Electric vehicles (EVs) are becoming a common sight on Dallas roads, thanks to their eco-friendly features and cutting-edge technology. But one question often comes up for potential EV owners: Does it cost more to insure an electric vehicle?

The answer is yes, but only slightly. Insuring an electric car typically costs 10–20% more than insuring a comparable gas-powered vehicle. This is due to higher repair costs, specialized parts, and the significant value of the EV battery. However, the good news is that the overall savings EVs offer in fuel, maintenance, and potential discounts can help balance the scales. Let’s dive deeper to understand the factors behind these costs and how you can make the most of your EV insurance.

Understanding EV Insurance in Dallas

Electric cars require insurance just like traditional gas-powered vehicles, but their unique design and features may influence your coverage needs.

Why Insurance for EVs Costs More

-

Higher Repair Costs: EVs often require specialized parts and trained technicians, which can increase repair costs. For example, replacing a Tesla Model S battery can cost between $12,000 and $20,000.

-

Vehicle Value: Electric cars generally have a higher upfront price compared to gas-powered vehicles, which affects the cost of collision and comprehensive coverage.

-

Advanced Technology: Features like autopilot and regenerative braking add complexity to repairs.

Despite these factors, EV owners can find ways to offset the higher premiums. Many insurers offer discounts for eco-friendly vehicles and advanced safety features, and bundling policies can further reduce costs.

Standard Coverage Requirements

In Texas, EVs must meet the same legal minimums as other vehicles:

-

Bodily Injury Liability: $30,000 per person, up to $60,000 per accident.

-

Property Damage Liability: $25,000 per accident.

EV Incentives

1. Federal Tax Credits

- New EVs: Up to $7,500 in tax credits for qualifying vehicles purchased after April 2023

- Used EVs: Up to $4,000 in tax credits for eligible used models

Qualification Requirements:

- Must be assembled in North America

- Must meet specific critical mineral and battery component standards

- Must not exceed certain price thresholds

2. Utility Company Discounts & Incentives

Rebates

- Some utilities provide rebates for purchasing and installing a Level 2 home charging station.

- Additional rebates may be available for home electrical upgrades to support EV charging.

Special Pricing Plans

- Certain plans reward drivers for charging during off-peak hours.

- Taking advantage of these schedules can significantly reduce your overall energy costs.

Lower Rates

- Some utilities offer discounted rates at specific times of day, such as early morning or overnight.

- For example, Southern California Edison’s TOU-D-PRIME plan provides lower rates outside of peak demand periods.

Monthly Credits

- In some cases, installing a separate meter for EV charging can earn you monthly bill credits from your utility.

EVs Known for More Affordable Insurance Rates:

- Ford F-150 Lightning

- Kia Niro EV

- Hyundai IONIQ

- Volvo C40/XC40 Recharge

- Chevrolet Equinox EV

- Fiat 500e

- Subaru Solterra / Toyota BZ4X / Fisker Ocean Sport

- Volkswagen ID Series

Ready to insure your EV? Start you electric car insurance quote today.

Are Hybrids More Expensive to Insure?

Hybrid vehicles, while more affordable than fully electric vehicles (EVs), can still be more expensive to insure compared to traditional internal combustion engine (ICE) vehicles. This is primarily due to their batteries and advanced technology. For instance, Forbes reports that the average annual premium for a hybrid Honda CRV is $1,831, whereas insurance for the gas-powered version costs about $1,574. The higher premiums for hybrids reflect the added cost of repairs and specialized parts, but they are often offset by fuel savings and lower emissions.

Real-World Scenario: Battery Replacement Costs

One of the most significant differences between EVs and traditional vehicles is the battery. EV batteries are built to last, often maintaining their functionality for 10–20 years. However, replacement can be costly if needed.

-

A Nissan Leaf battery replacement averages about $5,500.

-

For a Tesla Model S, replacement costs range from $12,000 to $20,000, depending on the model and battery size.

These figures highlight the importance of having adequate coverage to protect your investment.

Maintenance Insights for EV Owners

Electric cars generally require less maintenance than gas-powered vehicles due to fewer moving parts and no need for oil changes. Here are some key points to consider:

-

Brake System: EVs use regenerative braking, which reduces wear and extends brake life.

-

Battery Health: Keeping your battery charged between 20% and 80% and avoiding extreme temperatures can prolong its lifespan.

-

Fewer Moving Parts: Without an engine or transmission, there’s less to maintain, saving you both time and money.

According to Progressive, EV owners save around $300–$500 annually on maintenance compared to gasoline vehicles.

Environmental and Cost Benefits of Electric Vehicles

Owning an electric vehicle (EV) offers a range of advantages that go beyond lower emissions. While insurance costs may be slightly higher, the long-term savings and environmental benefits make EVs an excellent investment for many drivers.

1. Lower Fuel Costs

Switching to electricity over gasoline can significantly reduce your monthly transportation expenses.

-

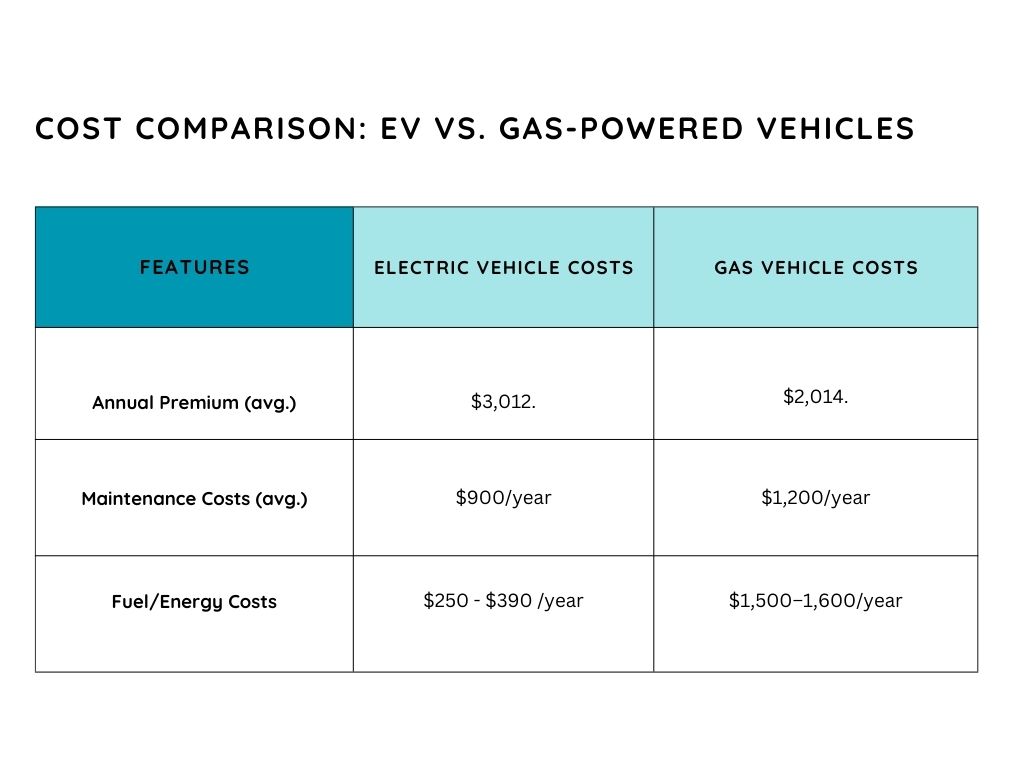

Charging an EV costs significantly less than filling up a gas tank. On average, EV owners pay around $250–$390 annually for electricity compared to $1,500–1,600 for gasoline in Texas.

-

Many Dallas EV owners also take advantage of local off-peak electricity rates to charge their vehicles overnight, saving even more.

2. Reduced Environmental Impact

Driving an EV helps lower your carbon footprint, contributing to a cleaner, healthier Dallas.

-

EVs produce zero tailpipe emissions, improving local air quality.

-

Even when accounting for electricity production, EVs generate significantly fewer greenhouse gas emissions than gas-powered cars.

-

Choosing an EV helps support global efforts to combat climate change while encouraging a shift toward renewable energy sources.

3. Long-Term Maintenance Savings

Electric vehicles have fewer moving parts than traditional cars, leading to lower maintenance costs over time.

-

No Oil Changes: Say goodbye to regular oil changes and engine maintenance.

-

Brake Longevity: Regenerative braking systems reduce wear and tear, extending the life of your brakes.

-

Fewer Repairs: EVs don’t have complex engines, transmissions, or exhaust systems, meaning fewer potential breakdowns.

On average, EV owners save $300–$500 per year on maintenance compared to gas-powered vehicles.

Why Choose the Thumann Agency?

As a Dallas-based independent insurance agency, the Thumann Agency understands the unique needs of local EV owners. Here’s how we help:

-

Personalized Service: We take the time to understand your needs and match you with the best coverage.

-

Expert Advice: Our team is well-versed in EV insurance, so you can trust you’re making informed decisions.

-

Local Focus: We know Dallas and Texas insurance laws inside and out, giving you peace of mind.

Drive Confidently in Your Electric Vehicle

Owning an electric car in Dallas is a step toward a more sustainable future, but it comes with its own set of considerations. By choosing the right insurance, staying on top of maintenance, and leveraging local resources, you can enjoy the benefits of EV ownership while keeping your car and finances protected.

Ready to insure your EV? Start you electric car insurance quote today. Let us help you drive confidently and securely on Dallas roads!

Last Updated: December 14th, 2024.

Disclaimer: This information is provided for general educational purposes only and is not intended to be construed as legal advice or as a complete description of available insurance products or coverages. Coverage terms, conditions, limitations, and exclusions vary by state and insurance provider. Not all products, coverages, or discounts mentioned are available in all states, including Texas. The examples and descriptions provided are for illustrative purposes only. For specific information about your insurance needs or questions about coverage, please contact The Thumann Agency directly.