Operating a restaurant in Texas involves managing a range of risks, from customer accidents to equipment failures and natural disasters. Whether you run a bustling Dallas diner, a cozy Austin café, or a catering business in Houston, understanding the costs of insuring your operation is vital for financial stability. Restaurant insurance protects against unexpected setbacks, but premiums vary widely based on location, business type, and specific needs.

This guide provides a detailed look at typical restaurant insurance cost breakdown, key coverages, and factors influencing rates in Texas. By exploring these elements, restaurant owners can make informed decisions to safeguard their businesses while keeping expenses manageable.

Understanding Restaurant Insurance Costs in Texas

Restaurant insurance is a critical expense for Texas business owners, ensuring protection against liabilities and property damage. The how much does restaurant insurance cost for a Business Owner’s Policy (BOP), which includes general liability and property coverage, typically ranges from $2,000 to $4,500 annually, averaging around $3,000, or $250 per month. Costs depend on several variables, including the restaurant’s size, location, and operational model. For example, a small San Antonio taco stand might pay $2,000 per year, while a large Fort Worth steakhouse could face $5,500 due to higher revenue and equipment values.

Location significantly impacts premiums. Urban areas like Dallas and Houston have higher crime rates and litigation risks, increasing general liability costs by 10-15% compared to rural regions, according to the Texas Department of Insurance. Coastal restaurants near Corpus Christi or Galveston face elevated property insurance rates, up to 20% higher, due to hurricane and flood risks. Statewide, premiums have risen 5-7% annually since 2020, driven by inflation, rising labor costs, and increasing legal settlements.

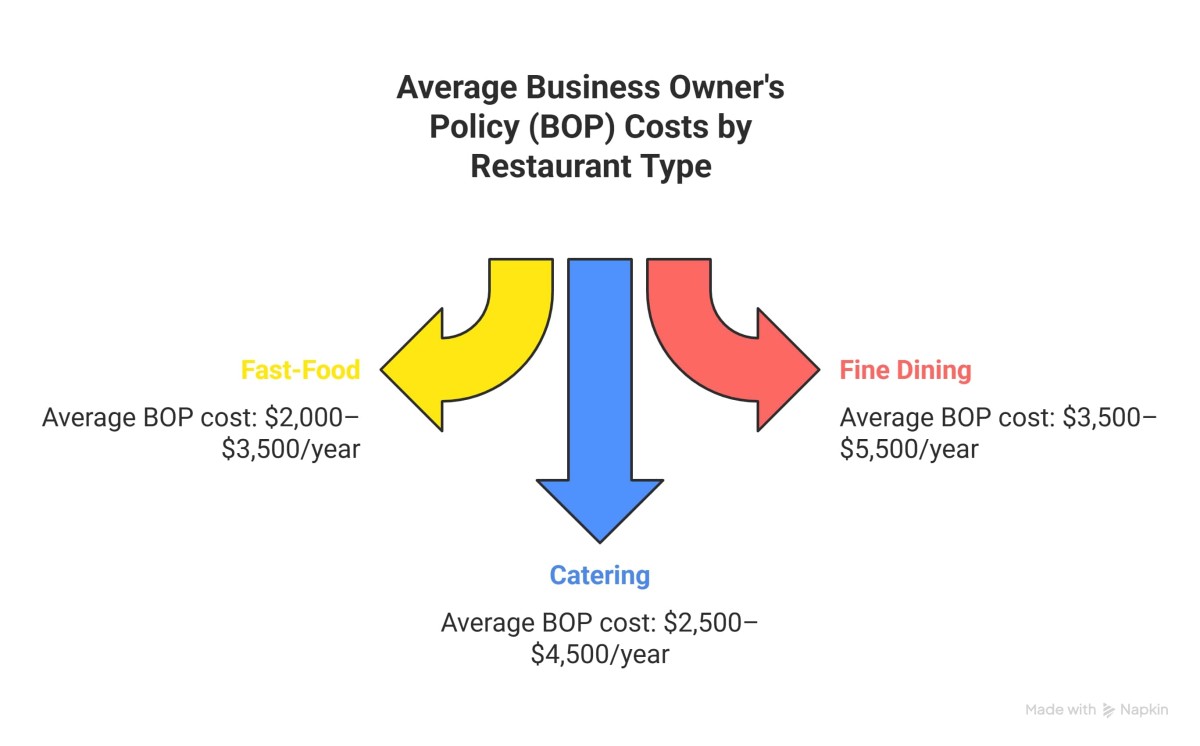

Restaurant type also plays a role. Fast-food operations, with simpler setups and minimal alcohol service, often secure lower rates than fine dining establishments, where upscale decor and extensive wine lists heighten risks. Catering businesses, operating at off-site events, incur additional costs of $500-$1,000 per year due to unique liabilities like transportation and event setup. Texas’s diverse economy, with over 50,000 restaurants employing 1.2 million workers (per the Texas Restaurant Association, 2024), underscores the need for tailored insurance solutions.

Another factor is the restaurant’s revenue and payroll. Higher earnings signal greater exposure, raising premiums. A Houston barbecue joint with $1 million in annual revenue might pay $4,000 for a BOP, while a Waco food truck with $200,000 in revenue pays $2,200. Payroll size affects workers’ compensation costs, with each additional employee adding roughly $100-$200 per year. Understanding these dynamics allows owners to budget effectively and avoid overpaying for coverage.

infographic comparing BOP costs by restaurant type:

-

Fast-food: $2,000-$3,500/year.

-

Fine dining: $3,500-$5,500/year.

-

Catering: $2,500-$4,500/year.

Key Coverage Types for Texas Restaurants

Restaurants in Texas face a variety of risks, requiring a mix of insurance policies to ensure full protection. Below, we outline the primary and specialized coverages, their costs, and their relevance, with examples drawn from the state’s vibrant restaurant industry.

General Liability Insurance

General liability insurance protects against claims of bodily injury, property damage, or advertising errors. In Texas, costs range from $500 to $2,500 per year, averaging $900 for a $1 million liability insurance policy cost for restaurants. For instance, if a customer at an El Paso café slips on a spilled drink and sues for $40,000 in medical expenses, this policy covers legal fees, settlements, and medical costs up to the policy limit.

Texas’s litigation environment, with an 8% rise in liability claims from 2020 to 2024, makes this coverage essential. Without it, a single lawsuit could cost thousands, threatening small businesses.

Commercial Property Insurance

Commercial property insurance covers physical assets, including kitchen equipment, inventory, furniture, and the building if owned. Costs in Texas range from $500 to $2,500 per year, averaging $740. Picture a fire at an Austin pizza parlor damaging $25,000 in ovens and supplies; this policy funds repairs and replacements, minimizing downtime. However, standard policies exclude flood damage, a significant concern in Dallas, where 12% of businesses reported flood losses in 2023, per FEMA. Adding flood insurance, costing $500-$1,500 annually, is advisable in high-risk areas to cover water-related damages.

Workers’ Compensation Insurance

Unlike most states, Texas does not mandate workers’ compensation insurance, but it’s a wise investment to cover employee injuries. The workers’ compensation insurance cost for restaurants ranges from $300 to $3,000 per year, averaging $600.

For example, if a Lubbock server sprains their ankle during a busy shift, incurring $15,000 in medical bills, this policy covers treatment and lost wages, protecting the business from lawsuits. With restaurant injury rates 18% higher than the national average, per OSHA 2024 data, this coverage is critical for kitchens with hazards like hot surfaces or sharp tools.

Liquor Liability Insurance

Restaurants serving alcohol need liquor liability insurance to cover claims from alcohol-related incidents. The cost of liquor liability insurance for restaurants averages $500-$1,000 per year, depending on alcohol sales volume. In a San Antonio brewpub, if an overserved patron causes a $75,000 accident, this policy covers legal costs and damages.

Texas’s dram shop laws hold businesses liable for over-serving, making this coverage vital for bars, wineries, or restaurants with robust cocktail programs. Establishments with high alcohol revenue (e.g., 50% of sales) face premiums at the upper end of the range.

Specialized Coverages

Additional policies address specific risks:

-

Spoilage Coverage ($200-$500/year): Covers losses from spoiled food, such as $4,000 in inventory ruined during a Houston power outage.

-

Food Contamination Coverage ($300-$700/year): Funds cleanup and lost income from incidents like salmonella, critical after Texas reported 250 health violations in 2024.

-

Cyber Liability Insurance ($500-$1,500/year): Protects against data breaches, essential for restaurants with online ordering, as 28% of small businesses faced cyberattacks in 2023.

-

Catering Off-Site Coverage ($300-$800/year): Covers event liabilities, like a tent collapse at an Amarillo wedding, ensuring caterers are protected.

Each coverage addresses distinct risks, allowing owners to customize policies. For example, a Dallas fine dining restaurant might prioritize liquor liability and cyber coverage, while a rural food truck focuses on property and spoilage protection. Consulting with an experienced broker helps identify the right mix.

Factors Affecting Restaurant Insurance Premiums in Texas

The factors affecting restaurant insurance premiums in Texas are diverse, reflecting the state’s varied business and environmental landscape. Understanding these factors helps owners anticipate costs and optimize their insurance plans.

-

Location: Restaurants in urban centers like Dallas or Houston pay 10-20% more due to higher crime rates and legal risks. For instance, general liability premiums in Dallas average $1,000, compared to $800 in rural Laredo. Coastal regions like Galveston face higher property rates, up to 25% more, due to hurricane risks, per NOAA 2024 data.

-

Restaurant Type: Fast-food restaurants, with streamlined operations, pay less than fine dining venues, where high-value equipment and alcohol service increase costs. A Waco burger joint might pay $2,200 for a BOP, while an Austin bistro pays $4,500. Catering operations add $500-$1,000 for off-site risks.

-

Business Size: Larger restaurants, with higher revenue or square footage, face steeper premiums. A 12,000-square-foot Corpus Christi seafood restaurant might pay $6,500 for a BOP, while a 1,500-square-foot Odessa café pays $2,300. Payroll size impacts workers’ compensation, with each employee adding $100-$200 annually.

-

Claims History: A clean record keeps rates low, but a single claim within 3-5 years can increase premiums by 15-25%. A past $50,000 liability claim could add $600 to a Houston restaurant’s annual costs.

-

Safety Measures: Training staff on safety protocols, like handling spills or using fire extinguishers, can reduce premiums by 5-10%. Installing security cameras or fire suppression systems in a Fort Worth kitchen might save $300-$500 per year.

External trends also influence costs. Rising labor expenses, up 30% since 2020, increase workers’ compensation rates, while larger jury awards, averaging $1.8 million in 2024, drive up liability premiums. Texas’s 50,000+ restaurants, contributing $70 billion to the economy, face these pressures, making cost management essential. Owners can mitigate expenses by maintaining safety records and comparing quotes from multiple insurers. Curious how other Dallas restaurants save on coverage? Check out our detailed guide on Risk Management Strategies to Lower Restaurant Insurance Premiums.

Texas-Specific Risks and Coverage Considerations

Texas’s unique geography and regulatory environment create distinct risks for restaurants, requiring tailored insurance solutions. Recognizing these challenges ensures owners are adequately protected.

-

Natural Disasters: Dallas’s flash floods, affecting 1,200 businesses in 2023, underscore the need for flood insurance, as standard property policies exclude water damage. Wildfires, impacting 8% of rural Texas restaurants annually, demand enhanced property coverage. Coastal hurricanes near Galveston can increase property premiums by 20-30%, per FEMA data.

-

Regulatory Environment: Texas’s optional workers’ compensation law offers flexibility but exposes businesses to lawsuits without coverage. In 2024, 20% of Texas restaurants faced employee claims, per the Texas Department of Insurance. Owners must weigh the cost of coverage against potential legal risks.

-

Catering and Startups: Catering businesses require off-site coverage for events, such as a $12,000 food poisoning claim at a Tyler wedding. Startups, lacking claims history, face 10-15% higher rates, making affordable policies critical. A new Austin food truck might pay $3,200 for a BOP, compared to $2,800 for an established one.

-

Health and Safety Regulations: Texas’s strict health codes, with 280 violations in Harris County in 2024, can lead to closures. Food contamination coverage mitigates losses from incidents like improper refrigeration, costing $10,000-$20,000 in cleanup and lost revenue.

Restaurants also face operational risks, such as equipment breakdowns (e.g., a $5,000 oven failure) or customer injuries from poorly maintained premises. Urban restaurants in Dallas, with higher foot traffic, report 15% more slip-and-fall claims than rural ones. Rural restaurants, however, may face challenges like limited access to emergency services, increasing the impact of fires or theft. By addressing these risks with targeted coverage, owners can protect their businesses while complying with local regulations.

Learn how Dallas-specific risks impact your insurance needs in our detailed guide: Restaurant Insurance: A Detailed Guide for Businesses in Dallas, Texas.

Strategies to Lower Restaurant Insurance Costs

Managing restaurant insurance pricing guide involves balancing protection with affordability. These strategies, tailored to Texas’s restaurant industry, help owners reduce premiums without compromising coverage.

-

Bundle Policies: Combining general liability, property, and business interruption into a BOP saves 10-15%. A Lubbock diner reduced costs from $4,200 to $3,500 by bundling. Comparing quotes from multiple insurers ensures the best rates.

-

Enhance Safety Practices: Training staff on safety, like proper food handling or spill cleanup, cuts injury claims by 25%, per OSHA. Regular maintenance, such as checking refrigeration units, qualifies for 5-10% discounts. A Brownsville café saved $350 by upgrading fire alarms.

-

Maintain a Clean Claims Record: Avoiding claims keeps premiums low. A single $30,000 claim can raise rates by $500 annually. Documenting safety efforts, like employee training logs, strengthens your case with insurers.

-

Review Coverage Annually: Business changes, like adding a patio or increasing revenue, affect insurance needs. An El Paso taqueria saved $400 by updating their policy after downsizing staff. Regular reviews prevent overpaying for outdated coverage.

Texas’s economic pressures, including a 6% rise in operating costs in 2024, make these strategies vital. Restaurants can also benefit from industry-specific discounts, such as those for Texas Restaurant Association members, which offer 3-5% savings. By implementing these measures, owners can optimize their insurance budgets while maintaining robust protection.

Testimonial: “Our San Antonio bistro saved hundreds by streamlining our coverage with expert guidance.” – Elena M., Restaurant Owner.

Restaurant Insurance Done Right – Here’s Why Thumann Agency Excels

For nearly three decades, Thumann Agency has served Texas businesses from our Dallas office, building a reputation for tailored insurance solutions. Since 1996, we’ve helped thousands of restaurant owners, from food trucks to fine dining establishments, navigate the complexities of restaurant insurance premium calculation. Our expertise lies in understanding the hospitality industry’s unique needs, ensuring coverage that fits each business’s risk profile.

Our strength is our independence. Partnering with over 80 insurers, we offer a wide range of options, securing competitive rates and customized policies. Our licensed agents, trained in risk assessment, analyze your operations whether it’s a Houston catering service or an Austin bar to eliminate redundant coverage and address gaps. This approach saved a Dallas food truck $600 annually by optimizing their liability policy.

Located in Dallas, we have deep knowledge of Texas’s risks, from urban crime to coastal storms and health regulations. This local insight allows us to craft policies that protect against region-specific challenges, like flood risks in Dallas or health violations in San Antonio. Our commitment to clear communication ensures you understand your coverage without confusing jargon.

With hundreds of positive reviews and recognition as a trusted Texas provider, our clients value our personalized service. A Fort Worth brewery owner noted, “Their team made insurance straightforward and affordable.” We offer flexible payment plans and cost-effective solutions, ideal for startups or established chains. Thumann Agency is your partner in protecting your restaurant. Call 972.991.9100 for a free restaurant insurance quote today.

FAQs on Restaurant Insurance in Texas

These FAQs clarify fast food restaurant insurance costs and coverage details for Texas restaurants.

How much does restaurant insurance cost per month?

Most Texas restaurants pay $80-$250 per month for a BOP, averaging $250/month or $3,000/year. Urban locations like Dallas have higher rates than rural areas.

How much does a $1 million liability insurance policy cost for restaurants?

A $1 million general liability policy costs $500-$2,500/year, averaging $900. Costs rise in high-risk areas like Houston.

How much does workers’ compensation insurance cost for restaurants?

Workers’ compensation costs $300-$3,000/year, averaging $600, based on payroll and kitchen hazards.

What is the cost of liquor liability insurance for restaurants?

Liquor liability insurance costs $500-$1,000/year, depending on alcohol sales, essential for Texas bars.

How can restaurants lower their insurance costs?

Bundle policies, train staff, maintain equipment, and compare insurer quotes. Annual reviews optimize costs.

What is a Business Owner’s Policy (BOP) and its average cost for restaurants?

A BOP combines general liability, property, and business interruption coverage, averaging $3,000/year in Texas.

Summary: Safeguarding Your Texas Restaurant

Restaurant insurance costs in Texas vary based on location, business type, and risks, with BOPs averaging $3,000 annually. Key coverages like general liability, property, and workers’ compensation protect against common threats, while specialized policies address niche risks like food contamination or off-site catering. Texas’s unique challenges floods, wildfires, and optional workers’ compensation require tailored solutions.

By understanding cost factors and implementing savings strategies, owners can secure affordable protection. Thumann Agency’s expertise and access to multiple insurers simplify this process, ensuring your restaurant is ready for any challenge. Call 972.991.9100 for a free restaurant insurance quote today

Last Updated: 14.07.2025

Author: Lauren Thumann Director of Marketing.

Disclaimer: This page is for educational purposes only. Coverage details vary by provider. Contact us for a personalized quote.