Owning an apartment building in Dallas, Texas, means managing a valuable asset exposed to diverse risks, from severe weather to tenant-related liabilities. Apartment building insurance provides financial protection, ensuring your investment remains secure against property damage, legal claims, and income loss.

This guide offers an in-depth, objective resource to help you understand the complexities of apartment building coverage. You’ll gain insights into policy types, costs, regulatory requirements, and risk management strategies tailored to Dallas’s unique environment. Whether you manage a small complex or a large multi-family property, this guide equips you with the knowledge to make informed decisions and protect your business.

What is Apartment Building Insurance?

Apartment building insurance is a specialized policy designed for multi-family properties, addressing risks such as property damage, liability claims, and loss of rental income. Unlike homeowners protection, which covers single-family residences, this plan focuses on the commercial aspects of managing apartment complexes, including shared spaces and business operations.

Key distinctions from homeowners policies include:

-

Commercial Scope: Protects against risks tied to tenant activities and property management.

-

Liability Safeguards: Addresses claims in common areas like stairwells, pools, or parking lots.

-

Income Security: Compensates for lost rent during repairs after a covered event.

This coverage ensures financial stability and compliance with lender or landlord requirements, preserving your property’s value.

Why Apartment Building Insurance Matters

Apartment building insurance is a critical tool for protecting your investment and ensuring operational continuity. In Texas, while not legally mandated, it’s often required by lenders, landlords, or lease agreements. Without adequate protection, you face significant financial risks from repairs, lawsuits, or disruptions.

Legal and Contractual Obligations: Lenders typically require proof of coverage for financed properties, and some Dallas lease agreements mandate specific policies to protect all parties.

Financial Safety: Insurance covers high-cost incidents, such as rebuilding after a fire or settling a tenant injury claim. A 2024 report from the National Association of Insurers Commissioners indicated that multi-family property claims averaged $15,000 to $50,000, highlighting the need for robust safeguards.

Dallas-Specific Challenges:

Dallas presents distinct risks, including:

-

Severe weather events like hailstorms and tornadoes, which frequently damage exteriors.

-

Urban factors such as higher crime rates and traffic, increasing liability exposures.

By addressing these risks, apartment building insurance helps you maintain your property and avoid financial strain.

Apartment building insurance includes a variety of coverages to address the diverse risks of multi-family properties. Understanding these options allows you to build a policy suited to your needs.

Property Insurance

Property insurance protects the building’s structure and contents, including appliances, fixtures, and common area furnishings. It covers damages from events such as:

-

Fire and smoke.

-

Theft and vandalism.

-

Windstorms and hail, which are prevalent in Dallas.

For example, if a hailstorm damages your roof, property insurance funds repairs. Policies often offer replacement cost coverage, ensuring you can rebuild at current market prices rather than depreciated values. In Dallas, where weather-related claims are common, verify that your plan includes adequate wind and hail protection.

Liability Insurance

Liability protection covers bodily injury and property damage claims arising in common areas or tenant units. If a tenant slips on a wet staircase or a visitor damages another resident’s property, this coverage handles legal fees, medical costs, and settlements. In Dallas’s dense urban environment, where accidents are more frequent, liability limits of $1 million or higher are advisable. A 2023 Insurance Information Institute study found that liability claims for multi-family properties averaged $30,000, emphasizing the importance of sufficient safeguards.

Business Interruption Insurance

Business interruption coverage compensates for lost rental income and operating expenses during repairs or closures following a covered event, such as a fire or storm. For instance, if a tornado forces tenants to vacate for three months, this insurance pays rent and utilities, maintaining your cash flow. In Dallas, where weather disruptions are frequent, this policy is vital for financial stability. Ensure your plan accounts for extended repair timelines, which can occur with complex damages.

Equipment Breakdown Insurance

Equipment breakdown policy covers mechanical systems like HVAC units, elevators, and plumbing. If an air conditioning system fails during a Dallas summer, this coverage funds repairs and temporary solutions, preventing tenant discomfort and operational disruptions. For larger complexes with intricate systems, this insurance is particularly valuable, as repair costs can exceed $10,000 for major equipment failures. Regular maintenance can complement this protection by reducing breakdown risks.

Crime Insurance

Crime safeguards protect against losses from theft, fraud, or employee dishonesty. In Dallas, where urban property crimes are higher than the state average, this coverage addresses risks like stolen maintenance equipment or fraudulent tenant transactions. For example, if a worker steals appliances from a vacant unit, crime insurance reimburses the loss. A 2024 Dallas Police Department report noted a 15% increase in property crimes in urban areas, underscoring the need for this protection.

Flood Insurance

Flood plan covers water damage from flooding, which is excluded from standard property policies. Dallas’s proximity to the Trinity River and frequent heavy rains make this coverage critical for properties in flood-prone areas. The National Flood Insurance Program (NFIP) reported a 22% rise in Dallas flood claims between 2020 and 2024. Use FEMA’s flood maps to assess your property’s risk and determine coverage needs. Private flood insurance may offer higher limits or lower premiums for some properties.

Other Specialized Coverages

Additional coverages address specific risks:

-

Umbrella Insurance: Extends liability protection beyond primary policy limits, ideal for large complexes with high exposure.

-

Environmental Liability Coverage: Covers pollution or contamination, such as mold or chemical spills from maintenance activities.

-

Earthquake Policy: While seismic activity is rare in Texas, properties near fault lines may benefit from this option.

Consult an insurance professional to evaluate which specialized coverages are necessary for your property.

Understanding Your Coverage Needs

Each apartment building has distinct risks and requirements. A thorough assessment helps you design a policy that provides adequate protection without unnecessary costs.

Assessing Risks Specific to Apartment Buildings

Apartment buildings face a range of risks, including:

-

Fire: Caused by electrical faults, cooking accidents, or external sources.

-

Water Damage: Resulting from leaks, burst pipes, or appliance malfunctions.

-

Liability Claims: Arising from tenant or visitor injuries in shared spaces.

-

Crime: Including theft, vandalism, or fraud, particularly in urban settings.

-

Weather-Related Damage: Driven by hail, tornadoes, and windstorms in Dallas.

Dallas-specific risks intensify these concerns:

-

Hailstorms frequently damage roofs and windows, with 2024 claims averaging $20,000 per incident, per Texas Department of Insurance data.

-

Tornadoes pose structural risks, necessitating strong property coverage.

-

Urban crime and traffic increase liability exposures, especially in downtown areas.

Conduct a risk assessment with an insurance professional to identify your property’s vulnerabilities. Consider factors like building age, location, and tenant activities to prioritize coverage.

Factors Influencing Coverage Requirements

Several factors shape your insurance needs:

-

Building Size and Age: Larger or older buildings require higher coverage limits due to increased repair costs and risks.

-

Construction Type: Wood-frame structures are more susceptible to fire than concrete buildings, affecting premiums.

-

Number of Units and Occupancy: High occupancy increases liability and maintenance risks.

-

Location: Properties in flood zones or high-crime areas need specialized coverages.

-

Tenant Demographics: Student housing faces higher turnover and damage risks, while luxury apartments require coverage for high-value amenities.

For example, a 30-unit building in downtown Dallas needs more liability and crime protection than a 5-unit suburban property due to urban density and risk exposure. A 2023 Urban Institute study noted that urban multi-family properties face 25% higher claim rates than suburban ones.

Tailoring Coverage to Your Property

Customizing your policy ensures comprehensive protection while managing costs. Key steps include:

-

Consulting an Expert: Work with an insurance agent to evaluate your property’s risks and requirements.

-

Prioritizing Coverages: Focus on property, liability, and business interruption insurance as foundational elements.

-

Balancing Costs: Consider higher deductibles to lower premiums if you have sufficient financial reserves.

Regularly review your policy to account for changes like renovations, new tenants, or updated local regulations. A tailored plan protects your investment while aligning with your budget.

Cost of Apartment Building Insurance

Understanding the factors that influence insurance costs helps you budget effectively and identify savings opportunities.

Factors Affecting Premiums

Premiums are determined by:

-

Location: Dallas’s urban environment and weather risks result in higher costs than rural Texas areas.

-

Building Characteristics: Older buildings or those with outdated systems (e.g., wiring, plumbing) are costlier to insure.

-

Coverage Limits and Deductibles: Higher limits or lower deductibles increase premiums.

-

Claims History: A history of frequent claims signals higher risk, raising costs.

-

Safety Features: Lack of sprinklers, alarms, or security systems can elevate premiums.

For instance, a downtown Dallas property in a flood zone faces higher premiums than a suburban building with modern fire suppression systems. A 2024 Texas Department of Insurance report noted that urban properties in Texas averaged 10 to 15% higher premiums than rural ones.

Average Costs in Texas and Dallas

Costs vary by property size, location, and coverage:

-

Small Buildings (5 to 10 units): $500 to $1,500 per month in Texas, with Dallas costs trending toward the higher end due to urban and weather risks.

-

Medium Complexes (10 to 20 units): $1,500 to $3,000 per month, with Dallas premiums reflecting increased liability exposure.

-

Large Complexes (20+ units): $3,000 to $6,000 per month, with Dallas costs at the upper range due to higher claim frequency.

These estimates, based on 2024 Texas Department of Insurance data, provide a benchmark. Actual costs depend on your property’s specifics. Request a personalized quote from an insurance professional for precise pricing.

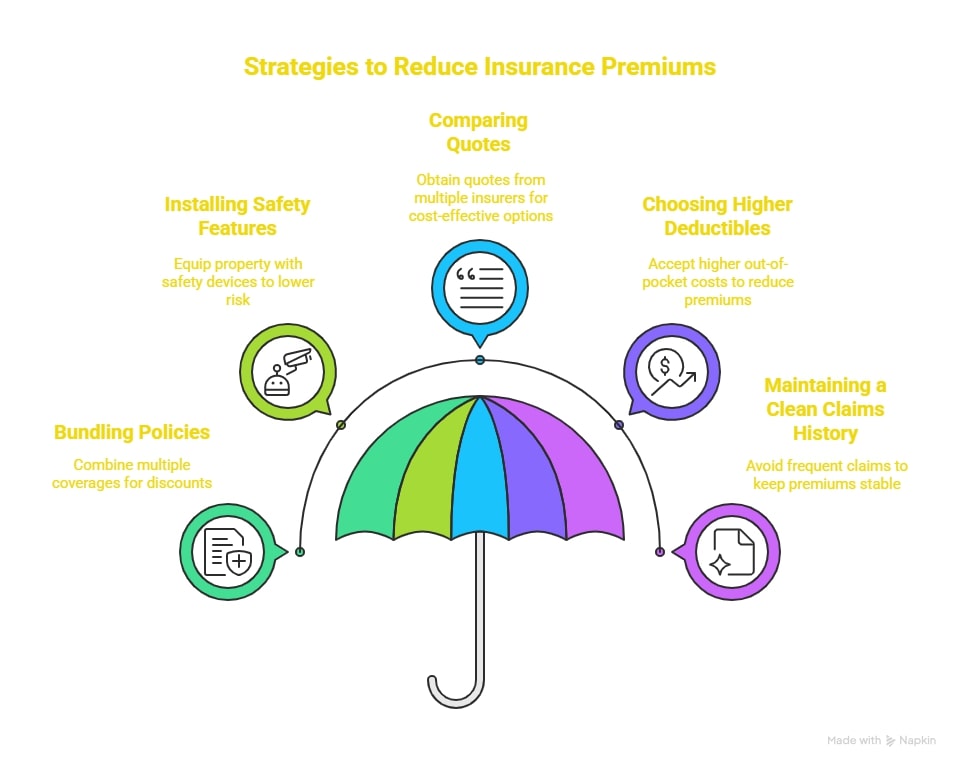

Strategies to Manage Insurance Costs

You can reduce premiums through strategic decisions:

-

Bundling Policies: Combine property, liability, and other coverages with one insurer for discounts.

-

Installing Safety Features: Equip your property with sprinklers, security cameras, and fire alarms to lower risk and premiums.

-

Comparing Quotes: Obtain quotes from multiple insurers to identify cost-effective options.

-

Choosing Higher Deductibles: Accept a higher out-of-pocket cost in the event of a claim to reduce monthly premiums.

-

Maintaining a Clean Claims History: Avoid frequent or frivolous claims to keep premiums stable.

Periodic policy reviews ensure you’re not overpaying for unnecessary coverage. For example, upgrading to energy-efficient systems can lower equipment breakdown risks and premiums.

Apartment Building Insurance Regulations in Texas

Compliance with Texas and Dallas regulations ensures your insurance meets legal and contractual standards.

State-Specific Requirements

While Texas does not mandate apartment building insurance, lenders, landlords, and lease agreements often require it. Policies must adhere to Texas Department of Insurance (TDI) regulations, which govern:

-

Policy Transparency: Insurers must provide clear terms and coverage details.

-

Claims Handling: Insurers are required to process claims fairly and promptly.

-

Consumer Protections: Policies must comply with TDI standards for pricing and coverage scope.

TDI’s 2024 guidelines emphasize timely claim responses and fair settlement practices, protecting policyholders from delays or unfair denials.

Local Considerations in Dallas

Dallas imposes additional requirements:

-

Building Codes: Compliance with local codes may necessitate specific coverages, such as windstorm or fire protection.

-

Urban Risks: Higher crime and traffic increase liability coverage needs, particularly in downtown areas.

-

Weather Risks: Frequent hail and tornadoes require robust property coverage, as Dallas claims rose 18% from 2020 to 2024, per TDI data.

Consult the City of Dallas’s zoning and building departments to confirm any ordinance-driven insurance requirements, such as coverage for public safety features.

Required Filings or Certifications

Certain contracts or municipal regulations may require:

-

Proof of Insurance: Certificates like Form E for lenders or city contracts, verifying coverage.

-

Ordinance Compliance: Adherence to local property management laws, including safety inspections or risk mitigation measures.

An insurance agent familiar with Dallas regulations can help you navigate these requirements and ensure compliance.

[Suggested Visual: Checklist for Texas and Dallas insurance compliance]

Finding Apartment Building Insurance in Dallas, Texas

Selecting the right insurance provider is essential for securing a policy that addresses your property’s needs and complies with local standards.

Local Insurance Agents and Brokers

Local agents offer specialized knowledge of Texas regulations and Dallas-specific risks. Examples of Dallas-based providers include:

-

Thumann Agency.

-

Quote Texas Insurance.

-

Wise Insurance Group.

These agents understand local weather patterns, urban challenges, and regulatory nuances, ensuring your policy is tailored to your property. For instance, they can recommend flood coverage for properties near the Trinity River or liability limits suited to high-traffic areas.

Online Options and Comparison Tools

Online platforms like Insurify, Progressive, or CoverWallet allow you to compare quotes from national and regional insurers. These tools provide quick estimates but may lack the localized expertise of a Dallas agent. When using online options, verify that policies meet Texas and Dallas requirements, particularly for weather-related coverages like hail or flood insurance. Cross-reference online quotes with local agent recommendations for a balanced approach.

Choosing a Dallas-Based Agent

When selecting an agent, prioritize:

-

Experience: Look for a proven track record with multi-family properties.

-

Local Expertise: Ensure familiarity with Dallas’s weather, crime, and regulatory landscape.

-

Professional Affiliations: Seek agents connected to Texas real estate or insurance associations, such as the Texas Apartment Association.

An experienced agent can guide you through policy customization and compliance, saving time and ensuring adequate protection. For example, Thumann Agency in Dallas, Texas, specializes in apartment building insurance, offering tailored solutions for multi-family properties.

The Claims Process for Apartment Building Insurance

Efficiently navigating the claims process minimizes financial and operational disruptions. Understanding each step prepares you for a smoother experience.

Steps to File a Claim

-

Document the Incident: Take photos, compile inventory lists of damaged items, and record details like the date and cause of the event.

-

Notify Your Insurer: Report the claim within 15 days, as required by Texas regulations, to avoid delays or denials.

-

Submit Supporting Evidence: Provide documentation, such as repair estimates or police reports, and cooperate with the insurer’s investigation.

Prompt and thorough reporting accelerates the process. Keep a detailed record of all communications with your insurer.

What to Expect During the Process

Texas regulations outline strict timelines for insurers:

-

Initial Response: Insurers must acknowledge your claim within 15 days.

-

Decision Timeline: After receiving all documentation, insurers have 15 business days to approve or deny the claim.

-

Settlement or Denial: You’ll receive a settlement offer or a detailed explanation of any denial.

An adjuster will assess the damage, often visiting the property to evaluate repair costs. For complex claims, such as those involving multiple units or structural damage, the process may take longer. If you disagree with the insurer’s decision, you can appeal through TDI’s complaint process or seek legal advice.

Common Pitfalls to Avoid

Avoid these mistakes to ensure a successful claim:

-

Delayed Reporting: Late notifications can lead to denials or reduced settlements.

-

Incomplete Documentation: Missing photos, receipts, or repair estimates slows processing.

-

Misrepresenting Details: Exaggerating damages or providing inaccurate information risks fraud allegations and claim rejection.

Maintain organized records and communicate transparently with your insurer to streamline the process.

Risk Management for Apartment Buildings

Proactive risk management reduces claim frequency, lowers premiums, and enhances tenant safety.

Common Causes of Claims

The most frequent claim triggers include:

-

Fire: Sparked by electrical issues, cooking accidents, or external fires.

-

Water Damage: Caused by burst pipes, leaks, or appliance failures.

-

Liability Incidents: Tenant or visitor injuries, such as slips or falls in common areas.

-

Crime: Theft, vandalism, or fraud, particularly in urban Dallas.

-

Weather-Related Damage: Hail, tornadoes, and windstorms, which accounted for 42% of Dallas apartment building claims in 2024, per TDI data.

Understanding these causes helps you prioritize preventive measures and coverage.

Preventive Measures to Reduce Risks

Implement these strategies to minimize risks:

-

Regular Maintenance: Conduct annual inspections of plumbing, electrical, and HVAC systems to identify potential issues.

-

Safety Protocols: Install fire alarms, sprinklers, security cameras, and access control systems to deter crime and accidents.

-

Tenant Education: Provide residents with safety guides and emergency procedures, such as fire evacuation plans or leak reporting protocols.

These measures reduce claim likelihood and signal to insurers that you prioritize risk management, potentially lowering premiums. For example, installing sprinklers can reduce fire-related premiums by up to 15%, per a 2023 NFPA study.

Mitigating Weather-Related Risks in Dallas

Dallas’s severe weather requires targeted preparations:

-

Storm Shutters: Protect windows and doors from hail and wind damage.

-

Secured Fixtures: Anchor outdoor equipment, like HVAC units, to withstand tornadoes.

-

Emergency Plans: Develop protocols for floods, hailstorms, and tornadoes, including tenant communication and evacuation procedures.

Review FEMA’s weather preparedness guidelines and TDI’s recommendations for Dallas-specific risks. For properties in flood zones, ensure landscaping directs water away from buildings to complement flood insurance.

Apartment Building Insurance for Specific Scenarios

Different property types and conditions require tailored insurance approaches to address their unique risks.

New Constructions vs. Existing Buildings

-

New Constructions: Require coverage for construction-phase risks (e.g., builder’s risk insurance) and modern systems. Premiums are typically lower due to updated materials and compliance with current codes.

-

Existing Buildings: Face higher premiums due to aging infrastructure, such as outdated wiring or plumbing. Retrofitting with modern safety features can reduce costs and risks.

For new constructions, ensure your policy transitions smoothly from builder’s risk to standard property coverage upon completion. For older buildings, conduct a structural assessment to identify coverage priorities.

Small vs. Large Apartment Complexes

-

Small Buildings (5 to 10 units): Have lower premiums and simpler coverage needs, focusing on property and liability insurance. These properties face fewer maintenance and liability risks.

-

Large Complexes (20+ units): Require comprehensive policies, including business interruption, equipment breakdown, and higher liability limits, due to increased exposure.

Small buildings benefit from streamlined policies, while large complexes need detailed risk assessments to ensure all systems and amenities are covered. For example, a 50-unit complex with a pool and gym requires higher liability limits than a 6-unit building.

Different Types of Apartment Properties

-

Luxury Apartments: Need higher coverage limits to protect upscale amenities like fitness centers, rooftop terraces, or smart home systems. Replacement costs for high-end fixtures are significant.

-

Student Housing: Faces elevated risks from high tenant turnover and property damage, requiring robust liability and property coverage.

-

Senior Living: Requires specialized coverage for medical equipment, accessibility features, and potential health-related liabilities.

Assess your property’s unique characteristics to ensure your policy addresses specific risks. For instance, student housing may need coverage for vandalism, while senior living facilities prioritize liability for medical emergencies.

Frequently Asked Questions (FAQs)

Is Apartment Building Insurance Required in Texas?

While not legally mandated, lenders, landlords, or lease agreements often require it to secure financing or tenancy contracts.

What Does Apartment Building Insurance Cover?

It covers property damage, liability claims, and loss of rental income. Additional coverages, like flood or crime insurance, may be necessary based on your property’s risks.

How Much Does Apartment Building Insurance Cost in Dallas?

Costs range from $500 to $6,000 per month, with Dallas premiums higher due to urban density and weather risks. Actual costs vary by property size, location, and coverage.

Can I Bundle Apartment Building Insurance with Other Policies?

Yes, combining property, liability, and other coverages with one insurer can reduce costs and simplify management.

How Can I Manage Apartment Building Insurance Costs?

Install safety features (e.g., sprinklers, security systems), compare quotes, bundle policies, or choose higher deductibles to lower premiums.

Does Apartment Building Insurance Cover Flood Damage?

No, standard policies exclude floods. Separate flood insurance through the NFIP or private insurers is required for flood-prone areas.

What Are the Most Common Claims for Apartment Buildings?

Common claims involve fire, water damage, liability incidents, crime, and weather-related damage, such as hail or tornadoes.

How Do I Choose an Insurance Agent for My Apartment Building?

Select an agent with experience in multi-family properties, knowledge of Dallas risks, and affiliations with Texas insurance or real estate associations.

How Long Does It Take to Process an Insurance Claim?

Texas regulations require insurers to respond within 15 days and decide within 15 business days after receiving documentation.

Does Apartment Building Insurance Cover Tenant Belongings?

No, it protects the building and common areas. Tenants need renters insurance to cover personal property.

What Safety Features Can Reduce Insurance Premiums?

Fire alarms, sprinklers, security cameras, and storm shutters lower risks and can reduce premiums by 10 to 20%.

How Often Should I Review My Insurance Policy?

Review annually or after significant changes, such as renovations or new tenants, to ensure coverage remains adequate.

What Happens If I Delay Reporting a Claim?

Late reporting within 15 days may lead to denials or reduced settlements, per Texas regulations.

Can I Get Insurance for a Vacant Apartment Building?

Yes, but vacant properties require specialized policies due to higher risks like vandalism or neglect. Discuss options with an agent.

How Do Dallas Weather Risks Impact Insurance?

Hail, tornadoes, and flooding increase claim frequency, raising premiums. Weather-specific coverages, like windstorm or flood insurance, are critical.

Do I Need Umbrella Insurance for My Apartment Building?

Umbrella insurance is advisable for large complexes to provide additional liability protection beyond primary policy limits.

What Documentation Is Needed for a Claim?

Provide photos, repair estimates, inventory lists, and incident details. Complete and accurate documentation speeds up processing.

How Does Building Age Affect Insurance Costs?

Older buildings with outdated systems face higher premiums due to increased repair risks. Upgrading infrastructure can lower costs.

Conclusion

Apartment building insurance is a fundamental component of responsible property management in Dallas, Texas, protecting against property damage, liability claims, and income disruptions. By understanding the range of coverages property, liability, business interruption, and specialized options like flood or crime insurance you can design a policy that addresses your property’s specific risks. Dallas’s distinct challenges, including severe weather, urban crime, and regulatory requirements, highlight the need for tailored protection. Effective risk management, regular policy reviews, and compliance with Texas and Dallas regulations further strengthen your safeguards.

To ensure your investment is secure, consult an insurance professional to assess your needs and build a comprehensive policy. For expert guidance, contact Thumann Agency in Dallas, Texas, at (972) 991-9100 or visit thumannagency.com to discuss your apartment building insurance options.

Last Updated: 20.07.2025

Author: Lauren Thumann Director of Marketing.

Disclaimer: This page is for educational purposes only. Coverage details vary by provider. Contact us for a personalized quote.