Have you ever walked into your business after a Texas winter storm and found frozen pipes that burst, flooding your office or storefront? Or perhaps you discovered a roof leak caused by heavy rain that damaged your inventory and equipment. If you have faced any of these challenges, you know how quickly a winter storm can turn into a disaster for your business.

It is frustrating, we know. You have likely been scrolling for hours, looking for answers to your insurance claim questions, but haven't found a clear guide to walk you through the process. You might feel overwhelmed by the options and unsure where to turn. You are not alone. We have seen this problem many times, and we are here to make it easier for you.

With nearly three decades of experience helping Texas businesses recover from winter weather damage, Thumann Insurance Agency understands exactly what you are going through. The good news? You do not have to navigate this alone.

In this guide, you will discover:

-

Step-by-step guidance on how to file a winter storm damage claim.

-

What commercial property insurance actually covers (from frozen pipes to roof damage).

-

Best practices for documenting your damages to get your claim approved faster.

-

How to avoid common mistakes that can delay or deny your claim.

Keep reading. By the time you finish, you will have a solid understanding of what to do next. Let’s get started. Your property deserves the best protection.

Why Do Texas Winters Lead to Major Property Insurance Claims?

Texas winters are famous for being unpredictable. We see temperature drops, freeze-thaw cycles, storms, and ice. These weather patterns create issues that can cause major damage to commercial buildings. From frozen pipes to roof collapses, winter puts a huge strain on properties that are not prepared.

The main weather damages businesses face include:

-

Frozen pipes: When pipes freeze and burst, they often cause extensive indoor flooding and damage to your building's structure.

-

Roof collapse: The heavy weight of snow or ice can damage roofs, especially if they haven't been maintained. Wind damage is also common during these months.

-

Power outages: Severe storms often cut power. This causes operational losses, food spoilage (for restaurants), and equipment breakdowns.

-

Water leaks: Heavy rain and melting snow can leak into your building, damaging walls, ceilings, and equipment.

-

Ice and snow accumulation: Ice buildup on gutters can hurt your structure. Snow can block ventilation, potentially breaking your HVAC systems.

For spots like Allen, Prosper, Frisco prep and coverage are musts. To ready your building, our tips on keep your business free of frozen pipes share fixes you'll kick yourself for skipping, preventing costly downtime.

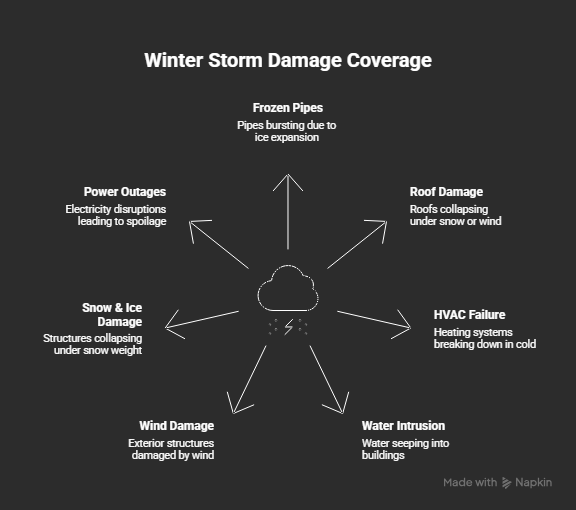

What Types of Winter Storm Damage Are Covered?

When preparing for winter, you need to know exactly what your commercial property insurance covers. Winter weather causes many different issues, and having the right policy makes a huge difference.

Here is what is typically covered:

-

Frozen or Burst Pipes: This is a top cause of winter damage. When temperatures drop, water inside pipes freezes and expands, causing them to burst. The resulting water damage to floors, furniture, and inventory is usually covered.

-

Roof Damage from Ice, Wind, or Debris: Ice buildup and strong winds can cause leaks or even collapse a roof. Most policies cover this, but be careful, they might exclude damage caused by "wear and tear" or lack of maintenance.

-

HVAC System Failure: If your heating system fails during a freeze, it can lead to other damage, like frozen pipes. Damage to the building caused by this failure is often covered.

-

Water Intrusion & Interior Flooding: Storms bring water. If wind-driven rain or snow gets inside, the damage to your floors and walls is typically covered.

-

Wind Damage to Exterior: High winds can damage windows, signs, and roofing materials. Standard commercial policies usually protect against this.

-

Snow & Ice Damage: In areas like the Texas Panhandle, heavy snow can damage the structure itself (like sagging roofs). This is generally covered.

-

Power Outages & Spoilage: If a storm knocks out power, you might lose income or inventory (like food). "Business interruption" coverage can help pay for these lost operations.

Policies differ review yours. For full details, our commercial property insurance guide breaks down must-haves you'll need to avoid gaps during storms.

Does Location Matter? Winter Risks Across Texas Regions

Texas is huge, and winter risks change depending on where you are. Understanding these regional differences helps you ensure your property is covered correctly.

How risks break down across the state:

In Dallas-Fort Worth, the main worry is often freeze damage. Houston businesses face more flooding issues, while Austin needs to worry about HVAC failures during sudden cold snaps.

What Immediate Steps Should You Take After Storm Damage?

If winter weather damages your property, acting fast is crucial. Follow these steps to ensure your insurance claim is processed smoothly.

-

Document Everything Immediately: Take clear, bright photos of all damage (interior and exterior). This evidence is essential for the claims adjuster.

-

Prevent Further Damage: Once you have photos, stop the damage from getting worse. Put up tarps or board up broken windows. This shows the insurer you are responsible.

-

Notify Your Agent Right Away: Report the damage immediately. The sooner you call, the faster your claim moves especially when insurers are busy with other storm claims.

-

Gather Repair History: Find records of previous maintenance. This proves you took care of the property, which can speed up approval.

-

List Damaged Items: Create a list of damaged equipment and inventory. Get repair estimates from contractors to support your claim.

-

Follow Up Frequently: During busy seasons, claims take longer. Check in regularly with your provider to keep things moving.

For filing tips, our how to file a homeowners insurance claim adapts well to commercial steps you'll thank for smoothing approvals.

How Does Commercial Property Insurance Support Your Recovery?

Commercial property insurance provides the financial support you need to repair and replace what was lost.

Here is how it helps you recover:

-

Pays for building repairs: Fixes structural elements like roofs, plumbing, and walls.

-

Replaces equipment and inventory: Helps you buy new stock or machinery.

-

Restores interiors: Covers costs for fixing flooring, drywall, and fixtures.

-

Covers water mitigation: Pays for professional drying and cleanup services.

-

Assists with temporary relocation: If you can't work in your building, it may cover the cost of moving temporarily.

-

Reimburses lost income: If you have business interruption coverage, it replaces the income you lost while closed.

Crucial for Aubrey, Corinth, Justin where weather halts work. Our how natural disasters affect commercial insurance reveals recovery tactics essential for bouncing back strongly.

Why Trust Thumann Insurance Agency with Your Business Protection?

Thumann Insurance Agency has been serving Texas businesses since 1996. With nearly 30 years of experience and a 4.9-star client rating, we make insurance simple for companies of all sizes.

Here is why Texas businesses choose Thumann:

-

Access to 80+ Carriers: We are an independent broker. We compare quotes from top insurers like Hartford, Travelers, and Progressive to find you the best rate and coverage.

-

Local Expertise: We know Texas risks. Whether it is hailstorms in Dallas or freezes in the Panhandle, we ensure you are covered for local weather events.

-

Fast Certificates & Quotes: Need a certificate for a contract? We provide same-day service so you don't face delays.

-

Comprehensive Protection: We offer full options property, liability, equipment, and business interruption.

-

Reliable Claims Support: Our agents guide you through the claims process to help you recover quickly and minimize downtime.

We deliver more than policies peace of mind with Commercial Property Insurance Texas.

FAQs: Common Questions About Commercial Property Claims

Does commercial property insurance cover winter storm damage in Texas?

Yes. Most policies cover damage from winter storms. This includes frozen pipes, roof damage from wind or ice, and water intrusion. However, flood damage (rising water) usually requires a separate policy.

What does commercial property insurance NOT cover during winter?

Standard policies usually exclude flooding (from outside the building) unless you have specific flood coverage. Also, they generally do not cover "gradual damage" caused by wear and tear or a lack of maintenance.

How do I file a commercial property insurance claim for winter damage?

Start by documenting the damage with photos. Then, contact your insurance agent immediately. You will need to submit your photos, a list of damaged items, and repair estimates to the claims adjuster.

How long after a storm can a Texas business file a claim?

Typically, you have up to one year to file a claim. However, you should file as soon as possible. Waiting too long can make it harder to prove the damage was caused by the storm.

Will filing a winter weather claim raise my insurance rates?

It can. If the damage is significant, your rate might go up. However, claims related to "Acts of God" (like severe weather) often result in smaller increases than liability claims.

What evidence do I need for a property damage claim?

You need clear photos of the damage, estimates for repairs from contractors, and maintenance records. These prove the extent of the loss and that the building was well-maintained before the storm.

Does commercial insurance cover roof collapse from ice or snow?

Yes, most policies cover structural damage caused by the weight of ice or snow. Check your policy terms to be sure, as some have specific exclusions for older roofs.

Ready to Prepare Your Property for Winter?

Winter storms can cause massive damage to your commercial property. Thumann Insurance Agency offers the expertise you need to protect your business from the unpredictable Texas weather. Don’t wait to get your coverage reviewed before the next storm hits.

Get Your Free Review | Call: (972) 991-9100