Managing business insurance costs is a priority for Texas entrepreneurs striving to protect their companies without straining budgets. Small businesses spend an average of $4,000 annually on premiums, according to industry data, and Texas’s unique risks, like hurricanes and strict regulations, can drive costs higher. Many owners struggle to balance affordability with reliable coverage, especially in high-risk industries or storm-prone regions.

This guide offers 10 practical strategies to save on business insurance costs, tailored to Texas businesses. From Dallas retail shops to Houston contractors, these tips help you reduce expenses while maintaining strong protection, addressing common financial pressures with actionable solutions.

Understanding Business Insurance Costs in Texas

Business insurance costs in Texas vary based on multiple factors, each shaping the premiums you pay. Industry classification determines risk levels; construction firms face higher Workers’ Compensation Insurance rates due to workplace hazards, while office-based consultants pay less. Coverage limits also influence costs higher limits offer more protection but increase premiums. Claims history matters; frequent claims raise rates as insurers see your business as riskier. Location is a significant driver in Texas, where coastal businesses in Galveston or Corpus Christi pay 20-30% more for Commercial Property Insurance due to hurricane and flooding risks, which affect 40% of small businesses yearly, per the Small Business Administration (SBA).

Texas regulations add layers of complexity. Workers’ Compensation is mandatory for most businesses with employees, but sole proprietors may opt out, saving costs if risks are low. Misinterpreting these rules can lead to overpaying for unneeded coverage. Common policies include:

-

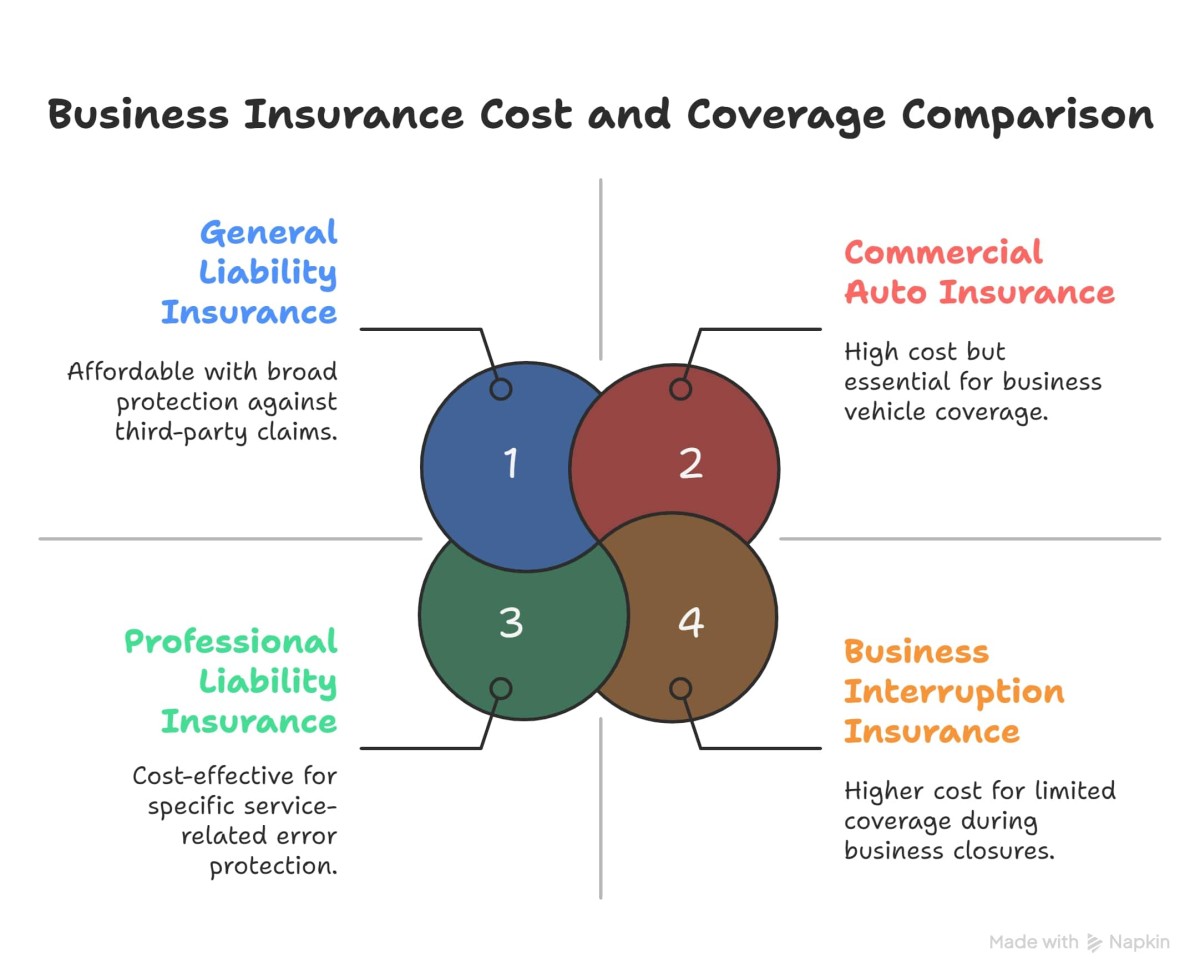

General Liability Insurance: Covers third-party claims like customer injuries, costing $360-$504 annually.

-

Commercial Auto Insurance: Required for business vehicles, ranging from $600-$2,496 yearly.

-

Professional Liability Insurance: Protects against service-related errors, averaging $720 yearly.

-

Business Interruption Insurance: Replaces lost revenue during closures, vital for Texas businesses hit by storms, costing $600-$1,800 annually.

Additional factors, like business size and revenue, also affect rates. A Dallas restaurant with high foot traffic needs broader General Liability coverage than a home-based freelancer. Understanding these variables helps you identify opportunities to reduce business insurance premiums without compromising protection. For example, reviewing your industry classification with an insurer ensures accurate risk assessment, avoiding inflated premiums. Texas’s diverse economy, from tech startups in Austin to oilfield services in Midland, means costs vary widely, making informed decisions essential.

Top 10 Ways to Save on Business Insurance

The following 10 strategies provide Texas businesses with practical, Texas-focused approaches to lower insurance costs while ensuring robust coverage. Each method addresses specific financial pressures and leverages local insights to maximize savings.

Shop Around with an Independent Broker

Comparing quotes from multiple insurers often uncovers significant savings, as rates vary based on risk assessment algorithms. Independent brokers access a broad network of carriers, unlike single-carrier agents restricted to one provider.

For a Dallas café, switching insurers saved 15% on a Business Owner’s Policy (BOP), which combines General Liability, Commercial Property, and Business Interruption Insurance. Brokers evaluate your business’s unique needs, such as Texas regulations or industry risks, to find tailored policies. Key benefits include:

-

Access to diverse carriers, increasing the likelihood of competitive rates.

-

Customized coverage that avoids unnecessary add-ons, like Commercial Auto for non-vehicle businesses.

-

Annual quote reviews to adapt to business growth or market changes.

This approach ensures you pay only for essential coverage, aligning with business insurance cost-saving tips. For example, a Houston retail store saved 12% by comparing quotes for General Liability and Business Interruption coverage. Shopping annually keeps rates competitive, especially as Texas’s insurance market fluctuates with economic or environmental trends.

Bundle Policies for Savings

Combining policies into a Business Owner’s Policy (BOP) saves 10-20% compared to purchasing separate plans. A BOP typically includes General Liability, Commercial Property, and Business Interruption Insurance, ideal for small businesses like retail or offices. A Dallas boutique saved 18% by bundling, avoiding the higher cost of individual policies. Benefits of bundling include:

-

Lower premiums through package discounts.

-

Simplified policy management with one renewal date.

-

Comprehensive coverage without gaps, tailored to Texas risks like storm damage.

However, BOPs may exclude Professional Liability or Commercial Auto, so assess your needs. A San Antonio accounting firm bundled its General Liability and Commercial Property but added Cyber Liability Insurance separately due to data breach risks. This strategy delivers affordable business insurance options, especially for Texas businesses seeking efficiency and value. Review BOP terms to ensure all critical risks, such as hurricane-related interruptions, are covered.

Raise Deductibles Wisely

Increasing your deductible lowers premiums by shifting more claim costs to your business. Raising a Commercial Property Insurance deductible from $1,000 to $2,500 might save $300 annually, as seen with a Fort Worth gym protecting its equipment. Considerations include:

-

Financial capacity to cover higher deductibles during claims.

-

Risk exposure, especially for Texas businesses facing frequent storm claims.

-

Premium savings versus potential out-of-pocket costs.

A Houston contractor adjusted its General Liability deductible to save 10% yearly, ensuring cash reserves covered the increase. This approach requires balancing savings with liquidity, particularly in Texas, where 30% of businesses face weather-related disruptions annually, per SBA data. Aligning deductibles with cash flow supports small business insurance discounts while maintaining coverage for major risks like property damage or liability claims.

Implement Risk Management

Proactive risk management reduces claims, lowering premiums by demonstrating lower risk to insurers. Safety programs, such as employee training on workplace hazards, prevent accidents, cutting Workers’ Compensation rates. A Dallas construction firm saved 10% after implementing safety drills. Texas-specific measures include:

-

Hurricane preparedness: Secure property, maintain generators, and store critical documents off-site.

-

Theft prevention: Install alarms, cameras, or secure storage, reducing Commercial Property claims.

-

Employee safety: Train staff on equipment use or ergonomic practices, minimizing injuries.

These efforts saved an Austin retailer 8% on its General Liability policy after adding security cameras. Risk management addresses Texas’s unique challenges, like hurricanes affecting 20% of businesses yearly, per SBA data. Regular audits identify vulnerabilities, such as outdated wiring in Houston warehouses, ensuring compliance and savings. This strategy supports business insurance cost reduction strategies by protecting your business and budget. Request a free quote to start saving on your business insurance today.

Leverage Insurance Discounts

Insurers offer discounts for claims-free records, annual payments, or group rates through trade associations. Paying Commercial Auto Insurance upfront saved an Austin bakery 15% annually. Common discounts include:

-

Claims-free: 5-15% off for no claims in 3-5 years.

-

Annual payments: Up to 15% savings versus monthly installments.

-

Group rates: 10-20% off through Texas industry associations, like retail or construction groups.

-

Safety equipment: Discounts for sprinklers, alarms, or modern HVAC systems.

A claims-free Dallas office saved 12% on its BOP with a group rate. Joining an association may involve fees, but savings often outweigh costs. Insurers also reward updated infrastructure, like a Plano manufacturer’s new roofing, reducing Commercial Property rates. These discounts for business insurance make coverage more affordable, especially for Texas businesses balancing tight budgets and high risks.

Review Policies Annually

Annual policy reviews prevent overpaying for outdated coverage. A Dallas tech startup saved 18% by removing redundant Professional Liability Insurance after scaling down services. Reviews ensure alignment with:

-

Business changes: New locations, equipment, or services may require updated coverage.

-

Texas regulations: Compliance with Workers’ Compensation or Commercial Auto mandates.

-

Risk exposure: Increased inventory or customer traffic may need higher General Liability limits.

A Houston retailer adjusted its Business Interruption coverage after expanding, saving 10%. Reviews also check deductibles and limits, ensuring cost-effectiveness. For example, a Galveston hotel reduced its Commercial Property premium by updating its risk profile post-renovation. This habit supports ways to save on commercial insurance by keeping your plan relevant and lean, avoiding unnecessary expenses.

Maintain Good Credit

In Texas, good credit can lower Commercial Auto Insurance premiums, as insurers view it as a sign of responsibility. A San Antonio caterer reduced rates by 8% after improving its credit score through timely payments. Tips for better credit include:

-

Pay bills on time to avoid late fees and negative reports.

-

Monitor credit reports for errors and dispute inaccuracies promptly.

-

Reduce debt to improve your credit utilization ratio.

While credit primarily affects auto policies, it indirectly influences other coverages. A Dallas delivery service saved 7% on its fleet insurance by boosting its score. This low-effort strategy aligns with how to get cheaper business insurance, offering consistent savings for Texas businesses with vehicle-heavy operations, like couriers or contractors.

Address Cyber Liability

Cyber threats are escalating, with 43% of small businesses facing data breaches yearly, per SBA data. Cyber Liability Insurance covers costs from hacks, such as legal fees or customer notifications, averaging $1,740 annually. Proactive measures reduce premiums and risks:

-

Employee training: Teach staff to recognize phishing emails, reducing breach risks.

-

Software updates: Regular patches prevent vulnerabilities, as seen in a Dallas accounting firm’s 7% premium cut.

-

Data backups: Off-site storage ensures quick recovery, minimizing Business Interruption claims.

A Houston law firm saved 6% by implementing two-factor authentication. As Texas businesses digitize, from Austin startups to Corpus Christi retailers, cyber protection is critical. This approach ensures lowering business insurance costs while safeguarding client trust and operational continuity in a connected world.

Understand Texas Regulations

Texas mandates specific coverages, but requirements vary by industry. Workers’ Compensation is required for most businesses with employees, but sole proprietors can opt out, saving costs if risks are low. Over-insuring wastes money, as seen when a Houston salon saved 10% by adjusting General Liability to match state needs. Key regulations include:

-

Workers’ Compensation: Mandatory for construction but optional for freelancers.

-

Commercial Auto: Required for business vehicles, even leased ones.

-

General Liability: Often required for commercial leases in Dallas or Austin.

A San Antonio contractor avoided excess Professional Liability coverage, saving 9%. Understanding rules prevents overpaying, especially in regulated industries like healthcare or transportation. This knowledge drives business insurance Texas savings, ensuring compliance and cost efficiency.

Work with a Local Expert

Local brokers understand Texas risks better than national providers. Dallas-based experts navigate urban regulations, like zoning, and coastal threats, like hurricanes affecting 20% of businesses, per SBA data. Benefits include:

-

Personalized risk assessments: Match coverage to your business, saving a Plano manufacturer 15%.

-

Local market knowledge: Access carriers with Texas-specific competitive rates.

-

Regulatory expertise: Ensure compliance with state mandates, avoiding penalties.

A Galveston restaurant saved 10% on Business Interruption coverage with a tailored plan. Local brokers also anticipate risks, like flooding in Houston, ensuring adequate Commercial Property protection. This expertise supports independent insurance broker Dallas solutions, delivering coverage that fits your business’s unique needs and Texas’s diverse challenges.

For a more detailed breakdown of business insurance in Dallas, read our Business Insurance: A Detailed Guide for Businesses in Dallas, Texas

Business Insurance Done Right – Why We’re Your Best Choice

Thumann Agency, based in Dallas since 1996, brings decades of experience to Texas businesses. Our licensed agents, trained in risk management, access over 80 insurers to secure competitive, tailored coverage. A Dallas restaurant owner shared, “Thumann saved us 20% on premiums while enhancing our protection.” Our deep understanding of Texas risks hurricanes, flooding, or urban regulations ensures your business gets the right coverage at the right price. With hundreds of positive reviews praising our clear communication and personalized service, we’re a trusted partner. Our commitment to your success sets us apart, making us the go-to choice for cost-effective, reliable business insurance.

FAQs on Saving on Business Insurance

What are effective strategies to reduce business insurance costs?

Shop with a broker, bundle policies, and raise deductibles. Risk management, like safety training, cuts claims. A Dallas retailer saved 20% by combining these approaches, maintaining strong coverage.

What factors help decrease business insurance costs?

Claims-free records, good credit, and bundling reduce costs. Texas-specific factors, like industry and storm risks, influence rates. Multiple insurer options ensure cost-effective plans.

How can I negotiate better rates for business insurance?

Compare quotes via a broker and highlight claims-free history or safety measures. Negotiations saved an Austin bakery 12% on its BOP, securing better rates effortlessly.

What safety measures lower commercial insurance premiums?

Training, storm preparedness, and security systems reduce claims. A Dallas construction firm cut Workers’ Compensation rates by 10% with safety drills, proving effective savings.

Is bundling policies a good way to save on business insurance?

Bundling into a BOP saves 10-20%, combining General Liability and Commercial Property. Customized BOPs ensure Texas businesses get value without gaps.

How to get affordable business insurance without sacrificing protection?

Compare quotes, bundle, and review annually. Texas expertise ensures plans balance cost and protection, saving a Plano manufacturer 15% through tailored strategies.

Save Smart with Thumann Agency

Texas business owners face rising insurance costs, but these 10 strategies, shopping around, bundling, and managing risks, help you save without compromising coverage. A Dallas restaurant owner shared, “Thumann Agency saved us 20% while improving our protection.” Our Dallas-based team, trusted since 1996, uses local expertise to navigate Texas risks, from hurricanes to regulations. With access to over 80 insurers, we find plans that fit your budget and needs. Call 972.991.9100 for a free consultation to start saving on your business insurance today.

Last Updated: 12.07.2025

Author: Lauren Thumann Director of Marketing.

Disclaimer: This page is for educational purposes only. Coverage details vary by provider. Contact us for a personalized quote.