Have you ever been behind the wheel during the holidays, staring at an endless stream of traffic, wondering if you are truly covered for the trip ahead? You are not alone. As more families hit the road in Texas, holiday driving becomes a stressful experience. You face potential hazards ranging from icy bridges in North Texas to heavy congestion in the cities.

If you have found yourself scrolling through pages of advice but still feel unsure, you are in the right place. At Thumann Insurance, we have seen these struggles time and again. We are here to guide you through the risks and give you the peace of mind you need to reach your destination safely.

Here is what you will learn from this guide:

-

Proven safety tips to keep you safe on Texas roads.

-

The essential insurance coverage you need before you leave.

-

How to handle Texas-specific risks like black ice and sudden weather changes.

By the end of this post, you will have the knowledge and coverage you need for a smooth trip without the last-minute stress.

Why Is Holiday Travel Riskier for Texas Drivers?

The holiday season brings heavy traffic and tired drivers, making the roads more dangerous for everyone. Whether you are driving on I-35 in Dallas or navigating through McKinney, Garland, or Little Elm, understanding the risks is the first step to staying safe.

Holiday travel is riskier because of a combination of rushed driving, distractions (like GPS navigation), and weather hazards like rain, fog, or icy patches on bridges.

It is vital to review your auto insurance coverage to ensure you are prepared. Liability coverage helps if you are at fault, while comprehensive coverage protects you from weather damage. Roadside assistance can be a lifesaver if your car breaks down miles from home.

Key factors that increase your risk:

-

Highway Congestion: Crowds make stop-and-go accidents more likely.

-

Driver Fatigue: Long drives and night driving reduce reaction times.

-

Impaired Driving: Alcohol-related incidents often spike during the holidays.

-

Weather Hazards: Sudden rain, fog, or ice can make roads slick.

-

Unfamiliar Drivers: Many people on the road do not know the local routes, leading to erratic driving.

Which Auto Insurance Coverages Are Essential for Holiday Travel?

Checking your insurance before you pack your bags is an essential step. You do not want to find out you have a coverage gap after an accident happens.

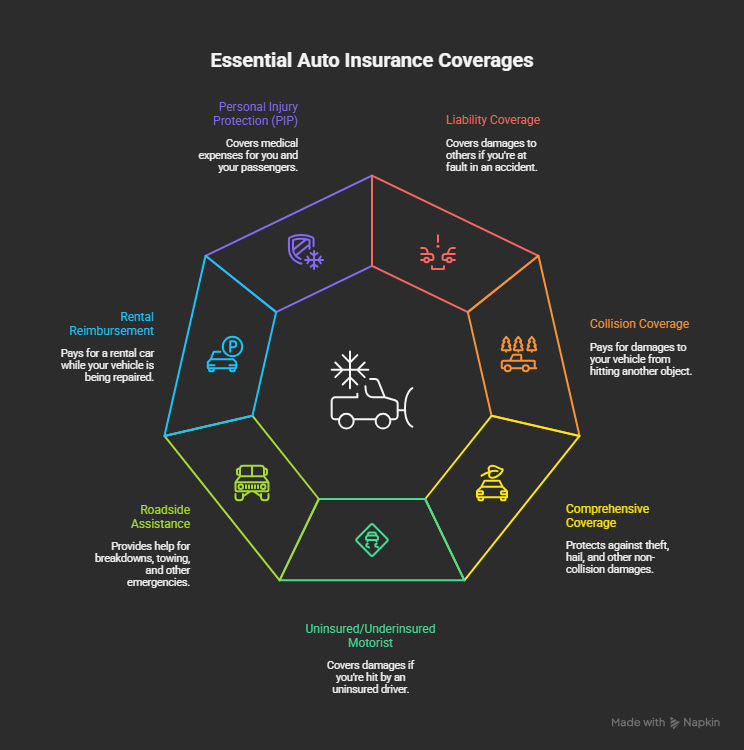

Here are the key coverages you should review:

-

Liability Coverage: This is a must-have. It pays for damages and medical bills for other people if you cause an accident.

-

Collision Coverage: This pays to repair your vehicle if you hit another car or an object. This is crucial in busy areas like Plano, Frisco, and McKinney.

-

Comprehensive Coverage: This protects against non-collision events. It covers theft, hail damage, and hitting an animal (very important for Hill Country driving).

-

Uninsured/Underinsured Motorist (UM/UIM): Many drivers on the road do not have enough insurance. If one of them hits you, this coverage pays for your damages.

-

Roadside Assistance: If you get a flat tire, lock your keys in the car, or break down on I-20 or the Dallas North Tollway, this covers the cost of help.

-

Rental Reimbursement: If your car is in the shop after an accident, this helps pay for a rental car so your trip isn't ruined.

-

Personal Injury Protection (PIP): This covers medical expenses for you and your passengers, regardless of who caused the accident.

Chat with your broker for full fit. Our understanding full coverage vs liability clarifies options you might miss, ensuring no surprises.

What Safety Tips Should Every Texas Driver Follow?

Preventing an accident is always better than dealing with one. Keeping your vehicle in good shape and driving smart are your best defenses.

Follow these practical tips for a safer journey:

-

Check Tire Pressure: Do this before you leave. Properly inflated tires grip the road better, especially on wet or icy surfaces.

-

Prepare for Weather: Ensure your windshield wipers, headlights, and taillights work perfectly. Pack an emergency kit with water, blankets, and first aid supplies.

-

Limit Night Driving: Visibility is lower at night, and glare from oncoming traffic can be blinding. Drive during the day when possible.

-

Avoid Peak Times: Try to stay off major highways like I-35 and I-45 during rush hours.

-

Watch for Wildlife: Deer are active in rural areas of Collin County and Denton County. Hitting a deer is covered under Comprehensive coverage.

-

Take Breaks: Stop every 2-3 hours to stretch and wake up. Fatigue is a major cause of holiday accidents.

-

Slow Down on Bridges: Bridges freeze before the rest of the road. Watch for "black ice" on overpasses.

For rainy drives, our 11 tips for driving in the Texas rain offers lifesavers for slick conditions.

Which Texas Winter Driving Hazards Should You Watch For?

Texas weather is unpredictable. Drivers need to be ready for specific regional hazards that pop up during the holidays.

While drivers in Dallas worry about black ice on high-speed highways, drivers in Central Texas often face thick fog. In Houston, heavy rain and flash flooding are the main threats. Also, freezing temperatures can cause sudden closures on rural roads near places like Farmers Branch or Mesquite.

Another major risk is the rise in hit-and-run accidents in parking lots. With everyone rushing to shop, parking lots become danger zones.

Specific Texas hazards to watch:

-

Black Ice: Common on Dallas highways and bridges.

-

Fog: Reduces visibility in Central Texas.

-

Heavy Rain: leads to hydroplaning in Houston.

-

Rear-End Collisions: Frequent on crowded tollways when traffic stops suddenly.

-

Parking Lot Accidents: High risk of dings and hit-and-runs at shopping centers.

How Does Insurance Help in Common Holiday Accident Scenarios?

Accidents happen, even to careful drivers. It helps to know exactly how your insurance steps in during common holiday scenarios.

Scenario 1: Rear-ended in Black Friday Traffic

-

The Situation: You are stuck in traffic in Dallas and someone hits you from behind.

-

The Solution: Collision coverage (or the other driver's liability) pays to fix your car.

Scenario 2: Sliding on Ice into a Guardrail

-

The Situation: A Houston driver hits a slick patch and spins into a rail.

-

The Solution: Collision coverage pays for repairs to your vehicle.

Scenario 3: Hitting a Deer in Hill Country

-

The Situation: A deer runs out in front of you on a dark road.

-

The Solution: Comprehensive coverage pays for the damage.

Scenario 4: Car Break-In at a Mall

-

The Situation: You come out of a store to find your window broken and gifts stolen.

-

The Solution: Comprehensive coverage repairs the window (homeowners insurance may cover the stolen items).

Scenario 5: Hit by an Uninsured Driver

-

The Situation: An out-of-state driver causes a pileup and doesn't have insurance.

-

The Solution: Uninsured Motorist (UM) coverage pays for your vehicle repairs and medical bills.

Why Choose Thumann Insurance Agency for Your Auto Insurance?

Thumann Insurance Agency has served Texas drivers since 1996. We provide tailored Auto Insurance in Texas with a 4.9-star rating.

Here is why Texas drivers trust Thumann:

-

Access to 80+ Top-Rated Carriers: We compare rates from giants like Hartford, Travelers, and Progressive to get you the best deal.

-

Local Expertise: We know Texas risks from hailstorms in Dallas to floods in Houston.

-

Fast Quotes: We provide quick, hassle-free service for urgent needs.

-

Comprehensive Coverage: We offer full protection, from liability to collision.

-

Reliable Claims Support: Our agents guide you through the claims process so you can recover quickly.

With Thumann Insurance Agency, you get more than just a policy; you get a partner dedicated to your safety.

FAQs About Holiday Auto Insurance in Texas

Does auto insurance cover accidents caused by winter weather in Texas?

Yes, comprehensive covers weather damage like hail or branches. Collision handles ice slides into objects. For more, see Wikipedia's auto insurance page.

What are the safest holiday travel tips for Texas drivers?

The best tips are simple: Check your tire pressure before you leave, prepare for sudden weather changes, avoid driving late at night, and stay alert for wildlife.

Can someone else drive my car during holiday travel if they aren’t on my insurance?

It depends on your policy. Generally, "permissive use" allows others to drive your car occasionally, but it is best to check with your provider. If they will drive often, you may need to add them as a temporary driver.

Do winter weather accidents raise auto insurance rates in Texas?

They can. If you are at fault (like sliding on ice and hitting someone), your rates may go up. However, "not-at-fault" claims (like hail damage) often have a smaller impact on premiums.

What auto insurance coverage do Texas drivers need for safe holiday travel?

For full peace of mind, you should carry Liability, Collision, and Comprehensive coverage. We also highly recommend Roadside Assistance and Uninsured Motorist coverage for long holiday trips.

Ready for Safe Holiday Travel? Review Your Auto Insurance Now!

Before hitting the road this holiday season, ensure that your auto insurance is up to date. With changing weather conditions and increased traffic, a quick policy review can give you peace of mind and protect your loved ones during the trip.

Get Your Free Review | Call: (972) 991-9100