Ever wonder if your personal car insurance actually covers your business activities? Spoiler alert: It probably doesn’t. Here's the difference between personal and commercial auto insurance—and why it matters if you're using your vehicle for work.

Whether you’re a small-business owner or even a delivery driver, or you simply want to know the fine print, it’s important to understand the difference between commercial auto insurance and personal auto insurance, especially if you ever use your vehicle for business purposes. So let’s dig into the differences, what each type of policy covers and how to determine which you need.

What is commercial auto insurance?

Commercial auto insurance is a policy designed for business-owned or business-used vehicles. Whether you’re delivering products, carrying tools to a job site, or managing a fleet, this policy protects your business operations on the road.

Purpose:

-

Covers vehicles used for business activities like deliveries, hauling equipment, or transporting employees

-

Helps businesses avoid financial loss from accidents, damage, theft, or lawsuits

When you need it:

You likely need commercial auto insurance if:

-

Your business owns the vehicle

-

You or your employees drive for business purposes

-

You manage a fleet of vehicles

-

You need to show a certificate of insurance to partners or vendors

-

Your vehicle is used for:

-

Deliveries

-

Construction

-

Equipment Hauling

-

Client transport

-

Commercial auto insurance cost:

Generally more expensive than personal auto insurance due to:

-

Higher coverage limits

-

Increased Liability

-

Broader risks

-

Multiple drivers or vehicles on one policy.

What is personal auto insurance?

Personal auto insurance is designed to protect households and individual drivers whose cars are primarily used for non-commercial purposes such as daily travel to work or leisure journeys.

Purpose:

-

Covers private-use vehicles such as sedans, SUVs, and family cars

-

Protects individual drivers and their families from financial loss in case of an accident

When you need it:

A personal auto policy works best if:

-

You use your car for commuting, errands, or family travel

-

You are a sole proprietor who does not use your vehicle regularly for work

-

You only occasionally use your car for business-related trips

Personal auto insurance cost:

Typically less expensive than commercial auto insurance because:

-

Risks are lower

-

Coverage limits are more modest

-

Policies are limited to fewer drivers and uses

What is the difference between commercial auto insurance vs personal auto insurance?

Now that we know what each one of these policies is on its own, it is time to compare commercial auto insurance and personal auto insurance.

The primary distinction between personal auto insurance and commercial auto insurance is the owner of the vehicle. However, if the company owns the vehicle, it generally needs to be covered under commercial auto insurance. But if the car is yours, you require personal auto insurance.

For small businesses, this line can be blurry. Business owners and employees of small businesses sometimes going to use their personal vehicles in the course of business. Create a delivery business with your own car, like using your own vehicle to transport business equipment there or deliver goods to customers for example.

In this case, you need to know that basic auto insurance policies, as a general rule, do not cover accidents or damages that happen while you are operating a vehicle for business purposes. In other words, if you get into an accident while delivering a service, you will not be covered under a personal auto insurance policy. So, if you're wondering whether you should quote for a commercial auto insurance policy, you should try to take into account how frequently you use your vehicle for business.

A second key difference between personal auto insurance and commercial auto insurance is cost. Commercial auto insurance can cost more than personal auto insurance because commercial policies usually include higher limits than personal policies. Higher limits equal more coverage in case of an accident. This is important when you are seeking coverage for a business rather than an individual.

However, commercial auto insurance doesn't have to be overly expensive.

Many factors determine the pricing of commercial auto insurance, such as:

- If you are working in an industry that is considered high-risk

- What type(s) of vehicle(s) does your company own?

- The number of vehicles your company owns.

- The frequency of use of the vehicle for commercial purposes

- Your employees' driving records and your own.

- The types of coverage you choose

- The limits of the policy you choose

- Finally, your auto insurance claims history

In short, the two main differences between personal auto insurance and commercial auto insurance are the types of uses covered and the cost of the policy.

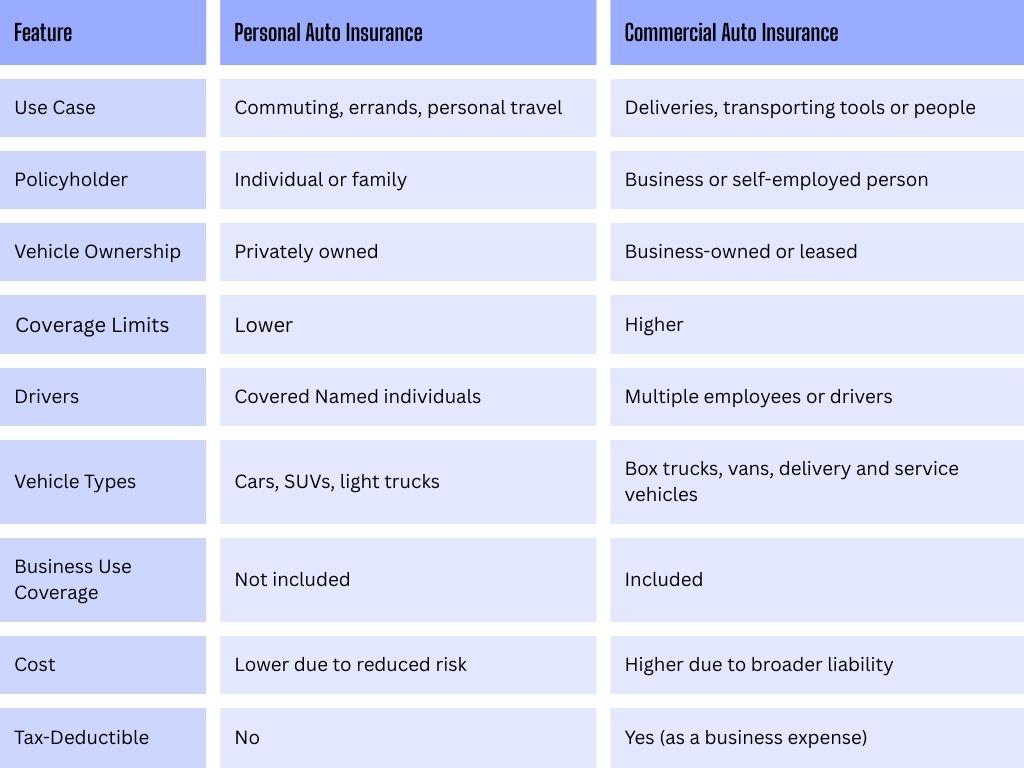

A side-by-side comparison of personal auto insurance and commercial auto insurance

Do I need both commercial and personal auto insurance?

Now, we’ve learned that commercial auto insurance is necessary if you drive your car for work purposes. On the other hand, personal auto insurance becomes appropriate when your vehicle is used for personal reasons. However, what if you use your vehicle for both personal and commercial purposes? Do you require personal and commercial auto insurance?

The simple answer is no! You don't have to get both a commercial and a personal auto insurance policy on the same vehicle. A commercial vehicle insurance plan could potentially provide sufficient protection when you regularly utilize a vehicle for professional purposes alongside non-commercial activities.

Typically, personal auto insurance policies do not cover the types of risks incurred by driving for business purposes. Therefore, when determining the appropriate coverage type for your car under a commercial or personal policy, consider how frequently you use the car for work-related activities. For example, if you use your car for personal purposes but occasionally drive it to the site of a client's business activity, then a personal auto insurance policy may be appropriate for you.

However, if you have a commercial auto insurance policy and, in most cases, if you're involved in a company car accident for personal use, the insurance will provide coverage. In this example, if the vehicle is used primarily for business purposes, yet you use the vehicle on your break to pick up lunch, a commercial auto insurance policy would better suit your needs.

Ultimately, it's unnecessary to maintain both commercial and personal auto insurance for the same vehicle. Talk with youragent to discuss your financial situation and determine the optimal type of policy that will suit your needs.

See! This is the ideal opportunity to enjoy your coverage!! A basic principle in deciding the difference is: who owns the vehicle? If you own it and it’s not used for commercial purposes, you should get your auto insurance policy unless you own a small business that uses that vehicle. If the vehicle is owned by a business, commercial auto insurance is likely the right route to take.

Am I required to have commercial vehicle insurance?

Yes, whenever a vehicle is used for business purposes, then you need commercial auto insurance. A personal policy won’t cover accidents that happen during business use, which can leave you exposed to denied claims and major out-of-pocket costs.

You’ll need a commercial policy if your vehicle:

-

Is it owned by your business

-

It is used regularly for commercial purposes

-

Is driven by employees or contractors

-

Is involved in high-risk activities, like construction or logistics

Even if the car is in your name, how you use it determines the type of coverage you need. When in doubt, consult with your insurance provider to prevent potential lapses in your protection.

Find the right coverage for your vehicles

Know the difference between Commercial Vehicle Insurance and Personal Vehicle Insurance. Though similar in certain respects, the two are not the same.

Commercial car policies are generally more comprehensive than the minimum legal requirements to insure for the greater risk on your behalf or that of the organization you work for.

Regular personal vehicle insurance policyholders are not generally subject to the same risks, so it is possible to pay lower rates with only the minimum limits of coverage required by the state without having any additional protection against other types of losses.

Still not sure which policy is right for you? Let our experienced agents at Thumann Insurance Agency help you compare coverage and costs. We’ll find the right fit—whether you’re behind the wheel for work, family, or both.

Get a fast quote today.

Frequently asked questions

1. Can I use my personal auto insurance for business activities?

No, personal auto insurance generally doesn't cover business activities. If you use your personal vehicle for work purposes, such as deliveries or transporting clients, you'll need commercial auto insurance to be fully protected.

2. What happens if I have an accident while using my personal car for work?

If you have an accident while using your car for business purposes, your personal insurance likely won't cover work-related damages. You'll need a commercial policy to cover those risks.

3. Does commercial auto insurance cover personal use of company vehicles?

Commercial auto insurance generally doesn't cover personal use. If you or someone else uses a company vehicle for personal purposes, damage won't be covered unless the driver is authorized, and the policy includes this type of coverage.

4. When should I consider switching from personal to business insurance?

If you use your personal vehicle primarily for work, you should consider commercial insurance. This is especially important if you frequently transport goods, customers, or work equipment.

Last Updated: 04.11.2025

Author: Lauren Thumann Director of Marketing.

Disclaimer: This page is for educational purposes only. Coverage details vary by provider. Contact us for a personalized quote.