Restaurants in Texas face a unique set of challenges, from bustling kitchens to unpredictable weather. Among these, insurance premiums often stand out as a significant expense, driven by risks like customer injuries, employee accidents, and property damage.

According to the National Restaurant Association, 60% of restaurants encounter at least one liability claim every five years, with costs averaging $20,000 per incident. By adopting Risk Management Strategies to Lower Restaurant Insurance Premiums, restaurant owners can mitigate these risks, create safer environments, and reduce financial burdens.

This guide provides practical, Texas-focused strategies to help you manage insurance costs effectively, tailored to the realities of running a restaurant in the Lone Star State.

Understanding Restaurant Insurance Costs in Texas

Insurance premiums for Texas restaurants reflect a complex interplay of operational risks and regional factors. Whether you’re managing a taco stand in Dallas or a steakhouse in Houston, grasping what drives these costs is the first step toward savings. This section explores the components of restaurant insurance, Texas-specific influences, and actionable insights to set the foundation for cost reduction.

Types of Restaurant Insurance Policies

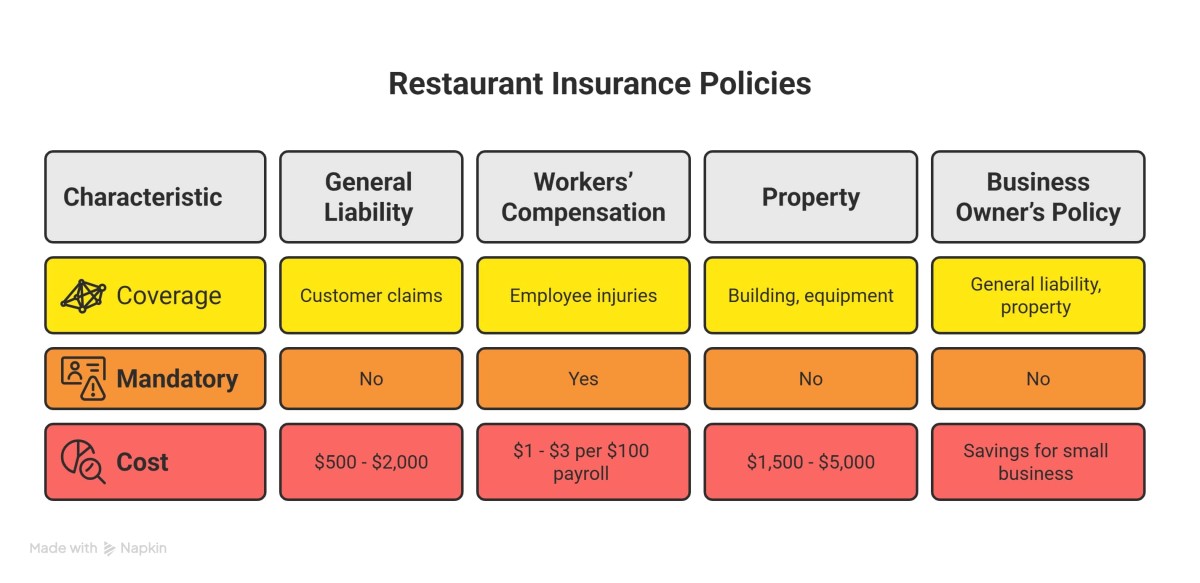

Restaurants typically rely on several policies to cover various risks:

-

General Liability Insurance protects against customer-related claims, such as slips or foodborne illnesses. In Texas, annual costs range from $500 to $2,000, depending on your risk profile and claim history.

-

Workers’ Compensation Insurance, mandatory in Texas, covers employee injuries like burns or falls. Premiums, averaging $1 to $3 per $100 of payroll, increase with frequent claims.

-

Property Insurance safeguards your building, equipment, and inventory from events like fires or storms. In Texas, premiums often fall between $1,500 and $5,000 yearly due to weather-related risks.

-

Business Owner’s Policy (BOP) combines General Liability and Property Insurance, offering savings for small to medium-sized restaurants.

Each policy’s cost hinges on underwriting criteria, including your location, revenue, and past claims. A restaurant with multiple slip-and-fall incidents, for instance, may see premiums 20% higher than one with a clean record.

Texas-Specific Factors Affecting Premiums

Texas’s unique environment shapes insurance costs in distinct ways. Severe weather, including hailstorms and hurricanes, poses constant threats to property. The Insurance Council of Texas reported $1.2 billion in commercial property claims in 2024, with restaurants accounting for a significant share. Additionally, Texas’s stringent health code regulations demand meticulous compliance to avoid fines or lawsuits, which can elevate premiums if ignored.

Your claims history plays a pivotal role. A single foodborne illness lawsuit, costing upwards of $50,000, can increase General Liability Insurance rates by 15%. Conversely, the Texas Department of Insurance notes that restaurants with documented safety practices can lower premiums by up to 20%. For example, a San Antonio café reduced costs by 12% after implementing regular safety inspections, showcasing the impact of proactive measures.

Strategies to Begin Cost Reduction

To start lowering premiums, focus on understanding your current coverage. Review your policies annually to ensure they align with your restaurant’s operations. A Dallas diner discovered it was overpaying for unused equipment coverage, saving $800 yearly after a policy adjustment.

Additionally, maintaining a clean claims record and documenting safety efforts can strengthen your case with insurers. These foundational steps pave the way for the targeted strategies outlined below, helping you achieve ways to save on restaurant insurance. Wondering how much insurance really costs in Texas? Our guide on Average Restaurant Insurance Costs in Texas: A Breakdown lays it all out for you.

Key Risk Management Strategies to Lower Premiums

Reducing insurance premiums requires a proactive approach to minimizing risks. The following five strategies, tailored for Texas restaurants, address common claim triggers and competitor gaps, such as health code compliance and policy bundling. Each offers practical steps to create a safer restaurant and lower costs.

Food Safety and Health Code Compliance

Foodborne illnesses are a major liability, with the CDC reporting 128,000 restaurant-related cases annually in the U.S. In Texas, a single outbreak can lead to lawsuits costing $50,000, directly impacting premiums. Robust food safety practices are essential.

-

Train Staff Regularly: Conduct quarterly training on safe food handling, focusing on cross-contamination prevention and proper cooking temperatures (e.g., poultry at 165°F). Use Texas Food Establishment Rules as a guide.

-

Maintain Hygiene Standards: Implement daily cleaning schedules for surfaces, refrigerators (kept below 40°F), and storage areas. Regular pest control prevents infestations, a common health code violation.

-

Document Compliance: Keep records of health inspections and training sessions. A Houston bakery lowered premiums by 10% by presenting a digital compliance log to its insurer.

Texas’s health code regulations require strict adherence, with fines up to $5,000 for violations. The Texas Department of Insurance recommends sharing documented efforts with insurers to demonstrate low risk, helping you reduce restaurant insurance costs.

Customer Safety and Slip-and-Fall Prevention

Slips, trips, and falls account for 25% of restaurant claims, with Texas’s busy dining scenes amplifying risks. The average claim costs $20,000, significantly raising premiums. Preventive measures can curb these incidents.

-

Install Safety Equipment: Use non-slip mats in kitchens and dining areas, and place wet floor signs after cleaning. Surveillance cameras deter fraudulent claims and provide evidence, potentially saving thousands.

-

Inspect Regularly: Check for hazards like uneven flooring or poor lighting daily. In Texas, summer heat can warp outdoor patios, so inspect exterior areas frequently.

-

Train Staff: Teach employees to report spills immediately. A quick response can prevent a costly lawsuit.

A Fort Worth diner reduced claims by 35% by adding cameras and mats, cutting premiums by 14%. These efforts show insurers you prioritize safety. Consider reviewing your safety measures for potential savings.

Employee Safety Training and Hiring Practices

Employee injuries, such as burns or cuts, drive up Workers’ Compensation Insurance costs, with claims averaging $40,000. Texas’s 1.2 million restaurant workers face daily risks, making safety training critical.

-

Conduct Ongoing Training: Hold monthly sessions on knife safety, proper lifting, and burn prevention. Provide gear like non-slip shoes and gloves, reducing injuries by 30%, per OSHA.

-

Perform Background Checks: Thorough background checks, often overlooked by competitors, ensure reliable hires, minimizing accidents or theft. This strengthens your risk profile.

-

Document Safety Efforts: Maintain training logs and certifications to share with insurers, proving a safer workplace.

A Lubbock barbecue joint cut workers’ comp claims by 45% after implementing training and checks, saving 11% on premiums. These steps offer restaurant insurance premium reduction tips that protect your team and budget.

Fire Safety and Equipment Maintenance

Fires pose a significant threat, with 7,410 restaurant fires annually causing $165 million in damage, per the National Fire Protection Association. In Texas, grease fires are prevalent, and insurers scrutinize prevention efforts.

-

Install Fire Systems: Use UL 300-compliant fire suppression systems, mandatory in Texas, above cooking equipment. Automated hood cleaning reduces grease buildup by 60%.

-

Maintain Equipment: Schedule quarterly checks for fryers and ovens to prevent malfunctions. A Dallas café avoided a $90,000 fire claim by fixing a faulty fryer.

-

Train Staff: Teach extinguisher use and evacuation protocols. Ensure emergency exits comply with Texas fire codes.

These measures, aligned with Texas Department of Insurance standards, help you achieve affordable restaurant insurance options by signaling low risk.

Policy Optimization and Bundling

Your insurance policies offer cost-saving opportunities through strategic adjustments.

-

Bundle Policies: Combine General Liability and Property Insurance into a Business Owner’s Policy (BOP) for 10–20% discounts. An Austin bistro saved $1,100 yearly by bundling.

-

Adjust Deductibles: A higher policy deductible (e.g., $2,000 vs. $500) lowers premiums if you have cash reserves. Consult a broker to balance savings and risk.

-

Review Coverage: Assess policies annually to avoid overpaying for unneeded coverage, like excess property insurance for a leased space.

These strategies address competitor gaps, ensuring you maximize savings while maintaining protection.

Texas-Specific Risk Management Tips

Texas restaurants face distinct challenges, from Dallas’s high-traffic dining to rural areas’ storm risks. Tailoring risk management to these factors lowers premiums and ensures compliance. This section provides Texas-focused insights to help you save.

Complying with Texas Regulations

The Texas Department of Insurance enforces rigorous standards, including the Texas Food Establishment Rules, which mandate specific food handling and sanitation practices. Violations can lead to $5,000 fines or claim denials, raising premiums.

-

Prepare for Inspections: Conduct quarterly safety audits using Texas Restaurant Association checklists to ensure compliance with health and fire codes.

-

Maintain Records: Document inspections and training. An El Paso diner saved 16% on premiums by presenting a compliance binder to its insurer.

Compliance demonstrates diligence, reducing risk and costs.

Implementing Loss Control Programs

Loss control programs identify risks before they become claims, especially important in Texas’s storm-prone climate.

-

Inspect Regularly: Hire professionals biannually to check wiring and flooring, preventing $50,000+ claims from fires or falls.

-

Use Reporting Systems: Implement digital incident reporting systems for accidents, reducing disputes. A Galveston restaurant saved 9% on premiums with streamlined reporting.

These programs show insurers you’re proactive, lowering rates.

Preparing Emergency Response Plans

Texas’s weather, with 1–2 hurricanes annually, demands robust emergency response plans.

-

Create a Plan: Outline evacuation routes and staff roles for fires, storms, or health violations. Train staff quarterly.

-

Test Plans: Conduct biannual drills. An Amarillo café avoided a $70,000 claim by evacuating efficiently during a 2024 tornado.

A Dallas pizza shop saved 13% on premiums with a documented plan, highlighting the value of preparedness for Dallas restaurant insurance.

Learn how Dallas-specific risks impact your insurance needs in our detailed guide: Restaurant Insurance: A Detailed Guide for Businesses in Dallas, Texas.

Restaurant Insurance Done Right – Here’s Why We’re Your Best Choice

Thumann Agency has served Texas restaurants since 1996, from casual eateries to fine dining establishments. With 29 years of experience, we understand the risks you face, from grease fires to health code compliance. Our licensed agents specialize in restaurant insurance, conducting risk assessments to identify savings, like bundling policies or safety upgrades.

Based in Dallas, we know Texas’s unique challenges, including hurricanes and strict regulations. Our partnerships with over 80 insurers allow us to find tailored, cost-effective coverage, unlike single-carrier agencies. A Plano diner saved 20% on premiums with our customized plan, and clients consistently praise our clear, no-jargon approach.

We use advanced tools to analyze your operations, ensuring compliance with Texas Department of Insurance standards. Our flexible solutions grow with your business, keeping costs low. Call 972.991.9100 for a free restaurant insurance review.

FAQs on Restaurant Insurance Savings

Below, we answer common questions Texas restaurant owners ask about lowering premiums, building trust through education.

How can safety training lower restaurant insurance premiums?

Regular employee safety training reduces accidents like burns or slips, leading to fewer workers’ compensation claims. Documented training shows insurers you’re proactive, often resulting in lower rates. Thumann Agency helps design training plans to maximize savings.

What fire prevention measures reduce restaurant insurance costs?

Installing UL 300-compliant fire suppression systems and automated hood cleaning reduces fire risks. Regular equipment maintenance and staff training on extinguishers lower claims, aligning with insurer standards.

How does food safety compliance impact restaurant insurance rates?

Compliance with Texas health code regulations prevents foodborne illness claims. Documented inspections and training signal low risk, reducing premiums for your restaurant.

What role does security play in lowering restaurant insurance premiums?

Surveillance cameras and alarms deter theft and vandalism, reducing claims. Well-lit parking lots enhance safety, supporting cost-saving measures for Texas restaurants.

How can employee training reduce restaurant liability risks?

Training on safe food handling and customer interaction minimizes claims, like slips or illnesses. Consistent training lowers General Liability Insurance costs, enhancing savings.

What are common risks in restaurants affecting insurance premiums?

Slips, fires, foodborne illnesses, and employee injuries drive premiums. Proactive measures like audits and compliance help achieve savings with expert guidance.

Final Course: Serving Safety with Savings

In Texas’s fast-paced restaurant scene, managing risk isn't just smart it’s essential. From storm-proofing your property to fireproofing your kitchen, each step toward safety directly influences what you pay for insurance. As seen through real-life savings from Dallas to El Paso, proactive strategies like staff training, equipment maintenance, and health code compliance do more than protect your restaurant they reduce your financial burden.

By tailoring your insurance approach with Texas-specific practices and continuously auditing your risks, you're not only safeguarding your team and customers but also investing in long-term stability. With guidance from experts like the Thumann Agency, insurance becomes less of a cost and more of a strategic asset.

Last Updated: 14.07.2025

Author: Lauren Thumann Director of Marketing.

Disclaimer: This page is for educational purposes only. Coverage details vary by provider. Contact us for a personalized quote.