Operating a business in Dallas, Texas, involves navigating a range of risks, from severe weather to urban property crimes. Commercial property insurance protects your physical assets, including buildings, equipment, and inventory, against losses from events like fires, theft, or storms. This guide offers a detailed, unbiased resource to help you understand the intricacies of this coverage, its types, costs, regulations, and risk mitigation strategies tailored to Dallas’s unique environment.

Designed for business owners in retail, manufacturing, or other sectors, it covers the science, history, and practical steps for securing your property. By the end, you’ll be equipped to assess your needs, select appropriate coverage, and prepare for local risks, allowing you to focus on growing your business.

What is Commercial Property Insurance?

Property insurance is a policy that safeguards businesses from financial losses due to damage or loss of physical assets, such as buildings, machinery, inventory, or furniture. Covered events typically include fire, theft, vandalism, and weather-related incidents like windstorms or hail, which are frequent in Dallas. Unlike general liability insurance, which addresses claims for injuries or damages to others, or commercial auto insurance, which covers business vehicles, this insurance focuses solely on physical property. For example, if a storm damages your Dallas retail store’s windows, business property insurance can cover repair costs, preventing significant financial strain.

Why Businesses Benefit from Commercial Property Insurance?

This coverage provides several advantages:

-

Financial protection: It covers repair or replacement costs, reducing out-of-pocket expenses after a loss.

-

Operational continuity: By addressing property damage, it helps maintain business operations during disruptions.

-

Contractual compliance: In Texas, many leased properties or loan agreements require this insurance to protect landlord or lender interests.

For Dallas businesses facing tornadoes, hailstorms, and urban risks like theft, insurance coverage is a practical necessity.

History and Evolution of Commercial Property Insurance

Origins of Property Insurance

The concept of property protection began in 17th-century Europe, where merchants sought to safeguard their assets against fires and maritime losses. The Great Fire of London in 1666, which destroyed over 13,000 buildings, prompted the creation of early fire insurance policies. Companies like the Fire Office (later Phoenix Assurance) offered coverage for structures, establishing the practice of pooling risk to cover losses. These early policies focused on urban properties, laying the foundation for modern business insurance.

Development in the United States

In the U.S., insurance policies emerged in the 18th century. Benjamin Franklin founded the Philadelphia Contributionship in 1752, one of the first fire insurance companies, offering coverage for homes and businesses. As industrialization expanded in the 19th century, the need for commercial coverage grew, driven by factories, warehouses, and urban development.

The 1906 San Francisco earthquake, which caused widespread destruction, exposed gaps in coverage, leading insurers to refine policies and introduce exclusions like earthquake damage. By the early 20th century, insurance providers began offering standardized policies for commercial properties, incorporating protections for equipment and inventory.

Modern Trends in Texas

In Texas, insurance regulations have shaped the industry since the Texas Department of Insurance (TDI) was established in 1876. The state’s unique risk profile, including hurricanes, tornadoes, and rapid urbanization, has driven demand for tailored business protection. Recent innovations include parametric insurance, which pays out based on predefined triggers (e.g., wind speed), and increased focus on cyber liability insurance for businesses handling digital data.

In Dallas, severe weather and urban growth have led insurers to develop policies addressing local risks, such as hail damage and theft. The rise of digital platforms has also made it easier for businesses to compare insurance quotes and customize coverage.

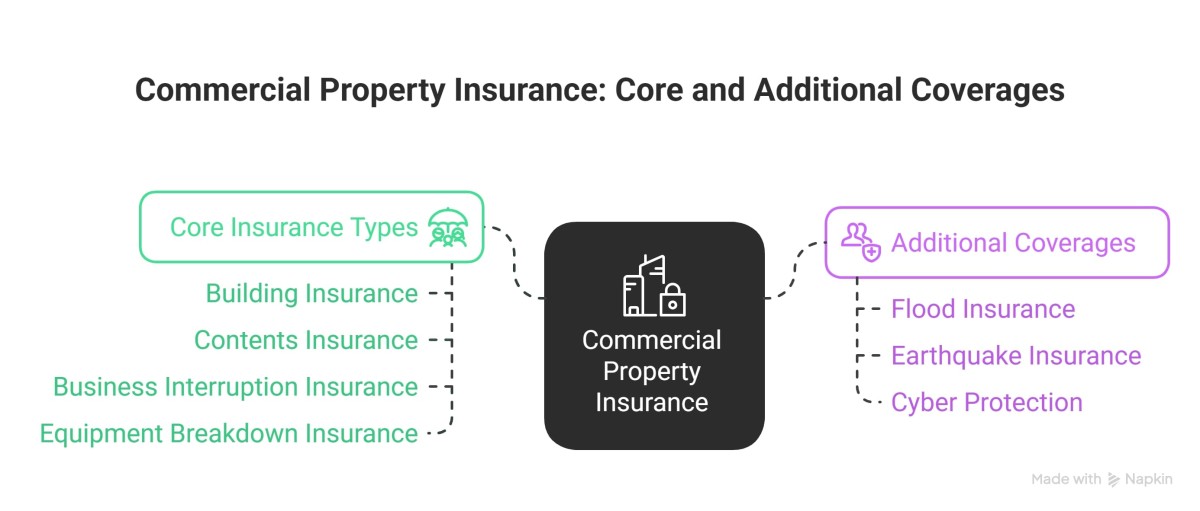

Types of Commercial Property Insurance

Coverage types vary to meet diverse business needs in Dallas, ensuring protection for different assets and risks.

Building Insurance

Building coverage protects the physical structure of your business property, including walls, roofs, floors, and built-in systems like HVAC or plumbing. If a hailstorm damages your Dallas office, this insurance covers repair or replacement costs. It’s essential for property owners but less relevant for tenants, who may prioritize contents coverage. This coverage ensures structural damage doesn’t disrupt your operations.

Contents Insurance

Contents protection safeguards business personal property, such as equipment, furniture, inventory, and supplies. For example, if a break-in at your Dallas retail store results in stolen electronics, this coverage helps replace them. It’s critical for businesses with valuable assets, like restaurants or warehouses, providing financial relief after theft or damage.

Business Interruption Insurance

Business interruption coverage compensates for lost revenue and ongoing expenses when a covered event, like a fire, forces temporary closure. For a Dallas manufacturing facility damaged by a tornado, this insurance can cover lost income, rent, or payroll during repairs. It supports financial stability during disruptions, helping businesses recover quickly.

Equipment Breakdown Insurance

Equipment protection addresses losses from mechanical or electrical failures of machinery, such as boilers, computers, or manufacturing equipment. If a power surge damages your Dallas office’s servers, this coverage covers repair or replacement costs. It’s valuable for industries reliant on specialized equipment, like healthcare or manufacturing.

Additional Coverages

Dallas businesses may need specialized insurance options based on their risks:

-

Flood insurance: Standard policies exclude flood damage, but Dallas’s proximity to the Trinity River makes this critical. Policies are available through the National Flood Insurance Program (NFIP).

-

Earthquake insurance: Though rare, earthquakes can occur in Texas, requiring separate coverage for seismic damage.

-

Cyber protection: For businesses handling sensitive data, this covers costs from data breaches, including legal fees and customer notifications.

Common Exclusions and How to Address Them

Standard insurance exclusions leave businesses vulnerable if not addressed. Common exclusions include:

-

Flood damage: Rising water, common in Dallas, requires a separate flood coverage policy.

-

Earthquake damage: Seismic activity is excluded; businesses in at-risk areas need earthquake coverage.

-

Wear and tear: Gradual deterioration isn’t covered, emphasizing regular maintenance.

-

Intentional acts: Damage caused deliberately by the policyholder is excluded.

-

War or nuclear hazards: These rare events are standard exclusions.

To address gaps, purchase endorsements or separate policies. For example, NFIP coverage protects Dallas businesses in flood-prone areas. Consulting an agent familiar with Texas risks ensures your policy customization accounts for local exclusions, such as severe weather or urban crime.

Levels of Commercial Property Coverage

Coverage levels offer different scopes of protection, tailored to your business’s risk profile.

Basic Form

Basic coverage protects against specific perils, including fire, lightning, windstorms, hail, theft, and vandalism. It’s cost-effective but limited, suitable for low-risk businesses, like a small Dallas office with minimal exposure to natural disasters.

Broad Form

Broad coverage includes basic perils plus additional risks, such as falling objects, water damage from leaks, and damage from ice or snow weight. It’s a balanced option for Dallas businesses facing moderate weather risks, like retail stores or restaurants.

Special Form

Special coverage is the most comprehensive, protecting against all risks except those explicitly excluded, like floods or earthquakes. It’s ideal for high-value properties or businesses in Dallas’s urban or weather-prone areas, such as warehouses or manufacturing facilities. Higher premiums reflect its extensive protection.

Why Businesses Need Commercial Property Insurance

Business necessity underscores the importance of this coverage for Dallas businesses, offering multiple benefits.

Financial Security

Unexpected events, like fires or storms, can lead to significant repair or replacement costs. Financial safety through insurance prevents businesses from depleting savings or taking on debt. For example, if a hailstorm damages your Dallas retail store’s inventory, insurance covers the loss, ensuring financial stability.

Contractual Requirements

While Texas doesn’t mandate mandatory insurance for all businesses, many leased properties or loan agreements require it. In Dallas, landlords and lenders often demand contractual coverage to protect their investments, making it a necessity for tenants or borrowers.

Operational Confidence

Dallas’s unpredictable weather, including tornadoes and hailstorms, combined with urban risks like theft, creates a challenging environment. Operational assurance from insurance allows you to focus on business growth, knowing your property is protected.

How to Choose the Right Commercial Property Insurance

Selecting an appropriate insurance selection involves a systematic approach to match coverage with your Dallas business’s needs.

Assessing Your Business Needs

Evaluate the value of your property, including buildings, equipment, inventory, and fixtures. Identify risks specific to your industry and location. For example, a Dallas retail store in a high-traffic area may prioritize theft protection, while a warehouse near a flood zone needs flood risk coverage. Consider your business’s size, revenue, and exposure to natural disasters.

Understanding Coverage Options

Choose a coverage option (basic, broad, or special) based on your risk profile. Basic suits low-risk businesses, while special is better for high-value properties. Add policy endorsements for excluded risks, like floods or cyberattacks, and review policy limits and deductibles to align with your financial capacity.

Consulting with an Insurance Agent

An agent familiar with Texas regulations and Dallas’s risk landscape can provide tailored guidance. They’ll help navigate coverage choices, identify exclusions, and ensure compliance with local requirements. For instance, an agent might recommend hail coverage for a Dallas office or flood protection for a warehouse.

Comparing Quotes

Obtain insurance comparisons from multiple insurers to balance coverage, limits, deductibles, and premiums. Evaluate policy terms, exclusions, and the insurer’s reputation for claims handling. Online tools or local agents can simplify this process, ensuring cost-effective coverage. For a detailed breakdown of Choosing Commercial Property Insurance, read our guide on How to Choose the Right Commercial Property Insurance.

Cost of Commercial Property Insurance

Understanding insurance costs helps you budget effectively for your Dallas business.

Factors Affecting Premiums

Premium factors include:

-

Location risks: Dallas’s severe weather (tornadoes, hail) and urban risks (theft, vandalism) increase costs.

-

Industry type: High-risk sectors, like manufacturing, face higher premiums.

-

Coverage scope: Higher limits or lower deductibles raise premiums.

-

Claims history: Frequent claims increase costs, signaling higher risk.

-

Building age: Older structures may incur higher premiums.

Average Costs in Dallas, TX

According to 2024 data from the Insurance Information Institute, small businesses in Texas pay an average of $67/month ($800/year) for business insurance costs. In Dallas, costs range from $1,000-$2,000 annually due to urban and weather risks. A retail store might pay $1,200/year, while a manufacturing facility could pay $2,500 or more, depending on coverage limits.

Strategies to Manage Costs

Reduce premium reduction with these strategies:

-

Policy bundling: Combine property and liability insurance for discounts.

-

Security enhancements: Install alarms or cameras to lower risk.

-

Higher deductibles: Increase deductibles to reduce premiums, balancing out-of-pocket costs.

-

Quote comparison: Shop around for competitive rates.

For a more detailed breakdown of Commercial Property Insurance Cost, read our guide on 10 Ways to Reduce Your Commercial Property Insurance Cost.

Commercial Property Insurance Regulations in Texas

Regulatory compliance ensures your Dallas business meets legal and contractual obligations.

State-Specific Requirements

Texas doesn’t mandate state insurance requirements for all businesses, but leased properties or loans often require it. The TDI regulates the industry, setting standards for policy standards, claims processing, and consumer protections. Insurers must follow TDI guidelines, such as responding to claims within 15 days.

Local Dallas Regulations

Dallas’s local regulations, including building codes and zoning laws, may require specific coverages, especially in flood zones or urban areas. For operations involving the Texas Department of Transportation (TxDOT), Form E proof may be required. Verify requirements with city authorities or an agent.

Dallas-Specific Risk Factors

Dallas risks include:

-

Weather hazards: Tornadoes, hail, and flooding increase claim risks.

-

Urban challenges: Theft and vandalism are prevalent in Dallas’s core.

-

High-risk zones: Properties in flood-prone areas require additional coverages.

Finding Commercial Property Insurance in Dallas, Texas

Choosing the right insurance provider is key to securing effective coverage.

Local Insurance Agents and Brokers

Local agents in Dallas offer expertise in Texas regulations and local risks, such as severe weather or crime. They provide personalized advice and access to multiple insurers. For example, Thumann Agency, based in Dallas, Texas, specializes in commercial insurance, tailoring policies to local needs.

Online Options

Online insurance platforms allow quick quote comparisons from national and regional insurers. They may lack localized knowledge for Dallas’s risks, like hail or flooding. Use online tools for initial research, then consult a local expert for customized solutions.

Working with Dallas-Based Insurers

Dallas insurers understand local weather, urban dynamics, and regulations. They design policies addressing risks like storm damage or property crime, ensuring comprehensive protection.

The Claims Process for Commercial Property Insurance

Understanding the claims process ensures efficient recovery after a loss.

Steps to File a Claim

-

Document damage: Take photos and compile an inventory of affected items.

-

Notify insurer: Report the claim within 15 days, per TDI rules.

-

Submit evidence: Provide photos, receipts, and other documentation.

-

Cooperate with adjusters: Allow inspections to verify coverage.

What to Expect During the Process

Insurers must acknowledge claim notifications within 15 days and decide within 15 business days after receiving documentation. An adjuster evaluates damage, estimates repair costs, and determines claim payouts based on policy terms. Payouts depend on coverage terms and deductible amounts.

Common Claims in Dallas

Frequent claims include:

-

Hail damage claims: Affects roofs and windows during spring storms.

-

Theft claims: Prevalent in urban Dallas.

-

Wind damage claims: Caused by tornadoes or thunderstorms.

-

Water damage claims: From leaks or flooding.

Common Pitfalls to Avoid

-

Delayed reporting: Late notifications complicate claims.

-

Incomplete documentation: Missing evidence reduces payouts.

-

Policy misunderstandings: Review exclusion terms to avoid surprises.

Risk Management for Commercial Property

Risk management minimizes claims and protects your Dallas business.

Common Causes of Claims in Texas

-

Natural disasters: Tornadoes, hurricanes, and flooding are frequent.

-

Fire risks: From electrical faults or arson.

-

Theft incidents: Common in urban Dallas.

-

Water issues: From pipes or flooding.

-

Wind impacts: Prevalent during stormy seasons.

Preventive Measures

-

Security systems: Install alarms and cameras to deter theft.

-

Maintenance routines: Inspect roofs and plumbing to prevent damage.

-

Emergency plans: Develop strategies for evacuations and asset protection.

Mitigating Weather-Related Risks in Dallas

-

Storm shutters: Protect windows from hail.

-

Reinforced structures: Strengthen roofs against tornadoes.

-

Secure equipment: Anchor outdoor items to prevent wind losses.

Employee Training

Train staff on safety protocols, including fire prevention and evacuations. Ensure compliance with Texas regulations, like OSHA standards, to reduce risks.

Preparing for Natural Disasters

Dallas’s weather requires thorough disaster preparedness.

Understanding Local Risks

Dallas faces tornado risks, hailstorm risks, and flooding risks. Hailstorms damage roofs and vehicles, while flooding is a concern near the Trinity River. The National Weather Service reports Dallas County averages 2-3 tornadoes annually.

Creating an Emergency Plan

-

Evacuation routes: Establish clear paths for staff.

-

Asset protection plans: Secure equipment during storms.

-

Communication strategies: Maintain contact during crises.

Securing Important Documents

Store business records in waterproof safes or digitally in the cloud. Off-site backups ensure access post-disaster.

Commercial Property Insurance for Specific Industries

Industry-specific coverage addresses unique risks.

Retail

Retail coverage protects inventory and fixtures. A Dallas clothing store needs inventory protection against theft or storm damage.

Manufacturing

Manufacturing coverage protects machinery and materials. A Dallas factory requires equipment coverage for breakdowns and fires.

Office Buildings

Office coverage protects furniture and documents. A Dallas law firm benefits from data protection for client records.

Warehouses

Warehouse coverage protects stored goods. Dallas warehouses need flood safeguards in at-risk areas.

Oil and Gas

Oil and gas coverage addresses industrial and environmental risks, like spills, common in Texas.

Technology

Tech coverage includes cyber safeguards for data breaches and equipment protection.

Healthcare

Healthcare coverage protects medical equipment and records. A Dallas clinic needs interruption coverage for downtime.

Regular Policy Reviews

Policy reviews ensure alignment with business needs.

When to Review Your Policy

-

Business growth: After adding assets or locations.

-

Annual checks: To address changing risks.

-

Regulatory changes: When Dallas or Texas laws shift.

How to Update Coverage

Work with an agent to adjust coverage adjustments, add policy additions, or remove unnecessary protections.

Choosing an Insurance Agent or Broker

A knowledgeable insurance agent is essential for effective coverage.

Qualities to Look For

-

Regulatory expertise: Familiarity with Texas laws.

-

Industry knowledge: Understanding of your business risks.

-

Reliability: Prompt responses to inquiries.

What to Look for in a Dallas-Based Agent

Select an agent with experience in Dallas’s weather risks and urban risks. Affiliations with the Independent Insurance Agents of Texas indicate credibility.

Asking the Right Questions

-

What coverage recommendations suit my risks?

-

How does the claims procedure work?

-

Are discount options available?

Frequently Asked Questions (FAQs) about Commercial Property Insurance

Is mandatory coverage required in Texas?

No, but leased properties or loans often require it.

What does property coverage include?

It covers damage to buildings, contents, and sometimes lost income from covered events.

How much are average insurance costs?

Small businesses pay $67/month in Texas; Dallas costs range from $1,000-$2,000/year.

Can I bundle policies?

Yes, combining with liability insurance reduces costs.

How can I reduce premium costs?

Enhance security, bundle policies, or increase deductibles.

Does it cover flood losses?

No, separate flood policies are needed.

Are tornado damages covered?

Yes, under windstorm coverage, but verify terms.

How does weather impact premiums?

Tornadoes and hail increase premiums in Dallas.

What if my property is damaged?

Document damage, notify your insurer, and submit evidence.

How do I choose coverage forms?

Basic for low-risk, special for high-value properties.

Are insurance discounts available?

Yes, for security systems or bundling.

What’s the difference between property and interruption coverage?

Property covers physical damage; interruption covers lost income.

How long is the claims timeline?

Insurers respond within 15 days, deciding within 15 business days.

Can I insure leased properties?

Yes, contents insurance covers equipment in leased spaces.

What are policy exclusions?

Floods, earthquakes, and wear and tear are excluded.

How does industry risk affect costs?

High-risk sectors face higher premiums.

Is cyber insurance necessary?

Tech businesses need it for breaches.

What claim documentation is needed?

Photos, inventories, and receipts support claims.

How often should I review policies?

Annually or after business changes.

Can weather exclusions be covered?

Yes, with separate endorsement options.

Conclusion

Comprehensive insurance is vital for Dallas businesses, offering financial security, operational stability, and compliance with contractual requirements in a city prone to severe weather and urban risks. From building protection to industry coverage, a tailored policy safeguards against events like tornadoes, hail, or theft.

By assessing risks, selecting appropriate coverage, and adopting risk mitigation, you can navigate Dallas’s challenges confidently. Regular policy updates and consultations with knowledgeable agents ensure your coverage evolves. To discuss tailored solutions, contact Thumann Agency in Dallas, Texas, at (972) 991-9100 or visit thumannagency.com

Last Updated: 13.07.2025

Author: Lauren Thumann Director of Marketing.

Disclaimer: This page is for educational purposes only. Coverage details vary by provider. Contact us for a personalized quote.