Have you ever scrolled through insurance options, feeling unsure if your nonprofit really needs Directors and Officers (D&O) Insurance? You are not alone. Many nonprofit leaders in Dallas, Houston, and Austin face the same dilemma. You want to focus on your mission, but you also worry: What if a decision leads to a lawsuit?

It is a scary thought. Whether you are managing funds, hiring staff, or signing contracts, one wrong move could expose your board members to expensive legal battles. The reality is that without protection, your personal assets like your home and savings could be at risk.

At Thumann Insurance Agency, we help nonprofit leaders navigate these uncertainties. We understand the weight of responsibility you carry. With the right D&O insurance, you can lead with confidence, knowing that your personal finances and your organization’s reputation are protected.

In this guide, you will learn:

-

Why D&O insurance is essential for Texas nonprofit leaders.

-

What specific risks and lawsuits the policy covers.

-

Who exactly is protected under these policies.

-

How much coverage costs and how to get the best rate.

Why Is D&O Insurance Critical for Texas Nonprofits?

In Texas, nonprofit boards are often made up of passionate volunteers. While they care deeply about the cause, they may not have legal or financial training. This creates a gap where mistakes can happen.

As a board member, you are legally responsible for the organization’s decisions. If a donor feels their money was misused, or if an employee sues for wrongful termination, the board members can be named personally in the lawsuit.

Here is why coverage is essential:

-

Financial & Governance Risks: Decisions about budgets or programs can lead to disputes. If funds are lost due to a bad decision, the board is responsible.

-

Employee Disputes: Allegations of discrimination, harassment, or wrongful termination are common, even in nonprofits.

-

Donor Scrutiny: If a donor believes you failed to meet their expectations or mismanaged a grant, they can take legal action.

-

Rapid Growth: As nonprofits expand in areas like McKinney, Garland, and Little Elm, the complexity of operations increases, leading to higher risks. To see how D&O fits into overall risk planning, explore our dedicated resource on nonprofit insurance in Texas.

To see how this fits into broader business protections, check out our detailed business insurance guide, it's full of insights that could help you spot hidden vulnerabilities and make smarter coverage decisions.

Who Is Actually Protected by D&O Insurance?

A common misconception is that D&O insurance only covers the "Directors." In reality, a good policy offers much broader protection.

Typically, D&O insurance covers:

-

Past, Present, and Future Directors and Officers: Protection continues even after a board member steps down.

-

Committee Members & Volunteers: Those helping with specific tasks or governance.

-

Employees: Staff members who may be named in a lawsuit alongside the board.

-

The Organization Entity: The nonprofit itself is often covered for its own liability in certain suits.

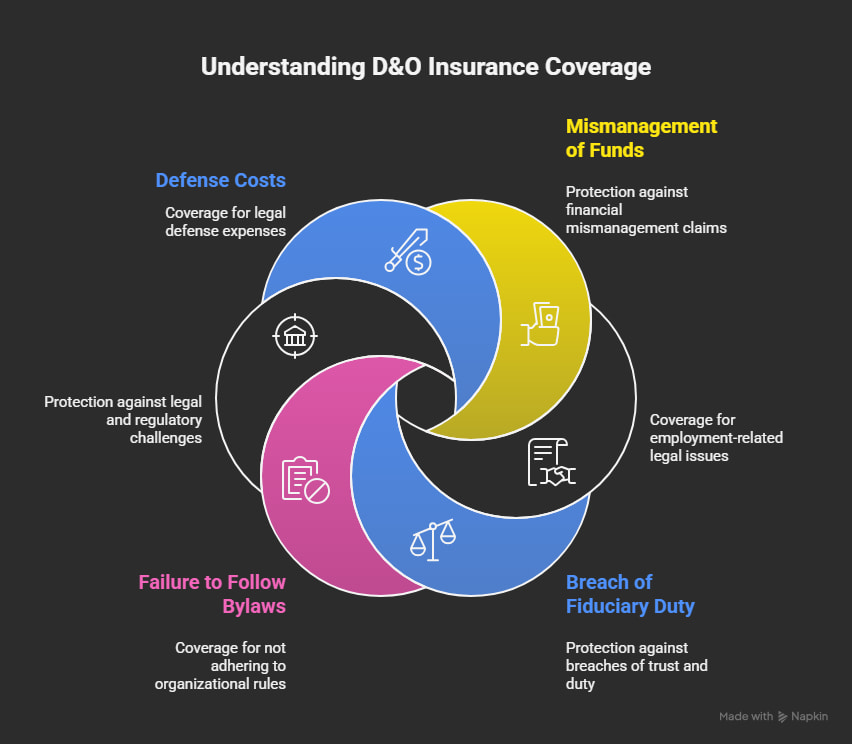

What Does D&O Insurance Actually Cover?

D&O insurance is designed to pay for legal defense costs and settlements if your leadership is accused of a "wrongful act."

Key protections include:

-

Mismanagement of Funds: Covers defense if you are accused of wasting or misusing company assets or donations.

-

Employment Practices: Protects against claims of wrongful termination, discrimination, or sexual harassment.

-

Breach of Fiduciary Duty: Covers you if you are accused of not acting in the best interest of the nonprofit.

-

Failure to Follow Bylaws: Protects you if a decision inadvertently violates the organization's own internal rules.

-

Regulatory Issues: Helps with legal costs if a government agency investigates the nonprofit for compliance failures.

-

Defense Costs: Perhaps the most important benefit it pays for the lawyers to defend you, which can cost tens of thousands of dollars even if you are innocent.

For a closer look at how this differs from other protections, our comparison of general liability vs. professional liability explains the nuances you'll need to avoid overlapping or missing coverage gaps.

What Is NOT Covered by D&O Insurance?

To be fully transparent, it is important to know what this policy excludes. D&O insurance generally does not cover:

-

Criminal Acts: Deliberate fraud, theft, or illegal activities.

-

Bodily Injury & Property Damage: These are covered by General Liability Insurance, not D&O.

-

Pending Litigation: Lawsuits that started before the policy began.

How Do D&O Needs Vary Across Texas Regions?

Texas is a diverse state, and the risks your nonprofit faces can change depending on your location.

What Specific Texas Risks Increase Liability?

Operating a nonprofit in Texas comes with unique challenges that increase the need for protection:

-

Strict Grant Reporting: Texas has rigorous compliance rules for state-funded grants. One reporting error can trigger a claim.

-

Volunteer-Led Boards: Without professional training, volunteer boards in fast-growing counties like Murphy and Irving are more prone to accidental governance errors.

-

Public Visibility: Events in Texas are big. High-profile fundraisers increase scrutiny from the public and donors, raising the chance of reputational lawsuits.

-

Regulatory Scrutiny: Texas agencies are increasingly watchful of nonprofit governance, meaning your records need to be spotless.

If you're concerned about overall business risks, our post on mitigating risks: the role of business insurance offers practical steps that could strengthen your nonprofit's defenses and prevent issues before they arise.

Why Choose Thumann Insurance Agency for Your Nonprofit?

Thumann Insurance Agency has been the trusted choice for Texas nonprofits since 1996. With nearly three decades of experience and a 4.9-star rating, we make complex insurance simple. We ensure your board members are protected so they can focus on doing good.

Here is why Texas nonprofits choose Thumann:

-

Access to 80+ Carriers: As an independent broker, we shop the market for you. We get quotes from top insurers like Hartford and Travelers to find the best rate.

-

Local Expertise: We know Texas. Whether you are dealing with Dallas regulations or Gulf Coast risks, we tailor the policy to your region.

-

Fast Service: Need a quote for a board meeting? We offer same-day quotes and quick certificate delivery.

-

Comprehensive Protection: We don't just sell Directors & Officers Insurance Texas. We help you build a full protection plan, including General Liability and Employment Practices Liability (EPLI).

-

Claims Support: If the worst happens, our dedicated agents are here to guide you through the claims process, minimizing stress and downtime.

FAQs About D&O Insurance for Texas Nonprofits

Do Texas nonprofits really need D&O insurance?

No, Texas law doesn't require it, but top board talent often won't join without this safeguard for their assets. For details on nonprofit status, check the IRS page on exempt organizations.

Is D&O insurance mandatory for 501(c)(3) organizations in Texas?

It is not legally required by the state, but most skilled board members will refuse to serve without it. It acts as a safety net for their personal assets.

How much does D&O insurance cost for a nonprofit?

Costs vary based on your budget size and number of employees. However, it is generally very affordable, often costing less annually than a single hour of legal advice.

What is the difference between D&O and General Liability?

General liability handles physical harms like slips. D&O covers decision risks such as mismanagement or wrongful acts. Both are usually needed. Learn more from Wikipedia's overview of liability insurance.

Can a volunteer board member be sued?

Yes. In Texas, being a volunteer does not automatically grant you immunity from lawsuits regarding mismanagement or negligence. D&O insurance is your primary defense.

Ready to Protect Your Nonprofit Leaders?

Your board members dedicate their time and energy to your mission. Don't let them risk their personal financial security to do so. Secure a D&O policy that lets them lead with confidence.

Request Your Free Quote Today!

Call Thumann Insurance Agency: (972) 991-9100