Operating a restaurant in Dallas, Texas, involves navigating a complex landscape of risks, from customer injuries to equipment damage and operational disruptions. Restaurant insurance serves as a critical tool to protect your business from financial losses while ensuring compliance with state and local regulations. This guide provides an in-depth, objective resource to help you understand the nuances of restaurant insurance, offering detailed insights into coverage types, costs, regulations, and risk management strategies tailored to the Dallas market.

The purpose of this guide is to equip restaurant owners with the knowledge to make informed insurance decisions, whether you manage a fine dining establishment, a fast-casual eatery, a food truck, or a bar. We’ll cover the science behind various policies, historical context, practical applications, and specific considerations for Dallas’s unique environment, such as severe weather and urban challenges. By understanding these elements, you can safeguard your business and focus on delivering exceptional dining experiences. This guide is structured to be accessible to both beginners and seasoned restaurateurs, providing clarity without unnecessary complexity.

What is Restaurant Insurance?

Restaurant insurance is a collection of specialized insurance policies designed to address the unique risks faced by food service businesses. Unlike standard business insurance coverage, which focuses on general commercial risks, restaurant insurance targets hazards specific to the industry, such as foodborne illnesses, alcohol-related incidents, and kitchen accidents. These policies combine various coverages, including general liability, property insurance, and workers’ compensation, to provide comprehensive protection.

For example, if a customer suffers an allergic reaction due to mislabeled ingredients, restaurant insurance could cover medical costs and legal fees. In Dallas, where restaurants operate in a dynamic urban environment with additional risks like severe weather, these policies are customized to address both industry-specific and location-specific challenges. The goal is to mitigate financial losses while ensuring compliance with Texas regulations. This insurance acts as a safety net, allowing you to focus on your operations without constant concern about potential setbacks.

Why Restaurant Insurance Matters

Restaurant insurance serves several critical functions for your business:

-

Regulatory Compliance: Texas mandates certain coverages, such as liquor liability for establishments serving alcohol, to maintain licensing and avoid penalties. Non-compliance can lead to fines or suspension of your business license.

-

Financial Security: Policies cover costs associated with claims, repairs, and lost revenue, protecting your business from significant financial setbacks. For instance, a kitchen fire could halt operations, but insurance can offset the costs of repairs and lost income.

-

Operational Confidence: With adequate coverage, you can manage your restaurant with greater peace of mind, knowing you’re prepared for unexpected events like lawsuits or natural disasters.

-

Customer Trust: Having insurance demonstrates professionalism and responsibility, reassuring customers that your business is prepared to handle incidents responsibly.

In Dallas, where the restaurant industry is a cornerstone of the local economy, insurance is particularly vital. The city’s high customer traffic, severe weather patterns, and strict regulatory requirements amplify the need for robust protection. A 2024 study by the Texas Restaurant Association found that 68% of restaurant owners faced at least one insurance claim in the past five years, with customer injuries and property damage being the most common issues. This data underscores the necessity of comprehensive insurance for Dallas restaurants.

Types of Restaurant Insurance

General Liability Insurance

General liability insurance is a foundational policy for restaurants, covering claims related to bodily injury, property damage, and personal injury (e.g., libel or slander). If a customer trips over a loose floorboard and sprains their wrist, this policy covers medical expenses and legal defense costs. In Dallas, where bustling dining rooms increase the likelihood of such incidents, this coverage is indispensable.

Key coverages include:

-

Bodily injury: Medical costs for injuries to customers or third parties.

-

Property damage: Repairs for damaged customer property, such as a spilled drink ruining a laptop.

-

Personal injury: Legal defense for claims like defamation or false advertising.

A 2023 report by the Insurance Information Institute found that slip-and-fall claims accounted for 35% of general liability claims in restaurants, highlighting the policy’s relevance. This coverage is often required by landlords or lenders as a condition of leasing or financing.

Property Insurance

Property insurance protects your restaurant’s physical assets, including buildings, kitchen equipment, inventory, and furniture, from perils like fire, theft, vandalism, or natural disasters. In Dallas, where hail and tornadoes pose significant threats, this coverage is critical. For example, if a storm damages your roof and floods the dining area, property insurance covers repairs and replaces spoiled food.

Key considerations include:

-

Ensure coverage includes Dallas-specific risks, such as hail and flooding, which may require additional endorsements.

-

Regularly update your policy to reflect new equipment purchases or renovations.

-

Consider adding coverage for outdoor signage or patio areas, common in Dallas restaurants.

This policy is essential for protecting the physical foundation of your business, especially in a city prone to unpredictable weather.

Workers’ Compensation Insurance

Workers’ compensation insurance covers medical expenses, rehabilitation, and lost wages for employees injured on the job, such as a dishwasher slipping on a wet floor or a chef suffering a burn. Although not mandatory in Texas, it’s highly recommended to avoid out-of-pocket costs and potential lawsuits. In Dallas’s fast-paced restaurant environment, where injuries are common, this coverage is a prudent choice.

Benefits include:

-

Covers medical bills, physical therapy, and partial wage replacement.

-

Protects against employee lawsuits for workplace injuries.

-

Demonstrates commitment to employee safety, improving retention.

According to the U.S. Bureau of Labor Statistics, the restaurant industry reported 3.6 injuries per 100 full-time workers in 2024, with cuts and burns being prevalent. This coverage ensures you’re prepared for such incidents.

Commercial Auto Insurance

Commercial auto insurance covers vehicles used for business purposes, such as delivery vans, catering trucks, or staff shuttles. It protects against accidents, theft, or damage. In Dallas, where heavy traffic and urban congestion increase accident risks, this coverage is essential for restaurants offering delivery or off-site services.

Key coverages include:

-

Liability for accidents caused by your drivers.

-

Physical damage to business vehicles.

-

Medical payments for injured drivers or passengers.

This policy is mandatory for businesses with company-owned vehicles and ensures compliance with Texas transportation regulations.

Cyber Liability Insurance

Cyber liability insurance protects against data breaches, hacking, and other cyber threats. With the rise of online ordering, digital payments, and customer databases, restaurants are vulnerable to cyberattacks. This policy covers costs like customer notification, credit monitoring, and legal fees. In Dallas, where technology adoption is widespread, this coverage is increasingly relevant.

What it covers:

-

Data breach response costs, including public relations efforts.

-

Legal fees for privacy violation lawsuits.

-

Business losses from system downtime or ransomware.

A 2024 Cybersecurity Ventures report estimated that 60% of small businesses, including restaurants, faced at least one cyberattack, underscoring the need for this coverage.

Employment Practices Liability Insurance (EPLI)

Employment practices liability insurance (EPLI) covers claims related to employment practices, such as discrimination, harassment, wrongful termination, or wage disputes. If an employee sues for unfair treatment, this policy covers legal defense and settlements. In Dallas’s competitive restaurant industry, where staff turnover is high, EPLI provides essential protection.

Key benefits include:

-

Covers legal fees, settlements, and judgments.

-

Protects against claims from current, former, or prospective employees.

-

Includes coverage for training or policy violations.

This policy is particularly relevant for larger restaurants with multiple employees.

Umbrella Insurance

Umbrella insurance provides additional liability coverage beyond the limits of your primary policies, such as general liability or commercial auto. If a major lawsuit exceeds your general liability limit, this policy covers the excess costs. In Dallas, where high customer volumes increase lawsuit risks, umbrella insurance offers an extra layer of protection.

Key benefits include:

-

Extends coverage for liability claims.

-

Covers legal fees and settlements beyond primary policy limits.

-

Provides peace of mind for high-risk scenarios.

This policy is ideal for larger restaurants or those in high-traffic areas.

Liquor Liability Insurance

Liquor liability insurance is mandatory for Texas restaurants and bars serving alcohol. It covers claims related to overserving, drunk driving accidents, or alcohol-related injuries. For instance, if a patron causes a car accident after leaving your establishment, this policy covers legal fees and damages. In Dallas, where nightlife is vibrant, this coverage is a critical safeguard.

Key features include:

-

Covers legal defense, settlements, and medical costs.

-

Required for any business with a liquor license.

-

May include coverage for alcohol-related fights or property damage.

This policy ensures compliance with Texas Alcoholic Beverage Commission (TABC) regulations and protects against costly claims.

Business Interruption Insurance

Business interruption insurance compensates for lost income and operating expenses during temporary closures caused by covered events, such as a fire, storm, or equipment failure. If a power outage forces your restaurant to close for a week, this policy covers rent, payroll, and lost revenue. In Dallas, where weather-related disruptions are frequent, this coverage ensures financial stability.

What it covers:

-

Lost revenue based on historical financial records.

-

Ongoing expenses like utilities and loan payments.

-

Temporary relocation costs, such as renting a food truck.

This policy is particularly valuable for maintaining cash flow during unexpected disruptions.

Commercial Crime Insurance

Commercial crime insurance protects against losses from employee dishonesty, theft, or fraud. For example, if a bartender pockets cash from the register, this policy covers the loss. In busy Dallas restaurants, where multiple employees handle cash and inventory, this coverage safeguards your finances.

What it covers:

-

Employee theft of money, inventory, or equipment.

-

Fraudulent transactions or forgery.

-

Third-party theft, such as break-ins.

This policy is a valuable addition for restaurants with significant cash-based transactions.

Extra Expense Insurance

Extra expense insurance covers additional costs incurred during a closure to maintain operations, such as renting a temporary kitchen or expediting equipment repairs. If a flood damages your Dallas restaurant, this policy funds a pop-up location to keep your business running. It complements business interruption insurance for comprehensive protection.

Key uses include:

-

Temporary relocation costs, such as leasing a food truck.

-

Expedited shipping for replacement equipment.

-

Marketing to inform customers of your reopening.

This coverage ensures you can resume operations quickly after a disruption.

Food Contamination and Spoilage Insurance

Food contamination and spoilage insurance covers losses from contaminated food or spoiled inventory due to power outages, equipment failure, or supply chain issues. If a refrigerator fails and ruins $5,000 worth of ingredients, this policy covers replacement costs and lost revenue. In Dallas, where summer heat can exacerbate spoilage risks, this coverage is valuable.

What it covers:

-

Replacement of spoiled or contaminated food.

-

Lost income from closures due to contamination.

-

Costs for health inspections or public relations efforts.

This policy is critical for restaurants with large perishable inventories.

Equipment Breakdown Insurance

Equipment breakdown insurance covers repair or replacement costs for critical equipment, such as ovens, refrigerators, or HVAC systems, that fail due to mechanical issues, electrical surges, or operator error. In a Dallas restaurant, where kitchen equipment is heavily used, this policy prevents costly downtime.

Key features include:

-

Covers repair or replacement of equipment.

-

Includes diagnostic and labor costs.

-

May cover temporary equipment rentals.

This coverage is essential for maintaining operational efficiency.

Understanding Coverage Needs

Assessing Risks Specific to Restaurants

Restaurants face a wide range of risks that require tailored insurance solutions:

-

Customer Injuries: Slips on wet floors, falls on uneven surfaces, or allergic reactions to food can lead to costly claims.

-

Foodborne Illness: Improper storage, cross-contamination, or supplier issues may cause customer sickness, resulting in lawsuits.

-

Kitchen Accidents: Fires from grease buildup, electrical faults, or employee injuries like cuts and burns are common.

-

Alcohol-Related Incidents: Overserving or alcohol-related fights can trigger liability claims.

-

Cyber Threats: Data breaches targeting online ordering systems or payment information pose significant risks.

-

Operational Disruptions: Power outages, equipment failures, or supply chain delays can halt operations.

In Dallas, additional risks include:

-

Severe Weather: Hail, tornadoes, and flooding can damage property or disrupt operations, requiring specific coverage.

-

Urban Challenges: High traffic, parking lot accidents, and crime increase liability exposure.

-

Regulatory Oversight: Dallas’s strict health and safety codes demand compliance to avoid fines or closures.

A 2024 study by the National Restaurant Association found that 72% of restaurant claims stemmed from customer injuries or property damage, with weather-related claims rising in Texas due to increasing storm frequency.

Tailoring Coverage to Your Restaurant

Selecting the right coverage depends on several factors unique to your business:

-

Business Size: Larger restaurants with more customers and staff need higher liability limits and workers’ compensation coverage.

-

Cuisine Type: High-risk cuisines, such as raw seafood or open-flame cooking, may require specialized endorsements for foodborne illness or fire risks.

-

Alcohol Service: Restaurants serving alcohol must include liquor liability to comply with Texas regulations.

-

Delivery Operations: Businesses with delivery services need commercial auto insurance to cover vehicles and drivers.

-

Technology Use: Online ordering or digital payments increase the need for cyber liability to protect against data breaches.

-

Location Risks: Dallas’s weather and urban environment may necessitate flood, hail, or crime coverage.

Collaborating with an insurance agent who understands the restaurant industry and Dallas’s specific challenges ensures your coverage is comprehensive and cost-effective. They can conduct a risk assessment and recommend policies that align with your operational model, balancing protection with affordability.

Cost of Restaurant Insurance

Factors Influencing Premiums

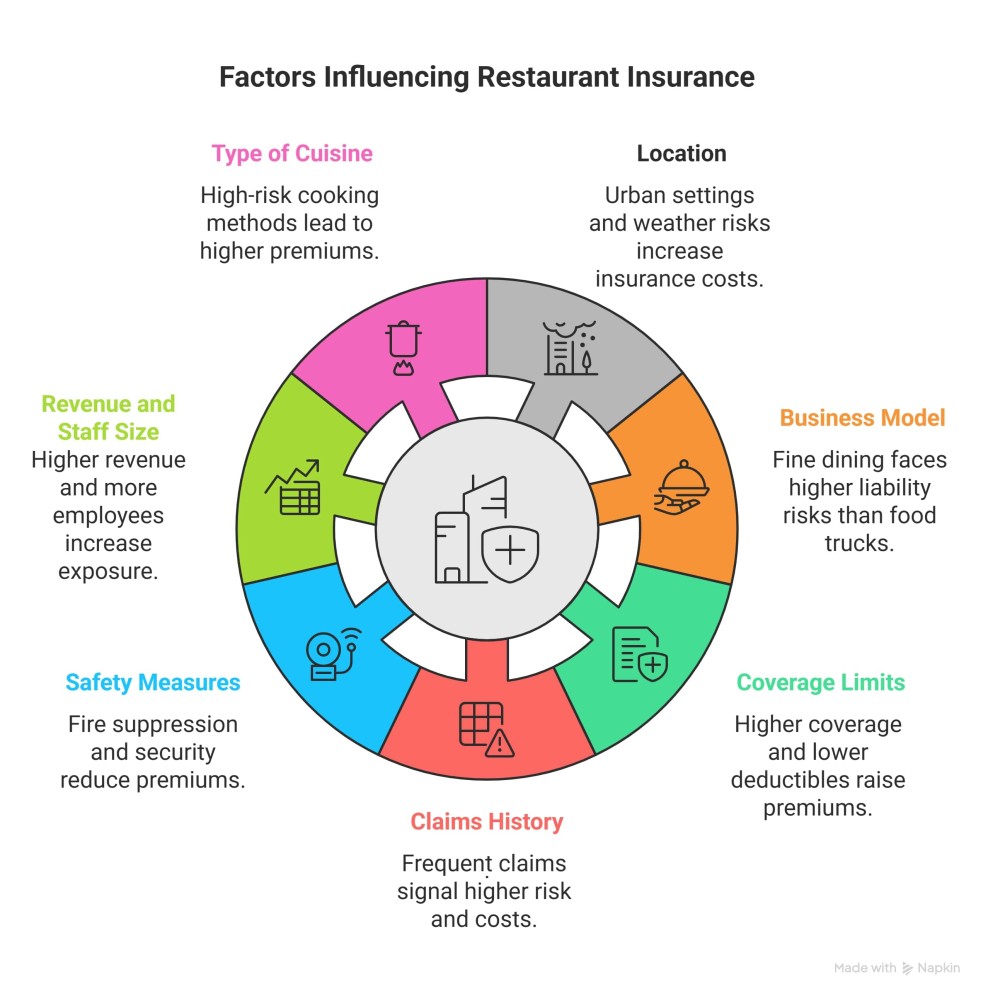

Insurance premiums vary based on several factors that reflect your restaurant’s risk profile:

-

Location: Dallas’s urban setting and weather risks, such as hail and tornadoes, elevate costs compared to rural areas.

-

Business Model: Fine dining restaurants face higher liability risks than food trucks, leading to increased premiums.

-

Coverage Limits and Deductibles: Higher limits or lower deductibles increase premiums, as they indicate greater insurer exposure.

-

Claims History: Frequent or severe claims signal higher risk, raising costs.

-

Safety Measures: Fire suppression systems, security cameras, and employee training can reduce premiums by lowering risk.

-

Revenue and Staff Size: Higher revenue or more employees increase exposure, affecting costs.

-

Type of Cuisine: Restaurants with high-risk cooking methods (e.g., deep frying) may face higher premiums due to fire risks.

Understanding these factors helps you anticipate costs and identify opportunities to manage premiums effectively.

Average Costs in Texas and Dallas

Based on 2024 industry data, approximate annual costs for restaurant insurance in Texas include:

-

General Liability: $805 to $6,000, average $1,440.

-

Business Owner Policy (BOP): $1,400 to $6,300, average $684.

-

Workers’ Compensation: $600 to $10,000, average $1,480.

-

Liquor Liability: $400 to $3,000, average $659.

-

Cyber Liability: $500 to $2,500, average $1,200.

-

Equipment Breakdown: $300 to $1,500, average $800.

-

Umbrella Insurance: $500 to $2,000, average $1,000.

In Dallas, premiums may be 10 to 20% higher due to urban and weather-related risks. For example, a mid-sized restaurant with alcohol service and delivery might pay $6,000 to $12,000 annually for comprehensive coverage, while a food truck might pay $2,000 to $4,000. These estimates vary based on specific risk factors and coverage selections.

Strategies to Manage Insurance Costs

You can manage premiums through several practical strategies:

-

Bundling Policies: A Business Owner Policy (BOP) combines general liability and property insurance at a lower cost than purchasing them separately.

-

Enhancing Safety: Install fire alarms, train staff on food safety, and use security systems to reduce risk and qualify for discounts.

-

Comparing Quotes: Request quotes from multiple insurers to find competitive rates, ensuring policies meet Texas requirements.

-

Adjusting Deductibles: Opt for higher deductibles to lower premiums, but ensure you can cover out-of-pocket costs in the event of a claim.

-

Maintaining a Clean Claims Record: Avoid frequent claims to keep premiums stable over time.

-

Annual Reviews: Reassess your coverage annually to eliminate unnecessary policies or add relevant ones as your business evolves.

-

Implementing Risk Management: Regular maintenance and employee training can prevent claims, keeping your insurance costs manageable.

For a detailed breakdown of restaurant insurance costs, read our full guide: Average Restaurant Insurance Costs in Texas: A Complete Breakdown.

Restaurant Insurance Regulations in Texas

State-Specific Requirements

Texas imposes specific insurance requirements for restaurants to ensure compliance and protect consumers:

-

Workers’ Compensation: Not mandatory but strongly advised to cover employee injuries and avoid lawsuits.

-

Liquor Liability: Required for any establishment serving alcohol to comply with Texas Alcoholic Beverage Commission (TABC) regulations.

-

General Liability and Property: Often required by landlords, lenders, or licensing authorities for operational permits.

-

Commercial Auto: Mandatory for businesses with delivery or catering vehicles to meet Texas transportation laws.

The Texas Department of Insurance (TDI) oversees insurance providers, ensuring policies meet state standards and protect restaurant owners from unfair practices.

Local Considerations in Dallas

Dallas presents unique regulatory and environmental considerations that impact insurance needs:

-

Urban Risks: High traffic, parking lot accidents, and crime increase liability exposure, requiring robust general liability and crime coverage.

-

Weather Risks: Hail, tornadoes, and flooding lead to frequent property claims, necessitating specific endorsements for these perils.

-

Local Ordinances: Dallas requires proof of insurance for permits, such as outdoor dining, alcohol service, or special events.

-

Health and Safety Codes: Strict compliance with food safety regulations is necessary to avoid fines, closures, or health-related claims.

These factors make it essential to work with an agent familiar with Dallas’s regulatory landscape.

Required Filings and Certifications

To operate legally, you may need to provide:

-

Proof of Insurance: Required for liquor licenses, landlord agreements, vendor contracts, or municipal permits.

-

TDI Compliance: Ensure policies adhere to Texas Department of Insurance standards for validity.

-

Certificates of Insurance: Provide these to municipalities, event organizers, or partners to verify coverage.

-

TABC Filings: Submit proof of liquor liability insurance to maintain your alcohol license, as required by the Texas Alcoholic Beverage Commission.

Finding Restaurant Insurance in Dallas, Texas

Working with Local Insurance Agents

Local insurance agents offer several advantages for Dallas restaurant owners:

-

Knowledge of Texas Regulations: They ensure compliance with state and local requirements, such as TABC and TDI standards.

-

Understanding of Dallas Risks: Agents tailor coverage for urban and weather-related challenges, such as hail or high crime areas.

-

Customized Solutions: They assess your restaurant’s specific needs and negotiate with insurers for optimal policies.

Reputable Dallas agencies, such as Thumann Agency, specialize in restaurant insurance and understand the local market’s unique demands. These agents can provide personalized guidance to ensure your coverage is both comprehensive and cost-effective.

Online Platforms and Comparison Tools

Online platforms like Insureon, CoverWallet, or The Hartford allow you to compare quotes from multiple insurers, providing a starting point for understanding coverage options and costs. These tools are convenient for gathering initial estimates but may not fully address Dallas-specific risks like severe weather or urban liability. To ensure compliance with Texas regulations, verify that any policy meets state and local requirements.

Combining online research with local agent expertise ensures you find coverage that balances affordability and protection. Online tools can help you narrow down options, while an agent can refine your choices based on your restaurant’s unique risk profile.

Selecting a Dallas-Based Agent

When choosing a Dallas-based insurance agent, consider the following criteria to ensure you receive reliable service:

-

Industry Experience: Select agents with a proven track record in restaurant insurance, as they understand the sector’s specific risks.

-

Local Expertise: Ensure they are familiar with Dallas’s weather, urban risks, and regulatory requirements to tailor coverage effectively.

-

Professional Affiliations: Look for memberships in organizations like the Texas Restaurant Association or Dallas Regional Chamber, indicating credibility.

-

Client Reviews: Check testimonials or case studies to gauge reliability, responsiveness, and customer service quality.

-

Accessibility: Choose an agent who is available for ongoing support, such as policy reviews or claims assistance.

An experienced agent can help you navigate the complexities of restaurant insurance and secure coverage that aligns with your business goals.

The Claims Process for Restaurant Insurance

Steps to File a Claim

Filing an insurance claim requires a structured approach to ensure timely processing and maximum coverage:

-

Document the Incident: Take photos, collect witness statements, and preserve evidence, such as damaged equipment or receipts, to support your claim.

-

Notify Your Insurer: Report the claim within 15 days, as required by Texas regulations, to avoid delays or denials.

-

Submit Documentation: Provide incident reports, invoices, and other relevant records to substantiate your claim.

-

Cooperate with Adjusters: Allow insurers to inspect damage or interview witnesses to assess the claim’s validity.

-

Track Progress: Follow up with your insurer regularly to ensure timely processing and address any additional requests.

Proper documentation and prompt reporting are critical to a successful claim.

What to Expect During the Process

Texas regulations outline specific timelines for insurers to handle claims:

-

Acknowledge claims within 15 days of notification to confirm receipt.

-

Approve or deny claims within 15 business days after receiving documentation, ensuring a fair evaluation.

-

Pay approved claims within 5 business days of approval to provide timely financial relief.

Insurance adjusters will assess damage, verify coverage, and determine payouts. For example, if a hailstorm damages your outdoor seating, the adjuster evaluates repair costs and confirms coverage under your property policy. Complex claims, such as foodborne illness lawsuits, may require additional investigation, including health department reports or legal reviews. Staying organized and responsive during this process ensures a smoother experience.

Avoiding Common Claims Mistakes

To maximize your claim’s success, avoid these common pitfalls:

-

Delayed Reporting: Late notifications can lead to claim denials or reduced payouts, as Texas regulations emphasize timely reporting.

-

Incomplete Documentation: Missing photos, receipts, or witness statements can delay processing or weaken your claim.

-

Inaccurate Information: Misrepresenting facts or exaggerating damages risks denial and potential policy cancellation.

-

Ignoring Adjuster Requests: Failing to provide requested information or access to the property can stall or jeopardize your claim.

-

Not Reviewing Coverage: Ensure the incident is covered under your policy to avoid filing ineligible claims.

By addressing these issues proactively, you can streamline the claims process and secure the coverage you’re entitled to.

Risk Management for Restaurants

Frequent Causes of Claims

Restaurants face a variety of insurance claims from multiple sources, each requiring specific risk management strategies:

-

Customer Injuries: Slips on wet floors, falls on uneven surfaces, or injuries from hot food/drinks are common, often leading to general liability claims.

-

Foodborne Illness: Contaminated ingredients or improper storage can cause customer sickness, resulting in lawsuits or health department investigations.

-

Kitchen Accidents: Grease fires, electrical faults, or employee injuries like cuts, burns, or slips contribute to property and workers’ compensation claims.

-

Alcohol-Related Incidents: Overserving or alcohol-related fights can trigger liquor liability claims, particularly in bars or nightlife venues.

-

Cyber Threats: Data breaches or ransomware targeting online systems can lead to significant financial and reputational losses.

-

Property Damage: Weather-related damage, vandalism, or equipment failure can disrupt operations and require costly repairs.

A 2024 National Safety Council report noted that restaurants accounted for 18% of workplace injury claims in the hospitality sector, with slips and burns being the leading causes. Understanding these risks is the first step toward effective prevention.

Preventive Strategies

Implementing risk management strategies can significantly reduce the likelihood and severity of claims:

-

Staff Training: Conduct regular training on food safety, fire prevention, and emergency procedures to minimize accidents and ensure compliance with health codes.

-

Equipment Maintenance: Inspect ovens, fryers, and refrigeration units regularly to prevent breakdowns or fires, reducing property and spoilage claims.

-

Security Systems: Install alarms, cameras, and locks to deter theft and vandalism, lowering crime-related risks.

-

Cybersecurity Practices: Use encrypted payment systems, strong passwords, and updated software to protect against data breaches and cyberattacks.

-

Floor Safety: Use non-slip mats, clean spills promptly, and maintain clear walkways to prevent customer and employee injuries.

-

Alcohol Service Protocols: Train staff to monitor alcohol consumption, verify IDs, and refuse service when necessary to avoid liquor liability claims.

-

Health and Safety Audits: Conduct periodic audits to identify and address potential hazards, such as faulty wiring or improper food storage.

These measures not only reduce claims but also demonstrate to insurers that your business prioritizes safety, potentially lowering premiums. For more proven ways to reduce premiums, visit our guide on Risk Management Strategies to Lower Restaurant Insurance Premiums.

Managing Weather-Related Risks in Dallas

Dallas’s weather conditions pose significant challenges for restaurants, requiring targeted risk management:

-

Hail and Tornadoes: Secure outdoor furniture, reinforce windows, and install storm shutters to minimize damage from severe storms.

-

Flooding: Elevate equipment, install sump pumps, and use water-resistant materials in flood-prone areas to protect against water damage.

-

Emergency Preparedness: Develop evacuation plans, stock emergency supplies, and train staff on severe weather protocols to ensure safety and continuity.

-

Insurance Endorsements: Add flood or windstorm coverage to your property policy, as standard policies often exclude these perils.

-

Business Continuity Plans: Establish temporary operating procedures, such as partnering with food trucks or delivery services, to maintain revenue during weather-related closures.

By preparing for Dallas’s unique weather risks, you can minimize disruptions and protect your business’s financial health.

Restaurant Insurance for Specific Business Models

Fine Dining Restaurants

Fine dining restaurants face elevated risks due to high customer expectations, upscale interiors, and extensive alcohol service. Comprehensive coverage, including general liability, property, and liquor liability, is essential. For example, a customer slipping on a polished floor or a wine spill damaging expensive clothing could lead to significant claims.

Recommended coverages include:

-

High-limit general liability for customer injuries and property damage in high-traffic dining areas.

-

Property insurance for high-value furnishings, art, and kitchen equipment, such as custom ranges or wine cellars.

-

Liquor liability for extensive wine and cocktail menus, common in fine dining settings.

-

EPLI for employee disputes in high-pressure environments with formal staff structures.

These policies ensure protection against the unique risks of fine dining operations.

Fast-Casual Restaurants

Fast-casual restaurants balance cost and coverage for moderate risks, focusing on high customer turnover and streamlined operations. They typically need general liability, property, and workers’ compensation, with optional business interruption for operational disruptions. A Dallas taco chain, for instance, might prioritize property insurance to protect against hail damage.

Key coverages include:

-

General liability for customer accidents in busy dining areas or drive-thru lanes.

-

Property insurance for equipment, signage, and inventory, such as grills and food prep stations.

-

Business interruption for closures due to weather or equipment issues, ensuring financial stability.

This coverage model suits the fast-paced, cost-conscious nature of fast-casual dining.

Food Trucks

Food trucks face mobile risks, including accidents, theft, and weather damage, requiring specialized coverage. In Dallas, where food trucks operate at festivals or high-traffic areas, coverage for urban risks is essential.

Essential coverages include:

-

Commercial auto for vehicle accidents, theft, or vandalism, critical for mobile operations.

-

Property insurance for cooking equipment and mobile setups, such as generators or fryers.

-

General liability for customer interactions at events, markets, or pop-up locations.

These policies address the unique challenges of operating a mobile food business.

Bars and Nightclubs

Bars and nightclubs face high liquor liability risks due to alcohol service, along with potential for fights, property damage, or noise complaints. Robust liability and EPLI coverage are necessary to protect against claims. In Dallas’s vibrant nightlife scene, comprehensive insurance is critical.

Key coverages include:

-

Liquor liability for alcohol-related incidents, such as overserving or fights.

-

General liability for injuries or property damage in crowded, high-energy venues.

-

EPLI for employee claims related to high turnover or workplace disputes.

These policies ensure protection in a high-risk environment.

Cafés and Coffee Shops

Cafés and coffee shops face moderate risks, primarily from customer injuries, equipment issues, and small-scale property damage. Coverage needs are simpler than for full-service restaurants but still require attention. In Dallas, where cafés often have outdoor seating, weather-related coverage is important.

Recommended coverages include:

-

General liability for customer slips or spills, common in high-traffic coffee shops.

-

Property insurance for espresso machines, furniture, and inventory, such as coffee beans or pastries.

-

Business interruption for closures due to power outages or storms, ensuring revenue stability.

These policies support the operational needs of smaller-scale establishments.

Pop-Up and Temporary Restaurants

Pop-up and temporary restaurants operate for short periods, often at festivals, markets, or special events, requiring flexible, short-term coverage. In Dallas, where pop-up dining is popular, these businesses face risks like weather damage, customer injuries, and equipment theft.

Key coverages include:

-

Short-term general liability for customer interactions at temporary locations.

-

Property insurance for portable equipment, such as grills or tents.

-

Event-specific coverage for festivals or markets, often required by event organizers.

These policies provide targeted protection for transient operations.

Historical Context of Restaurant Insurance

Evolution of Insurance in the Food Service Industry

Restaurant insurance has undergone significant changes over the past century, reflecting the growth and diversification of the food service industry. In the early 1900s, basic property and liability insurance emerged to protect businesses from fires and customer injuries, which were the primary risks at the time. As restaurants expanded in the mid-20th century, particularly with the rise of fast food, new risks emerged, such as drive-thru accidents and high employee turnover, prompting insurers to develop specialized policies like workers’ compensation and commercial auto.

The introduction of liquor liability insurance in the 1980s addressed the growing prevalence of alcohol service in restaurants and bars, driven by stricter state regulations. The digital era brought cyber liability insurance to tackle data breaches and online ordering risks, reflecting the industry’s increasing reliance on technology. In Texas, the rapid growth of the restaurant sector, particularly in urban hubs like Dallas, has driven demand for comprehensive policies that account for weather, regulatory, and operational challenges. A 2023 analysis by the Journal of Insurance Studies noted that restaurant insurance premiums have increased 15% annually since 2000, driven by rising claim costs and regulatory complexity.

Impact of Regulatory Changes

Regulatory changes have significantly shaped restaurant insurance requirements over time. In Texas, the introduction of mandatory liquor liability laws in the 1980s forced bars and restaurants to secure coverage to maintain licenses, reflecting heightened public safety concerns. The Texas Department of Insurance, established in 1991, standardized insurance regulations, improving consumer protections and insurer accountability. Recent updates, such as stricter health and safety codes in Dallas, have increased the need for proof of insurance for permits and licenses, particularly for outdoor dining and alcohol service.

Federal regulations, like the Occupational Safety and Health Act (OSHA) of 1970, influenced the adoption of workers’ compensation, even in states like Texas where it’s not mandatory. These changes reflect a broader trend toward greater accountability and risk management in the restaurant industry, ensuring businesses are prepared for a wide range of liabilities.

Technological Influences on Insurance

Technology has transformed restaurant insurance by introducing new risks and coverage options. The rise of online ordering, digital payments, and customer databases has increased the need for cyber liability insurance to protect against data breaches and hacking. Point-of-sale (POS) systems, while improving efficiency, have also become targets for cybercriminals, prompting insurers to offer specialized policies. Additionally, smart sensors and IoT devices, such as fire detection systems or refrigeration monitors, have enabled restaurants to reduce risks and qualify for premium discounts by providing real-time data to insurers.

In Dallas, where restaurants are early adopters of technology, these advancements have reshaped insurance needs. For example, a 2024 study by the National Restaurant Association found that 45% of Texas restaurants implemented smart technology to monitor equipment, reducing claims by 12%. These technological influences highlight the evolving nature of restaurant insurance and the importance of staying informed about new coverage options.

Frequently Asked Questions (FAQs)

Is Restaurant Insurance Mandatory in Texas?

Restaurant insurance is not universally mandatory, but specific coverages are required in certain cases. General liability and property insurance are often required by landlords or lenders, while liquor liability is mandatory for alcohol-serving establishments. Workers’ compensation is optional but recommended to avoid lawsuits. Local permits, such as those for outdoor dining, may also require proof of insurance.

What Does General Liability Insurance Cover for Restaurants?

General liability insurance covers bodily injury (e.g., customer slips), property damage (e.g., damaged customer belongings), and personal injury (e.g., defamation claims). It’s a core policy for managing customer-facing risks and is often required by landlords or licensing authorities.

How Much Does Restaurant Insurance Cost in Dallas?

Insurance costs range from $1,500 to $12,000 annually, depending on coverage, business size, and risks. Dallas’s urban and weather risks may increase premiums by 10 to 20% compared to rural areas, with larger restaurants or those with alcohol service paying more.

Does Restaurant Insurance Cover Food Spoilage?

Food spoilage is not covered under standard policies but can be added through an endorsement. This coverage is critical for restaurants with large perishable inventories, especially in Dallas’s hot climate.

What’s the Difference Between General and Liquor Liability Insurance?

General liability covers broad risks like customer injuries or property damage. Liquor liability specifically addresses alcohol-related claims, such as overserving or drunk driving accidents, and is mandatory for Texas restaurants serving alcohol.

Is Workers’ Compensation Required in Texas?

Workers’ compensation is not mandatory in Texas but is strongly recommended to cover employee injuries and avoid lawsuits. Most Dallas restaurants opt for this coverage to protect against financial and legal risks.

What Steps Should I Take If I Have a Claim?

To file an insurance claim, document the incident with photos and witness statements, notify your insurer within 15 days, and provide complete documentation to ensure efficient processing. Follow up regularly to track progress.

Are Discounts Available for Restaurant Insurance?

Insurance discounts are available for bundling policies, maintaining a clean claims history, or implementing safety programs like employee training or security systems. Ask your agent about eligible discounts.

Can I Get Insurance for a Food Truck in Dallas?

Yes, food trucks require commercial auto insurance for vehicles and specialized property coverage for equipment. General liability is recommended for customer interactions at events or markets.

How Long Does It Take to Process a Restaurant Insurance Claim?

Claims processing typically takes 15 days for insurers to acknowledge, 15 business days to approve or deny after receiving documentation, and 5 business days to pay approved claims, per Texas regulations.

Which Restaurants Need Liquor Liability Insurance?

Any Texas restaurant or bar serving alcohol requires liquor liability insurance to cover alcohol-related claims, such as overserving or accidents, as mandated by the Texas Alcoholic Beverage Commission.

Does Restaurant Insurance Cover Cyberattacks?

Standard policies don’t cover cyberattacks, but cyber liability insurance can protect against data breaches, hacking, and related losses, which is increasingly important for restaurants with online systems.

How Often Should I Review My Restaurant Insurance?

Review your insurance policy annually or after significant changes (e.g., adding delivery, alcohol service, or new equipment) to ensure coverage meets your current needs and reflects your business’s risk profile.

Can Restaurant Insurance Cover Lost Income?

Business interruption insurance covers lost income and operating expenses during closures caused by covered events, such as fires, storms, or equipment failures, helping maintain financial stability.

What Happens If I Don’t Have Restaurant Insurance?

Without restaurant insurance, you’re personally liable for claims, repairs, or lawsuits, which could lead to financial ruin. Some coverages are also required for licensing, permits, or contracts, making insurance essential.

Do I Need Insurance for Outdoor Dining in Dallas?

Yes, outdoor dining requires general liability and property insurance to cover customer injuries or weather-related damage. Dallas’s weather risks may necessitate endorsements for hail, wind, or flooding.

How Do I Know If My Restaurant Insurance Is Sufficient?

Work with an insurance agent to assess risks, review coverage limits, and ensure policies address your restaurant’s specific needs, such as alcohol service, delivery, or weather risks, to confirm adequacy.

Can Insurance Cover Employee Theft?

Commercial crime insurance covers losses from employee theft, fraud, or dishonesty, protecting your business from internal financial risks, such as cash skimming or inventory theft.

Does Restaurant Insurance Cover Equipment Breakdowns?

Standard policies exclude equipment breakdowns, but equipment breakdown insurance covers repair or replacement costs for critical systems like ovens or refrigerators, ensuring operational continuity.

Can I Get Short-Term Insurance for a Pop-Up Restaurant?

Yes, pop-up restaurants can secure short-term general liability and property insurance for temporary operations. Event-specific coverage may also be required for festivals or markets in Dallas.

What Should I Do If a Customer Files a Lawsuit?

If a customer files a lawsuit, notify your insurer immediately, provide documentation, and cooperate with legal defense efforts. General liability or EPLI can cover legal fees and settlements, depending on the claim.

Conclusion

Restaurant insurance is a vital component of financial and operational stability for Dallas-based businesses, offering protection against a wide range of risks, from customer injuries and foodborne illnesses to severe weather and cyberattacks. By understanding the various coverage types, including general liability, property, workers’ compensation, and specialized policies like liquor liability or cyber insurance, you can tailor your insurance to your restaurant’s unique needs. Dallas’s urban environment, weather challenges, and regulatory landscape make comprehensive coverage particularly critical for ensuring long-term success.

Insurance costs vary based on factors like business size, location, and risk profile, but strategic measures, such as bundling policies, enhancing safety, and comparing quotes, can help manage premiums effectively. Texas regulations, combined with Dallas’s local ordinances, underscore the importance of compliance and preparedness. Effective risk management, including staff training, equipment maintenance, and weather planning, further reduces your exposure to claims, enhancing your business’s resilience.

To thrive in Dallas’s dynamic culinary scene, regularly review your insurance policies to adapt to evolving risks, such as new services, regulatory changes, or environmental factors. Consulting with a knowledgeable, Dallas-based insurance agent can help you navigate these complexities and secure coverage that balances protection and affordability. For personalized guidance, consider contacting Thumann Agency in Dallas, Texas, at (972) 991-9100 or www.thumannagency.com to discuss your restaurant’s insurance needs and ensure your business is well-protected

Last Updated: 14.07.2025

Author: Lauren Thumann Director of Marketing.

Disclaimer: This page is for educational purposes only. Coverage details vary by provider. Contact us for a personalized quote.