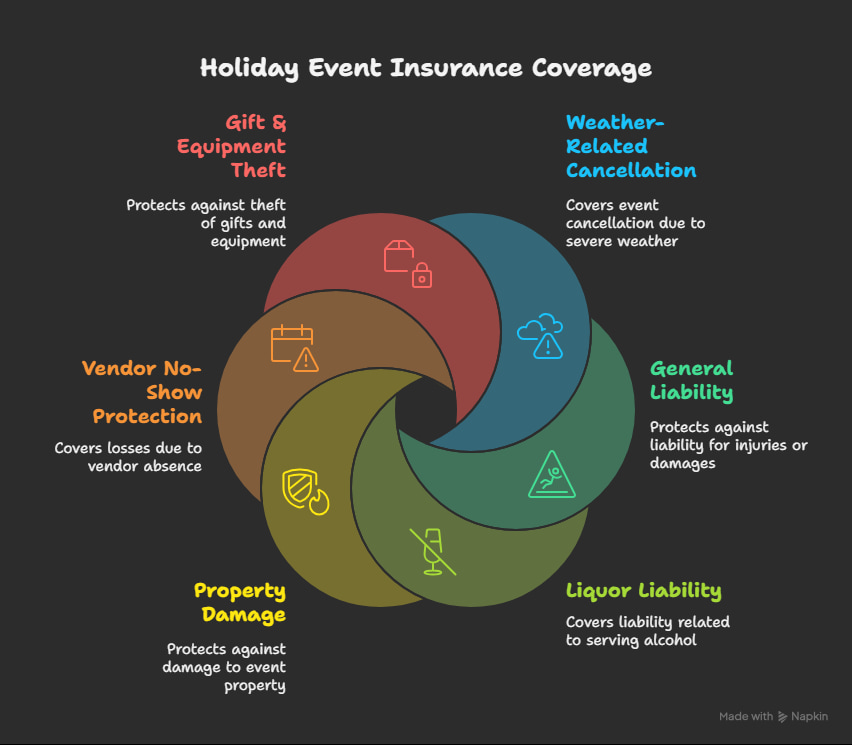

Many people think event insurance is just for cancellations, but it covers much more. Here is a breakdown of the specific protections included in a strong Holiday Event Insurance policy:

1. Weather-Related Cancellation

If an ice storm hits Dallas or flooding strikes Houston, and you must cancel or postpone, this coverage reimburses your lost deposits and non-refundable costs.

2. General Liability (Slips, Falls & Injuries)

This is your most important defense. If a guest slips on an icy sidewalk or trips over a cord, general liability pays for their medical bills and protects you from lawsuits.

3. Liquor Liability

Are you serving cocktails or champagne? If a guest drinks too much and causes an accident or injury later, you could be held responsible. Liquor liability protects you from these specific alcohol-related claims.

4. Property Damage

Accidents happen. If a decoration scratches the venue’s floor or a storm breaks a rented tent, this coverage pays for the repairs so you don’t have to pay out of pocket.

5. Vendor No-Show Protection

If your caterer or DJ fails to show up, this insurance helps cover the cost of hiring a last-minute replacement or reimburses your lost deposit.

6. Gift & Equipment Theft

Holiday events are targets for theft. This aspect of the policy covers you if sound equipment, rented furniture, or even gifts are stolen during the event.

Curious about liability basics? Our post on the importance of liability insurance reveals details that could prevent unexpected claims, ensuring you don't overlook this essential layer.

How Do Risks Vary Across Different Texas Regions?

Texas is huge, and the risks change depending on where your event is held. A party in the Hill Country faces different threats than a festival in Houston.

We have broken down the risks by region to help you understand what you need:

What Real-Life Problems Does Insurance Solve?

Sometimes it helps to see exactly how insurance saves the day. Here are common scenarios we see during the Texas holidays and how the right policy fixes them:

-

The Power Outage: A winter strain on the grid cuts power to your venue.

-

Solution: Equipment breakdown coverage helps pay for rented generators or damaged electronics.

-

-

The Icy Walkway: A guest slips on ice outside your rented hall and breaks an ankle.

-

Solution: General Liability covers their medical costs and legal fees.

-

-

The Missing Santa: Your hired entertainment cancels on the morning of the event.

-

Solution: No-show coverage helps you recover the deposit money you lost.

-

-

The Stolen Gifts: During a corporate party, a pile of employee gifts disappears.

-

Solution: Theft protection reimburses the value of the stolen items.

-

For holiday hazards, check our tips on 6 holiday safety hazards vital insights to sidestep issues that insurance can't always prevent.

How to Secure Coverage: A Simple Step-by-Step Guide

Getting protected is not complicated. Follow these steps to ensure you are fully covered before your guests arrive.

-

Assess Your Risks: Look at your venue contracts. Do they require a Certificate of Insurance (COI)? Are you serving alcohol?

-

Gather Event Details: You will need the date, location, estimated number of guests, and total budget.

-

Contact a Local Broker: Speak with a Texas-based agent (like Thumann Insurance) who understands local weather patterns.

-

Review the Quote: Make sure "Liquor Liability" is included if you are serving drinks, and check the cancellation terms regarding weather.

-

Get Your Certificate: Once you pay, you receive a Certificate of Insurance to show your venue and vendors.

For hosting advice, our tips for hosting the holiday party shares ideas you'll love, complementing your insurance for a seamless event.

Why Choose Thumann Insurance Agency for Holiday Event Insurance?

Thumann Insurance Agency has been the trusted choice for Texas event organizers since 1996. With nearly three decades of experience and a 4.9-star client satisfaction rating, the agency simplifies complex insurance needs, offering tailored coverage for all types of holiday events.

Whether you're planning a corporate gathering in Dallas or a community festival in San Antonio, Thumann ensures comprehensive Event Insurance in Texas, protecting your event, guests, and vendors.

Here’s why Texas event organizers choose Thumann:

-

Access to 80+ Carriers: As an independent broker, Thumann offers quotes from top insurers like Hartford, Travelers, and Progressive, providing competitive rates and customized coverage tailored to your event’s specific needs.

-

Local Expertise: With in-depth knowledge of Texas-specific risks such as ice storms in Dallas, rain and flooding in Houston, and high winds in Austin, Thumann ensures your event is covered against regional weather events and local regulations, making sure your event remains safe and compliant.

-

Fast Certificates and Same-Day Quotes: Perfect for meeting event deadlines or insurance certificate requirements, Thumann provides quick certificates and same-day quotes, helping you stay compliant and ensuring a smooth event setup without delays.

-

Comprehensive Event Protection: From general liability to liquor liability, equipment coverage, and weather-related cancellation protection, Thumann offers a full range of event insurance options to ensure your event remains resilient in the face of risks.

-

Reliable Claims Support: Thumann’s dedicated agents guide you through the claims process, helping you recover quickly and minimizing downtime after a loss. This support ensures that your event can continue smoothly even in the face of unexpected setbacks.

With the Thumann Insurance Agency, Texas event organizers receive more than just a policy; they gain a reliable partner who understands the unique challenges of hosting events in Texas. Thumann provides clarity, value, and lasting peace of mind, making sure your celebration is fully protected from start to finish.

Frequently Asked Questions (FAQs)

What specific incidents does holiday event insurance cover in Texas?

It covers a wide range of issues including event cancellation due to severe weather, lawsuits if a guest gets injured (liability), damage to the venue, and issues with vendors not showing up. If you serve alcohol, it can also cover alcohol-related accidents.

Does this insurance really cover weather cancellations?

Yes, most policies include "weather postponement" coverage. This means if a snowstorm, ice storm, or severe flood makes it impossible to hold your event, the policy helps cover the money you lost on deposits and setup. For Texas-specific forecasts, check the Texas Department of Transportation's winter travel tips.

What is typically NOT covered by event insurance?

Insurance usually won't cover problems caused by your own negligence or illegal acts. It also typically excludes "known" risks that existed before you bought the policy, or intentional damage caused by the organizer.

How much should I budget for event insurance in Texas?

It is very affordable. For a small party, it might cost between $100 and $500. For large festivals or corporate galas with hundreds of people, it usually ranges from $1,000 to $3,000.

When is the best time to buy the policy?

Do not wait until the last minute. You should buy it as soon as you book your venue, or at least 3 to 4 weeks before the event. If you buy it after a storm is already forecast, weather coverage may not apply.

Ready to Cover Your Winter Event? Secure Protection Today!

Don't let an unpredictable Texas winter ruin the event you worked so hard to plan. Secure comprehensive protection for your holiday celebration and enjoy peace of mind knowing you, your guests, and your budget are safe.

Contact Thumann Insurance Agency today for a free quote before you book your venue!

Get Your Free Quote | Call: (972) 991-9100