Every year, Dallas roads witness over 30,000 vehicle accidents, with commercial trucks and delivery vans often caught in the chaos of I-35E or Loop 12. For Texas businesses, a single crash can halt operations, rack up repair costs, and spark stress over insurance claims. The commercial auto insurance in Dallas claim process can feel like navigating a maze, but it doesn’t have to. At Thumann Agency, we’ve spent nearly three decades helping Dallas businesses recover swiftly after accidents.

This guide walks you through each step, shares local insights, and equips you with practical tips to keep your business on track.

What Is the Commercial Auto Insurance Claim Process?

A commercial auto insurance claim is your request for financial coverage from an insurer after a business vehicle think delivery vans, service trucks, or heavy-duty rigs is involved in an incident. This could be a fender-bender in downtown Dallas, a theft in Deep Ellum, or storm damage on a parked fleet. The process involves reporting the incident, submitting evidence, and collaborating with a claims adjuster to evaluate damages and secure a payout. In Dallas, where congested highways and sudden weather shifts amplify risks, knowing this process inside out is a game-changer.

Consider a local catering company whose van was sideswiped on Central Expressway. They faced potential downtime that could’ve cost thousands in lost bookings. By understanding the claim process, they worked with their insurer to secure repairs and a rental vehicle within days. Your business can achieve the same smooth recovery with the right knowledge. This section lays the foundation, but we’ll dive deeper into actionable steps, documentation, and Dallas-specific challenges as we go.

Steps to File a Commercial Auto Insurance Claim in Dallas

Filing a commercial auto insurance claim in Dallas demands quick thinking and organization, especially with Texas’s strict reporting rules. A well-handled claim can mean the difference between a week of downtime and months of headaches. Here’s how to navigate the process like a pro:

-

Ensure Safety and Report the Incident: If an accident occurs, pull over to a safe spot away from Dallas’s bustling traffic and activate hazard lights. Call 911 for injuries or disabled vehicles. For minor incidents, reach Dallas police at 214-744-4444 to file an accident report. Texas law mandates reporting crashes with injuries or damages over $1,000, which is common for commercial vehicles.

-

Collect Critical Details: Exchange names, contact info, and insurance details with other drivers. Jot down the time, location, and conditions (e.g., rainy roads near Fair Park). Snap photos of vehicle damage, traffic signs, and skid marks. These details can make or break your claim.

-

Notify Your Insurer Promptly: Contact your insurance agent or carrier as soon as possible. Have your policy number, police report number, and a brief incident summary ready. Texas insurers often enforce a 30-day filing window, and delays can jeopardize approval.

-

Engage with the Claims Adjuster: A claims representative will review your policy, inspect damages (often at a Dallas repair shop), and request documentation. Respond quickly to keep the process moving. In complex cases, like multi-vehicle pileups on I-635, adjusters may need extra time to determine fault.

-

Finalize the Settlement: Once the adjuster completes their review, you’ll receive a settlement offer, repair authorization, or, in rare cases, a denial. If approved, funds may be direct-deposited or mailed as a check. If denied, you can appeal with additional evidence.

A Dallas plumbing company recently used these steps after a collision on Woodall Rodgers Freeway. By reporting the incident within hours and providing clear photos, they secured a rental truck and repairs in under two weeks. With our partnerships across 80+ top insurers, we help businesses like yours find policies that prioritize fast claims, ensuring minimal disruption.

Read more about what factors affect commercial auto insurance premiums in Texas and learn how to potentially lower your costs.

What Documentation Is Needed for a Commercial Auto Insurance Claim?

Submitting complete documentation is the backbone of a successful commercial auto insurance claim. In Dallas, where insurers and adjusters juggle high claim volumes, missing paperwork can stall your case for weeks. Here’s a detailed checklist to keep your claim on track:

-

Police Report: Secure an official accident report from the Dallas Police Department, available online or at their Records Division. This document verifies the incident and is required for most claims.

-

Photographic Evidence: Take clear, high-resolution photos of vehicle damage, road conditions, and any injuries. For example, capture dents on your delivery van’s bumper or debris from a crash on I-20. Multiple angles strengthen your case.

-

Witness Statements: Collect names, phone numbers, and brief statements from bystanders. A witness confirming a reckless driver cut you off on Harry Hines Boulevard can clarify fault.

-

Proof of Loss Form: Your insurer provides this form, which you’ll sign to detail the incident and damages. Complete it accurately to avoid disputes.

-

Repair Estimates: Obtain quotes from reputable Dallas repair shops, like those in our network. For commercial trucks, shops like Texas Truck Works provide specialized estimates.

-

Medical Records: If injuries occurred, include hospital bills, doctor’s notes, or therapy records. Even minor injuries can lead to significant claims.

-

Expense Receipts: Save receipts for towing, temporary repairs, or rental vehicles. These may be reimbursable under your policy.

In 2023, a Dallas logistics firm avoided claim delays after a theft by storing digital policy copies in their fleet’s gloveboxes. This prep work let them submit documents within 24 hours. Pro Tip: Use a cloud storage app to back up photos and reports, ensuring easy access during chaotic post-accident moments. As we move forward, we’ll explore how these documents impact claim timelines and settlements.

How Long Does a Commercial Auto Insurance Claim Take in Dallas?

The commercial auto insurance claim timeline in Dallas hinges on the incident’s complexity and your preparedness. On average, claims resolve in 2–8 weeks, but this varies widely. Minor issues, like a cracked windshield on a delivery van, may wrap up in 7–14 days. Complex cases say, a multi-vehicle crash on LBJ Freeway with injuries can stretch to two months or more. Texas insurance regulations, outlined in the Texas Insurance Code, require insurers to acknowledge claims within 15 days and issue a decision within 45 days after receiving all documents.

Several factors influence timelines:

-

Documentation Speed: Submitting complete paperwork upfront can shave weeks off the process. A Dallas bakery once cut their claim time by providing photos and a police report on day one.

-

Adjuster Availability: Dallas’s high accident rate means adjusters are often booked. Scheduling inspections within 48 hours helps.

-

Dispute Resolution: Fault disagreements or third-party claims can delay settlements. Clear evidence, like dashcam footage, resolves these faster.

-

Policy Coverage: Policies with comprehensive or rental reimbursement coverage often process quicker, as insurers prioritize business continuity.

To accelerate your claim, respond to adjuster requests within 24 hours and verify your policy covers downtime costs. Our Dallas-based agents understand local claim patterns, like seasonal spikes during winter storms, and guide you to insurers with streamlined processes. Later, we’ll cover how to avoid common pitfalls that extend timelines.

Tips for Handling Commercial Truck Accident Insurance Claims

Commercial truck accident insurance claims carry unique challenges due to the size, cargo, and regulations governing trucks in Dallas. With I-20 and I-45 as hotspots for truck crashes, these tips can save your business time and money:

-

Report Immediately: Texas requires accident reports within 10 days for commercial vehicles, but filing within 24 hours with your insurer avoids coverage disputes.

-

Document Cargo Thoroughly: If your truck’s cargo say, electronics or perishables is damaged, photograph it and note its value. A Dallas grocer once recovered $10,000 by documenting spoiled inventory.

-

Verify Liability Coverage: Truck accidents often involve third-party claims. Confirm your policy covers bodily injury or property damage to others, especially in multi-vehicle crashes.

-

Choose Specialized Repair Shops: Dallas shops like Lone Star Truck Repair are equipped for heavy-duty vehicles, ensuring accurate estimates and quality work.

-

Track Business Losses: Log downtime costs, like missed deliveries, to support claims for loss of use. This can offset revenue dips during repairs.

In 2022, a Dallas trucking firm faced a jackknife accident on I-30. By following these steps and leveraging their policy’s rental reimbursement, they kept their fleet running while repairs were completed. Our agents, with deep knowledge of Texas trucking risks, match you with policies that prioritize uptime. Next, we’ll tackle delivery vehicle claims, which face their own hurdles in Dallas’s urban sprawl.

Common Challenges in Delivery Vehicle Insurance Claim Procedures

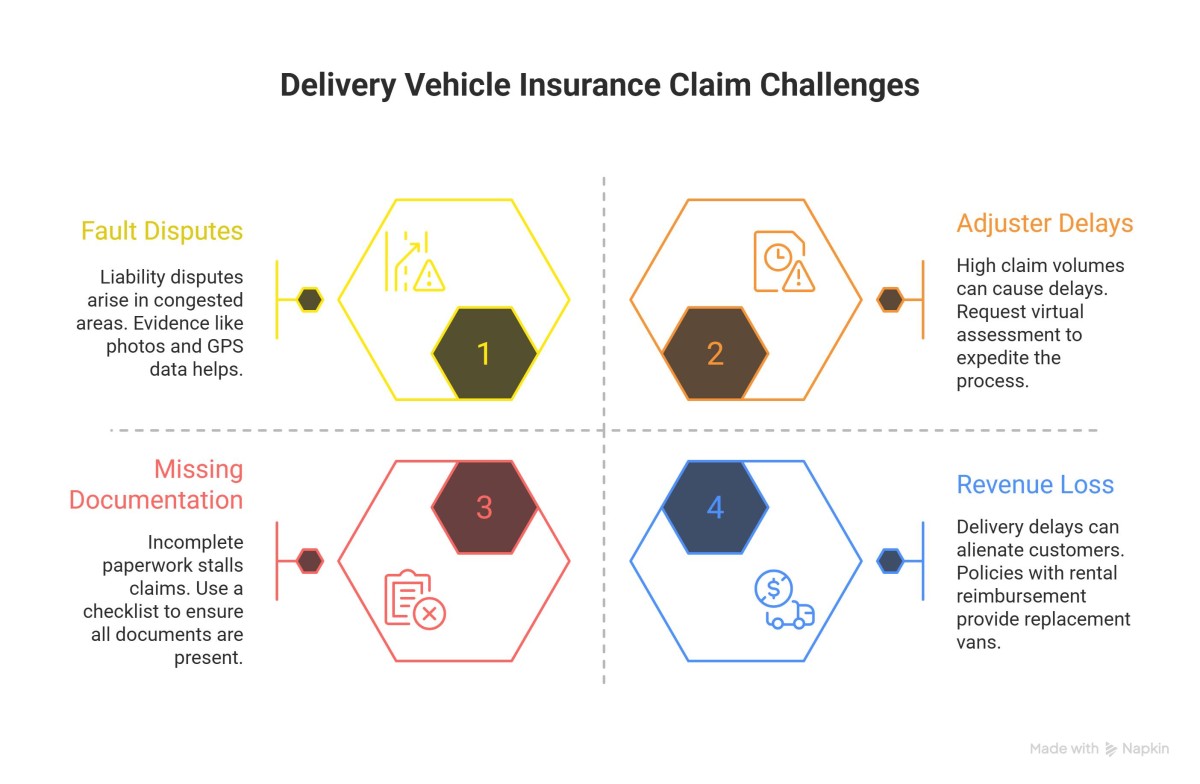

Delivery vehicle insurance claim procedures in Dallas are fraught with obstacles, given the city’s gridlocked streets and high demand for last-mile delivery. Whether you operate a single van or a fleet, these challenges can disrupt your business. Here’s how to overcome them:

-

Fault Disputes in Congested Areas: Crashes on roads like Central Expressway often spark arguments over liability. Clear evidence photos, witness accounts, or GPS data helps resolve these. A Dallas courier avoided a lengthy dispute by submitting dashcam footage.

-

Adjuster Delays: High claim volumes in Dallas can delay inspections. Request a virtual assessment or schedule within 48 hours to keep things moving.

-

Missing Documentation: Incomplete paperwork, like omitting a proof of loss form, stalls claims. Use our earlier checklist to stay organized.

-

Revenue Loss from Downtime: Delivery delays can alienate customers. Policies with rental reimbursement or loss of use coverage provide replacement vans, as one Dallas florist discovered after a crash.

Local knowledge matters here. Dallas’s construction zones and rush-hour snarls increase risks for delivery drivers. Our team helps you anticipate these challenges, pairing you with insurers who understand urban logistics. As we near the FAQs, we’ll share a real client story that ties these lessons together.

Commercial Auto Insurance Claims Done Right – Here’s Why We’re Your Best Choice

For nearly 30 years, Thumann Agency has been Dallas’s go-to for commercial auto insurance claims, helping businesses from mom-and-pop shops to large fleets recover after accidents. Our expertise isn’t just in insurance it’s in understanding Dallas’s unique challenges, from navigating I-635’s traffic to complying with Texas’s complex regulations. With partnerships across 80+ top-rated insurers, we handpick policies that minimize downtime and maximize payouts, tailored to your business’s needs.

What sets us apart? Our licensed agents act as your personal risk specialists, leveraging decades of experience to simplify claims. We’re certified by Texas’s Department of Insurance, ensuring compliance and trust. Local market knowledge means we anticipate risks like Dallas’s storm seasons or urban delivery hazards. Clients rave about our service hundreds of reviews praise our clear communication and fast results. A 2023 award from the Dallas Business Journal named us a top independent broker, a testament to our commitment. Plus, our flexible approach ensures cost-effective coverage without sacrificing quality.

For a detailed step-by-step breakdown on commercial auto insurance, read our Commercial Auto Insurance: A Detailed Guide for Businesses in Dallas, Texas. Whether you’re a trucking firm or a delivery startup, we’re built to deliver peace of mind. Our no-jargon guidance and hands-on support make claims stress-free. Call 972.991.9100 for a free claim consultation and experience the Thumann difference.

FAQs About Commercial Auto Insurance Claims in Dallas

What Are the Steps in the Commercial Auto Insurance Claim Process?

The commercial auto insurance claim process starts with reporting the accident, collecting evidence (photos, police report), notifying your insurer, collaborating with an adjuster, and finalizing the settlement. In Dallas, file within 24 hours and follow Texas laws to avoid delays. Check our earlier steps for a full breakdown.

How Long Does a Commercial Auto Insurance Claim Take to Process?

Dallas commercial auto insurance claims typically take 2–8 weeks. Minor claims, like glass damage, may resolve in 7–14 days, while injury-related cases stretch longer. Texas requires insurers to respond within 15 days and decide within 45 days post-documentation. Complete paperwork speeds things up.

What Are Common Mistakes to Avoid When Filing a Commercial Auto Claim?

Common errors in filing a commercial auto insurance claim include late reporting (aim for 24 hours), admitting fault, missing documents (e.g., police report), or ignoring adjuster requests. In Dallas, skipping Texas’s 30-day filing window risks denial. Use our documentation checklist to stay on track.

What Does a Commercial Auto Insurance Policy Cover?

A commercial auto insurance policy covers liability (third-party injuries/damage), collision (vehicle repairs), comprehensive (theft, vandalism), medical payments, and often rental reimbursement. Coverage varies. In Dallas, prioritize downtime protection for delivery or trucking. Our 80+ insurer partnerships ensure tailored options.

Why Do Commercial Auto Insurance Claims Get Denied?

Claims may be denied for late filing, incomplete documentation, excluded damages (e.g., mechanical wear), or policy violations (e.g., unlicensed drivers). In Dallas, missing Texas deadlines is a common pitfall. Submit thorough evidence and appeal denials with our guidance.

How to Handle a Commercial Auto Insurance Claim Dispute?

For a commercial auto insurance claim dispute, request a written denial reason, gather extra evidence (e.g., photos, statements), and file an appeal with your insurer. In Dallas, our agents navigate Texas regulations to bolster your case. Contact us for expert assistance.

Conclusion: Master the Claim Process with Confidence

The commercial auto insurance claim process in Dallas doesn’t have to derail your business. By acting quickly, gathering thorough documentation, and choosing the right coverage, you can minimize downtime and protect your bottom line. From understanding Texas regulations to navigating Dallas’s busy roads, each step reporting, documenting, and settling builds toward a swift recovery. Thumann Agency’s local expertise and access to 80+ insurers ensure your claims are handled with care, keeping your trucks, vans, or fleet operational. Your business deserves coverage that works as hard as you do. Call 972.991.9100 for a free claim consultation and let us simplify the process for you.

Last Updated: 14.07.2025

Author: Lauren Thumann Director of Marketing.

Disclaimer: This page is for educational purposes only. Coverage details vary by provider. Contact us for a personalized quote.