What would you do if your payment system froze due to a ransomware attack on Black Friday? For retailers in Dallas or e-commerce shops in Austin, the holiday season is the most profitable time of the year. But it is also when cyber threats skyrocket.

Cybercriminals know you are busy. They know you have temporary staff, higher transaction volumes, and less time to check every email. Whether it is a ransomware attack, a data breach, or a phishing scam, the holidays create the "perfect storm" for hackers to strike.

We have seen it happen too many times: a business is caught off guard right when they should be celebrating their best sales numbers. The good news? You do not have to face this risk alone. Cyber Liability Insurance ensures that if an attack happens, your business can recover quickly without financial ruin.

In this guide, you will learn:

-

Why cyber risks spike during the Texas holiday rush.

-

The difference between First-Party and Third-Party protection.

-

Common scams targeting local businesses right now.

-

Real-life examples of how insurance saves the day.

Why Do Cyber Risks Spike During the Holidays?

The holiday season creates weak spots in your business defense. Hackers are opportunistic; they look for chaos and distraction.

Here is why your risk increases in November and December:

-

High Transaction Volume: More credit card swipes mean more data for thieves to steal.

-

Temporary Staff: Seasonal hires often lack deep cybersecurity training, making them easy targets for phishing emails.

-

Remote Work Vulnerabilities: If your team works from home during the holidays, unsecured personal Wi-Fi networks can open a door for hackers.

-

Distraction: When you are rushing to meet shipping deadlines, you are less likely to notice a suspicious link or a fake invoice.

-

Phishing Scams: Hackers send fake emails pretending to be vendors or offering "holiday deals" to trick employees into revealing passwords.

Texas spots like Frisco retail and McKinney online shops are hot targets. For more on why this coverage is key, see our deep dive into cyber liability insurance: why it's essential, you'll uncover benefits that could save your business from unseen dangers.

What Does Cyber Liability Insurance Actually Cover?

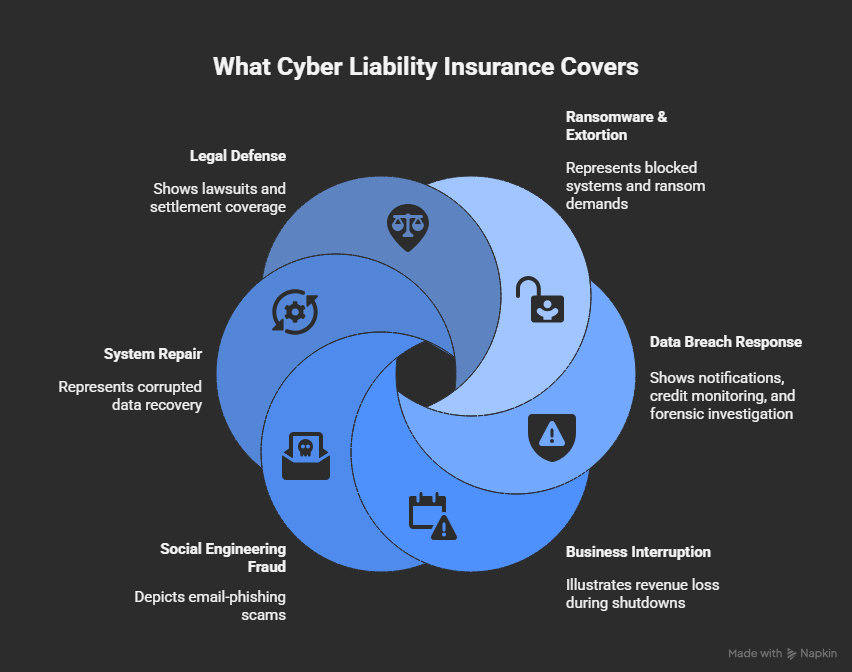

Cyber liability insurance is comprehensive. It does not just pay for lawsuits; it pays for the immediate crisis response.

Here is what a strong policy covers:

-

Ransomware & Extortion: If hackers lock your computers and demand money (ransom) to release them, insurance helps cover the payment and the cost of negotiating.

-

Data Breach Response: If customer data is stolen, you are legally required to notify them. Insurance pays for notification letters, credit monitoring services for victims, and forensic experts to find the leak.

-

Business Interruption: If a cyberattack forces you to close your store or website for days, this covers your lost revenue during that downtime.

-

Social Engineering & Fraud: Covers losses if an employee is tricked into transferring money to a fake account (wire fraud).

-

System Repair: Pays to restore your corrupted data and repair damaged software.

-

Legal Defense: Covers attorney fees and settlement costs if customers or vendors sue you for losing their data.

To learn how this fits with other protections, check our guide on does commercial insurance cover cyber, it's crucial reading to ensure no gaps leave you exposed.

First-Party vs. Third-Party Coverage: What Is the Difference?

To fully understand your protection, you need to know these two terms. A good policy includes both:

-

First-Party Coverage: Pays for your own losses.

-

Example: Recovering your lost data, paying a ransom, or covering lost income while your system is down.

-

-

Third-Party Coverage: Pays for liability to others.

-

Example: Legal fees if a customer sues you because their credit card number was stolen from your system.

-

How Do Cyber Threats Vary Across Texas Regions?

Cybercrime is not the same everywhere. Different cities in Texas face different types of primary threats during the holidays.

Which Specific Holiday Scams Should You Watch Out For?

In cities like Farmers Branch, Mesquite, and Highland Village, we are seeing sophisticated attacks designed to trick busy employees.

-

Fake Shipping Notifications: Hackers send texts saying a package is delayed. Clicking the link installs malware on your phone or network.

-

Gift Card Fraud: Criminals use stolen credit cards to buy gift cards from your business, leading to chargebacks later.

-

Payroll Diversion: Scammers impersonate the CEO and email HR, asking to change "their" direct deposit information to a fraudulent account.

-

Malicious "Holiday Deals": Fake vendor emails offering massive discounts on supplies to get you to click malicious links.

For tips on dodging these, our article on protect your business with cyber insurance shares strategies you'll regret not knowing sooner.

Real-Life Scenarios: How Does Insurance Save the Day?

Here is how coverage works in practice for Texas businesses:

-

The POS Lockdown: A Dallas store's registers freeze on Christmas Eve due to ransomware.

-

Insurance Solution: Business Interruption coverage pays for the income lost while the store was unable to process sales.

-

-

The Invoice Scam: An Austin manager receives a fake invoice from a "vendor" and wires $10,000.

-

Insurance Solution: Social Engineering coverage reimburses the stolen funds.

-

-

The Data Leak: A San Antonio retailer accidentally exposes a list of 500 customer addresses.

-

Insurance Solution: Breach Response coverage pays for the legal notifications and credit monitoring for those customers.

-

These build on insurance, reducing claims. Dive deeper with our top 3 benefits of cyber liability, discover how prevention plus coverage creates unbreakable defense.

Why Choose Thumann Insurance Agency for Cyber Liability?

Thumann Insurance Agency has been a trusted choice for Texas businesses since 1996. With nearly three decades of experience and a 4.9-star client satisfaction rating, we simplify the complexities of Cyber Liability Insurance in Texas. We know that retailers in Dallas and startups in Austin have different needs, and we tailor solutions for every size of business.

Here is why Texas businesses choose Thumann:

-

Access to 80+ Carriers: As an independent broker, we shop top insurers like Travelers, Hartford, and Progressive to find you the best rates and strongest protection.

-

Local Expertise: We understand Texas-specific risks. From Houston phishing rings to Dallas ransomware trends, we ensure your policy matches the local threat landscape.

-

Fast Service: Need coverage before a big event or contract? We provide same-day quotes and fast certificate issuance so you never face a delay.

-

Comprehensive Protection: We do not just cover the basics. We offer full protection including ransomware negotiation, social engineering, and third-party liability.

-

Claims Support: If you get hacked, you need help immediately. Our dedicated agents guide you through the claims process to get your systems and your revenue back online fast.

FAQs About Cyber Liability Insurance in Texas

What does cyber liability insurance cover for small businesses?

It covers data breach costs like customer notifications, ransomware payments, lost income from downtime, and legal fees from suits. For more on cyber insurance basics, see Wikipedia's page on cyber-insurance.

Does this insurance protect against holiday-specific attacks?

Yes. It covers phishing, social engineering, and system attacks that are common during high-traffic seasons like Black Friday and Christmas.

What is typically NOT covered?

Most policies exclude preventable negligence (like failing to update software after a warning), insider attacks (theft by an employee), and physical theft of hardware (which requires property insurance).

How much does cyber liability insurance cost in Texas?

Premiums vary by industry and revenue, but for small businesses, it typically ranges from $1,000 to $7,500 annually. This is a small price compared to the average cost of a data breach, which can exceed $100,000.

Is cyber insurance worth it for a small shop?

Absolutely. Small businesses are actually targeted more often than large corporations because they usually have weaker security. One attack can bankrupt a small business without insurance.

Ready to Shield Your Business This Holiday Season?

The hackers are preparing for the holidays. Are you? Don't wait until your systems are locked down to think about protection. Secure your hard-earned revenue with Thumann Insurance Agency.

Get Your Free Quote Today!

Call: (972) 991-9100