Operating a business in Dallas, Texas, involves navigating a range of potential risks, from customer interactions to unpredictable weather events. Whether you manage a food truck in Deep Ellum, a tech startup in Uptown, or a construction firm in the suburbs, incidents such as customer injuries or property damage can disrupt your operations and financial stability. General liability insurance serves as a vital safeguard, covering costs associated with lawsuits or accidents involving third parties.

This guide provides a detailed examination of what this insurance entails, who needs it, what it covers, and how it applies to Dallas businesses. You will find insights into costs, claims processes, and risk management strategies, all designed to help you make informed decisions to protect your enterprise.

What is General Liability Insurance?

General liability insurance protects businesses from financial losses due to claims of bodily injury, property damage, and personal and advertising injury caused to third parties. For instance, if a customer slips on a wet floor in your Dallas retail store and files a lawsuit, this insurance covers medical expenses and legal fees.

It differs from professional liability insurance, which addresses errors in services, and workers’ compensation, which covers employee injuries. The primary purpose is to shield your business from the high costs of lawsuits, settlements, or damages, ensuring operational continuity. In Dallas’s busy commercial landscape, this coverage is a practical tool for managing third-party risks.

Why Businesses Need General Liability Insurance

This insurance is valuable for several reasons. In Texas, while not required by state law, it is often mandated by commercial leases, client contracts, or lenders, particularly in Dallas’s competitive real estate market. Financially, it covers legal fees, settlements, and damages, preventing a single incident from causing significant losses.

For example, a small Dallas café could face a $50,000 claim from a customer injury, and insurance absorbs these costs. Additionally, it provides peace of mind, allowing you to focus on operations without constant concern about potential liabilities. In Dallas, where urban density and weather events like hailstorms increase risks, this coverage is highly relevant.

Who Needs General Liability Insurance?

Types of Businesses That Benefit

General liability insurance is relevant for a wide range of businesses, from small startups to large corporations. Retail, restaurants, construction, healthcare, technology, and real estate businesses all face third-party risks that this coverage addresses. In Dallas, specific industries encounter distinct challenges.

Food trucks at festivals, tech startups hosting client demonstrations, and oil and gas firms operating heavy equipment are particularly exposed to liability. Even home-based businesses, such as consultants meeting clients at their residence, benefit from this protection. Any business with public interactions, whether through physical locations, events, or services, should consider this insurance to manage potential claims.

Is General Liability Insurance Mandatory in Texas?

Texas law does not require general liability insurance, but it is often a practical necessity. Commercial leases in Dallas’s urban areas, such as Downtown or the Design District, frequently mandate it as a condition of tenancy. Client contracts, particularly in industries like construction or event planning, may also require coverage.

Lenders financing equipment or property might insist on it to safeguard their investment. Without this insurance, you risk breaching agreements or facing uncovered claims, which could lead to significant financial strain. In Dallas’s business landscape, carrying general liability insurance is often a standard expectation.

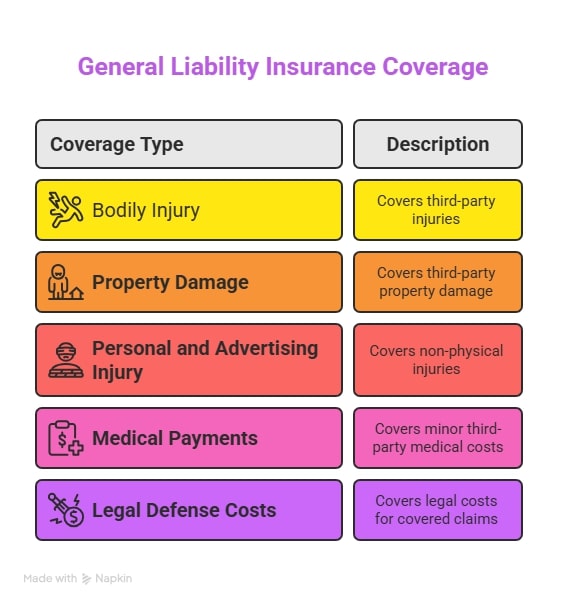

What Does General Liability Insurance Cover?

Bodily Injury

This coverage applies to injuries sustained by third parties, such as customers or visitors, due to your business activities. For example, if a customer slips on a spilled drink in your Dallas coffee shop and fractures a wrist, general liability insurance covers their medical bills and any resulting legal claims. It includes costs for hospital visits, rehabilitation, and lawsuit settlements, protecting your business from substantial financial burdens. This is particularly relevant in high-traffic businesses like retail or hospitality, where accidents are more likely.

Property Damage

If your business accidentally damages a third party’s property, this coverage handles the costs. For instance, a Dallas landscaper’s mower might damage a client’s fence during a job. General liability insurance covers repair or replacement expenses and legal fees if the client pursues a claim. This applies only to third-party property, not your own business assets, ensuring you are protected from external liabilities.

Personal and Advertising Injury

This component addresses non-physical injuries, such as libel, slander, or copyright infringement. If your Dallas advertising agency’s campaign unintentionally copies a competitor’s slogan, leading to a lawsuit, this coverage manages legal costs and damages. It also applies to claims of defamation, such as a negative social media post by your business that prompts legal action. This protection is crucial for businesses engaged in marketing or public communications.

Medical Payments

This coverage handles minor medical expenses for third-party injuries, regardless of fault. For example, if a visitor to your Dallas office twists an ankle on a staircase, the policy might cover their doctor’s visit without requiring a formal claim. This feature aims to resolve small incidents quickly, reducing the likelihood of lawsuits and maintaining positive relationships with customers or visitors.

Legal Defense Costs

General liability insurance covers attorney fees, court costs, and settlements for covered claims. If a customer sues your Dallas gym over an injury from faulty equipment, the policy funds your legal defense, even if the case is dismissed. Legal fees can escalate rapidly, and this coverage ensures your business is not drained by these expenses, allowing you to focus on operations during a dispute.

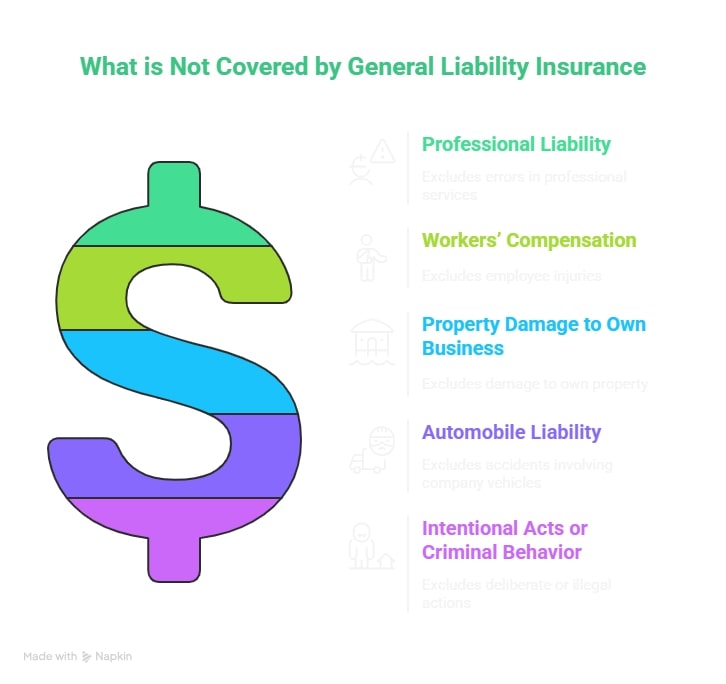

What is Not Covered by General Liability Insurance?

Professional Liability

Errors in professional services, such as a Dallas consultant providing incorrect financial advice, are not covered. You need professional liability insurance, also known as errors and omissions insurance, to address these risks. This is essential for service-based businesses like accounting or legal firms.

Workers’ Compensation

Injuries to employees, such as a server’s burn in a Dallas restaurant, fall under workers’ compensation insurance. Texas does not require workers’ comp, but it is advisable for businesses with employees to protect against workplace injury claims.

Property Damage to Your Own Business

Damage to your own property, such as a flood in your Dallas storefront, requires commercial property insurance. General liability focuses solely on third-party property, ensuring you are not responsible for external damages but leaving internal assets unprotected without additional coverage.

Automobile Liability

Accidents involving company vehicles, like a delivery truck in Dallas traffic, need commercial auto insurance. General liability excludes vehicle-related incidents, making separate coverage necessary for businesses with fleets or delivery services.

Intentional Acts or Criminal Behavior

Deliberate damage or illegal actions, such as vandalism by your business, are not covered. General liability applies only to accidental incidents, ensuring that only unintentional liabilities are addressed by the policy.

How Much General Liability Insurance Do You Need?

Factors to Consider

The appropriate coverage depends on your business’s characteristics. A Dallas construction company with heavy equipment needs higher limits than a small retail shop. Key factors include:

-

Business Size: Larger firms with more employees or revenue face greater exposure.

-

Industry: High-risk sectors like construction or healthcare require robust coverage.

-

Location: Dallas’s urban density and weather risks, such as hailstorms, increase liability.

-

Risk Exposure: Businesses with frequent customer interactions, like restaurants, face higher risks.

Contracts or leases may also dictate minimum limits, often $1 million per occurrence, to ensure adequate protection.

Understanding Coverage Limits

Policies specify two limits: per occurrence (the maximum for a single claim) and aggregate (the total for all claims in a policy term). A standard policy offers $1 million per occurrence and $2 million aggregate, suitable for most small to medium Dallas businesses. High-risk industries, like oil and gas, may require $2 million per occurrence or more. Under-insuring leaves you vulnerable to uncovered claims, while over-insuring inflates premiums. Consulting an agent helps balance coverage and cost effectively.

Cost of General Liability Insurance

Factors Affecting Premiums

Premiums are influenced by multiple factors:

-

Business Type: High-risk industries like construction or manufacturing pay more than low-risk ones like consulting.

-

Location Risks: Dallas’s urban challenges, including traffic and crime, and weather events like hail or tornadoes, elevate costs.

-

Claims History: Previous claims suggest higher risk, increasing premiums.

-

Coverage Limits and Deductibles: Higher limits or lower deductibles raise costs.

-

Revenue and Payroll: Larger businesses with higher revenue or more employees pay more.

For example, a Dallas contractor might pay more than an Austin retailer due to industry risks and urban factors.

Average Costs in Texas and Dallas

According to Insureon, small businesses nationally pay about $42 per month for general liability insurance. In Texas, costs range from $50 to $60 per month due to urban and weather-related risks. Dallas businesses often fall in this range, with premiums varying by industry. A small retail store might pay $45 per month, while a construction firm could pay $100 per month or more. Costs depend on specific business details, so obtaining a tailored quote is advisable to understand your expenses.

Strategies to Reduce Premiums

-

Bundle Policies: Combine general liability with property or auto insurance for discounts.

-

Enhance Safety: Install security systems or maintain premises to lower risks.

-

Compare Quotes: Obtain quotes from multiple insurers to find cost-effective options.

-

Increase Deductibles: Higher deductibles can lower premiums if you can afford out-of-pocket costs.

-

Maintain a Clean Claims History: Avoiding claims keeps premiums stable over time.

General Liability Insurance in Texas

State-Specific Regulations

Texas does not mandate general liability insurance, but many practical scenarios require it, such as leases or client contracts. Policies must adhere to Texas Department of Insurance (TDI) guidelines, which ensure fair claim handling and policy terms. Insurers operating in Texas must be licensed by TDI, and businesses should verify this to avoid unreliable providers. TDI also regulates claim response times, requiring insurers to acknowledge claims within 15 days to ensure timely processing.

Common Claims in Texas

-

Slip-and-Fall Accidents: Frequent in retail, restaurants, and hospitality, especially in high-traffic Dallas areas.

-

Weather-Related Damage: Hail and wind claims are common, with Texas ranking high for severe weather incidents.

-

Product Liability: Defective products lead to claims, particularly in manufacturing or retail.

A 2024 TDI report noted that slip-and-fall and weather-related claims account for a significant portion of general liability payouts in Texas, highlighting the need for coverage.

Local Considerations for Dallas Businesses

Dallas presents unique challenges that impact liability:

-

Urban Risks: High traffic, pedestrian activity, and crime rates increase liability exposure in areas like Downtown or Oak Lawn.

-

Weather Risks: Hailstorms and tornadoes, frequent in Dallas County, drive claims for property damage, affecting businesses with outdoor operations.

-

Economic Factors: Dallas’s thriving economy, with industries like tech, oil, and real estate, creates a dense business environment where liability protection is critical.

A 2024 study by the National Weather Service highlighted Dallas as a hotspot for hail-related property damage, impacting businesses such as car dealerships or outdoor venues. These factors make general liability insurance particularly relevant for Dallas enterprises.

Finding General Liability Insurance in Dallas, Texas

Local Insurance Agents and Brokers

Working with a local agent offers advantages, as they understand Texas regulations and Dallas-specific risks, such as urban density or severe weather. Agents can tailor policies to your industry, whether you run a food truck or a tech firm. Examples include Thumann Agency, Quote Texas Insurance, and Wise Insurance Group, all experienced in serving Dallas businesses. Local expertise ensures your policy addresses both state and regional requirements effectively.

Online Options and Comparison Tools

Online platforms like Insureon, Simply Business, or The Hartford allow you to compare quotes from national and regional insurers. These tools are convenient for gathering multiple options quickly but may lack the localized expertise of a Dallas agent. Ensure online policies comply with TDI regulations and address Dallas-specific risks, such as weather-related claims, to meet your business’s needs.

Choosing a Dallas-Based Agent

Select an agent with experience serving local industries, from retail to oil and gas. Look for affiliations with organizations like the Independent Insurance Agents of Texas, which indicate credibility. An agent familiar with Dallas’s business landscape can recommend coverage that balances cost and protection. For example, Thumann Agency, based in Dallas, Texas, provides expertise in crafting policies for local businesses, ensuring compliance and relevance. Contact a qualified agent to discuss your specific insurance needs and secure appropriate coverage.

The Claims Process for General Liability Insurance

Steps to File a Claim

-

Document the Incident: Collect photos, witness statements, and detailed incident notes.

-

Notify Your Insurer: Report the claim within 15 days, as required by TDI regulations.

-

Submit Supporting Evidence: Provide documentation to validate the claim’s details.

-

Cooperate with the Insurer: Respond to adjuster inquiries or requests for additional information promptly.

Proper documentation and timely reporting are critical to a successful claim process.

What to Expect During the Process

Per TDI regulations, insurers must acknowledge claims within 15 days and issue a decision within 15 business days after receiving all necessary documentation. An adjuster evaluates the damage or injury, determining if the claim falls under your policy’s coverage. If approved, you receive payment for covered costs, such as repairs, medical bills, or legal fees. Denied claims may be appealed, though this requires additional evidence to support your case. Understanding this timeline helps you prepare for the process.

Common Pitfalls to Avoid

-

Delayed Reporting: Late notifications can lead to claim denials, as insurers require prompt reporting.

-

Incomplete Documentation: Missing photos or statements weakens your case and may delay processing.

-

Inaccurate Details: Misrepresenting the incident risks denial or policy cancellation, impacting future coverage.

Avoiding these errors ensures a smoother claims experience and faster resolution.

Risk Management and Prevention

Safety Measures to Reduce Claims

Implementing safety protocols can significantly lower your liability risks:

-

Install Security Systems: Cameras and alarms deter theft and vandalism, common in urban Dallas.

-

Maintain Premises: Fix hazards like uneven floors or loose railings to prevent accidents.

-

Conduct Safety Audits: Regularly inspect your business for potential risks, such as outdated wiring.

For example, a Dallas retail store might install slip-resistant flooring to prevent customer falls, reducing the likelihood of claims.

Employee Training

Train staff on safety practices, such as proper equipment use or spill cleanup procedures. Ensure they understand incident reporting protocols to comply with insurance requirements. In Dallas, where businesses must adhere to local regulations like fire codes, training also ensures legal compliance. A 2024 study by the Occupational Safety and Health Administration (OSHA) found that businesses with regular safety training reported 20% fewer liability claims, demonstrating the value of proactive education.

Mitigating Dallas-Specific Risks

Dallas’s unique environment requires targeted strategies to address local challenges:

-

Weather Preparedness: Develop emergency plans for hailstorms or tornadoes, such as securing outdoor signage or equipment.

-

Urban Risk Management: Use security measures like lighting and alarms to address theft or vandalism in high-crime areas.

-

Traffic Safety: For businesses with delivery services, train drivers to navigate Dallas’s busy roads safely to avoid accidents.

A 2024 TDI report noted that Dallas businesses with proactive risk management reduced claim frequency by 15% compared to those without such measures, underscoring the importance of tailored strategies.

General Liability Insurance for Specific Industries

Retail

Retail businesses face risks like customer slips or defective product claims. General liability insurance covers injuries, such as a shopper tripping in a Dallas mall, and product-related lawsuits, like a faulty appliance causing harm. This is critical for stores with high foot traffic.

Construction

Construction firms encounter site accidents, such as a worker damaging a client’s property during a project. In Dallas’s booming construction market, general liability insurance covers these incidents, protecting against financial losses from lawsuits or repairs.

Restaurants

Restaurants deal with slip-and-fall incidents and food-related claims, such as allergic reactions from mislabeled menu items. General liability insurance addresses these risks, ensuring Dallas eateries can operate without fear of costly lawsuits that disrupt operations.

Technology

While general liability covers office-related risks, like a visitor’s injury in a Dallas tech office, it does not include cyber liability. Tech firms in Dallas’s growing startup scene need separate cyber insurance to protect against data breaches or hacking incidents.

Healthcare

General liability covers general risks, like a patient slipping in a waiting room, but excludes medical malpractice. Dallas healthcare providers need professional liability insurance for treatment-related errors to ensure comprehensive protection.

Other Dallas-Relevant Industries

-

Oil and Gas: Covers environmental risks, such as accidental spills during drilling, which are common in Texas’s energy sector.

-

Real Estate: Protects against property management liabilities, like tenant injuries on rental properties, prevalent in Dallas’s active housing market.

-

Event Planning: Covers incidents at events, such as a guest’s injury at a Dallas festival, ensuring organizers are protected.

Frequently Asked Questions (FAQs)

Is General Liability Insurance Required by Law in Texas?

Texas law does not require general liability insurance, but commercial leases, contracts, or lenders often mandate it, especially in Dallas’s urban areas where tenancy agreements are strict.

What Does General Liability Insurance Cover?

It covers bodily injury, property damage, personal and advertising injury, medical payments, and legal defense costs for third-party claims, ensuring comprehensive protection against common liabilities.

How Much Does General Liability Insurance Cost in Dallas?

Small businesses pay approximately $50 to $60 per month, with Dallas costs slightly higher due to urban density and weather risks like hailstorms that increase claim frequency.

Can I Bundle General Liability with Other Policies?

Yes, combining it with property or auto insurance, often as a Business Owner’s Policy, can reduce costs by consolidating coverage and securing discounts.

Does General Liability Insurance Cover Cyber Liability?

No, cyber incidents like data breaches require separate cyber liability insurance, which is critical for tech or data-driven businesses in Dallas.

How Does General Liability Differ from Professional Liability?

General liability covers general business risks, like customer injuries, while professional liability addresses service-related errors, such as a consultant’s financial miscalculation.

What Are the Most Common Claims in Dallas?

Slip-and-fall accidents, weather-related damage from hail or wind, and product liability claims are frequent due to Dallas’s urban and climatic conditions.

Do I Need General Liability Insurance if I Work from Home?

Yes, if clients visit or you conduct off-site business activities, as these can lead to liability claims not covered by homeowners’ insurance.

Can I Get General Liability Insurance for a Startup?

Yes, insurers offer policies tailored for new businesses, including Dallas startups in tech, retail, or other emerging sectors, ensuring early protection.

How Can I Lower My General Liability Insurance Premiums?

Enhance safety measures, bundle policies, compare quotes, and maintain a clean claims history to reduce costs while maintaining adequate coverage.

How Long Does a General Liability Claim Take to Process?

Insurers must acknowledge claims within 15 days and decide within 15 business days, per TDI regulations, ensuring a structured and timely process.

Does General Liability Cover Damage from Natural Disasters?

It covers third-party property damage from weather events, like hail damaging a client’s vehicle, but not your own property, which requires separate coverage.

Can General Liability Insurance Cover Independent Contractors?

Yes, if they are acting for your business, but verify with your policy, as some exclude contractors to limit coverage scope.

What Happens if I Don’t Have General Liability Insurance?

You are personally liable for claims, risking significant financial losses or penalties for breached contracts, which can jeopardize your business’s stability.

Is General Liability Enough for My Dallas Business?

It is a foundation, but high-risk industries or specific risks, such as cyber or malpractice, require additional policies for full protection.

How Does Dallas’s Weather Impact General Liability Insurance?

Hailstorms and tornadoes increase claims for property damage, raising premiums for Dallas businesses, particularly those with outdoor operations.

Can General Liability Insurance Cover Advertising Mistakes?

Yes, it covers claims of copyright infringement or defamation in advertising, such as a Dallas firm’s ad dispute, protecting against legal costs.

What Documentation is Needed for a General Liability Claim?

Photos, witness statements, and detailed incident reports are critical to support your claim and ensure a smooth processing experience.

How Often Should I Review My General Liability Policy?

Review annually or after major business changes, like expanding locations or services, to ensure coverage aligns with your current needs.

Does General Liability Insurance Cover Lawsuits from Former Employees?

No, employee-related claims, like wrongful termination, require employment practices liability insurance, separate from general liability coverage.

Conclusion

General liability insurance is a critical component for Dallas businesses, offering protection against the financial impact of third-party claims, such as customer injuries, property damage, or advertising errors. In a city like Dallas, where urban density, severe weather, and a vibrant economy heighten risks, this coverage ensures financial stability and compliance with common contractual requirements. Costs, typically $50 to $60 per month for small businesses, vary by industry and risk profile, but proactive risk management, such as safety training or security upgrades, can keep premiums manageable. From retail to oil and gas, every Dallas business benefits from tailored coverage to address its unique challenges.

Regularly assess your policy to align with evolving needs, and consult a local agent to ensure comprehensive protection. For personalized guidance, contact Thumann Agency in Dallas, Texas, at (972) 991-9100 or visit thumannagency.com to discuss your business’s insurance requirements and secure the right coverage.

Last Updated: 20.07.2025

Author: Lauren Thumann Director of Marketing.

Disclaimer: This page is for educational purposes only. Coverage details vary by provider. Contact us for a personalized quote.