Restaurant Insurance in Dallas, TX

From family-owned diners to fine dining spots, Dallas restaurants face unique risks every day - customer injuries, kitchen accidents, or even food spoilage. That’s why choosing the best restaurant insurance in Dallas TX matters.

Why Choose Us

Choosing the right insurance partner makes all the difference in protecting your restaurant, your staff, and your customers. Here’s why Dallas restaurant owners trust the Thumann Agency:

-

We Shop for You - With partner with 80+ top-rated carriers, to compare quotes and find the best value - saving you time and money.

-

Trusted Risk Advisors - We help you choose coverage that protects your kitchen, staff, and reputation.

-

We're Local - Nearly 30 years serving Dallas restaurants gives us insight into the risks you face.

-

BBB Accredited - Accredited since 2011 with an A+ rating for honesty and reliability.

-

Client-Centered Approach - We focus on what matters to you, delivering solutions that make sense for your business.

Experience the difference of working with an Insurnace agency that understands the risks of the restaurant industry - and works relentlessly to keep you protected.

Essential Insurance for Your Texas Restaurant

Safeguarding your restaurant requires coverage that addresses your risks. Thumann Agency offers restaurant insurance Dallas TX solutions that protect your business and staff. We recommend these core policies:

-

Business Owner’s Policy (BOP): Ideal for quick service restaurant insurance, this combines Commercial property insurance, Business interruption insurance, and liability coverage.

What It addresses:-

Customer injuries, such as slip-and-fall incidents

-

Property damage to your building or equipment

-

Food spoilage losses

-

Income loss during closures from covered events

-

Equipment repair costs

-

-

General liability insurance: Selected by most small businesses.

What it covers:-

Medical payments for customer injuries

-

Damage to third-party property

-

Legal fees and judgments

-

Employment practice claims

-

-

Workers’ compensation insurance:

What it covers:

o Medical expenses related to workplace injuries or illnesses

o Wage replacement for lost income during recovery time

o Rehabilitation costs including physical therapy and vocational retraining

o Disability benefits (temporary or permanent) if the worker is partially or fully disabled

o Death benefits for the employee’s family in case of a work-related fatality

o Legal expenses if the employer faces a lawsuit related to a covered incident

o Ongoing care costs for severe injuries (e.g., long-term nursing or therapy)

-

Commercial Property Insurance:

Commercial property insurance protects your business’s physical assets from damage or loss due to events like fire, theft, or storms.

What It Covers:

o Business buildings and structures

o Office equipment and furniture

o Inventory and stock

o Tools and machinery

o Outdoor signs

o Damage from fire, theft, vandalism, and certain natural disasters

Other Types of Insurance That Restaurants May Need Include:

Our goal is to provide a customized policy that meets your restaurant's unique needs. In addition to general coverage, here are other types of insurance you may want to consider:

- Business Interruption Insurance – Protects your income and helps cover ongoing expenses if your restaurant has to close temporarily due to a fire or natural disaster.

- Commercial Auto Insurance – Covers accidents, vehicle damage, and liability if your restaurant offers delivery services or owns company vehicles.

- Cyber Liability Insurance – Safeguards your business from costs associated with a data breach or cyberattack, protecting both your customer data and your reputation.

- Employment Practices Liability Insurance (EPLI) – Protects your restaurant against employee claims related to wrongful termination, discrimination, or harassment.

- Food Spoilage Insurance – Protects you from financial loss due to spoiled food caused by equipment malfunctions or power outages.

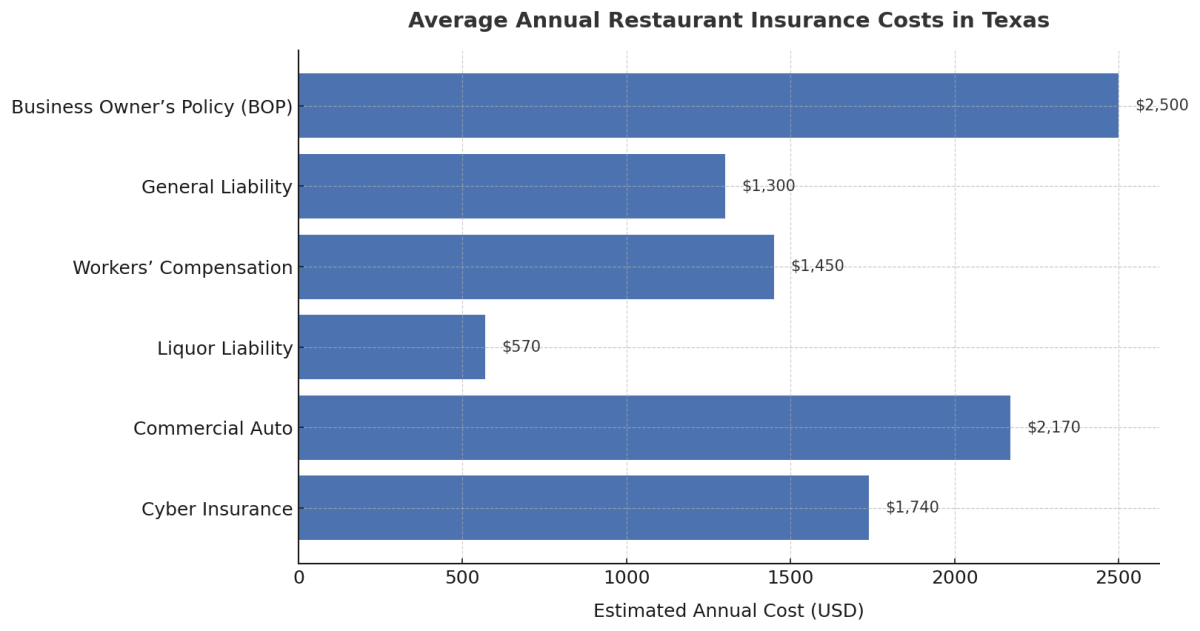

How Much Does Restaurant Insurance Cost in Dallas, TX?

One of the first questions owners ask is: “How much does restaurant insurance cost in Dallas, TX?” The truth is, costs vary depending on your restaurant type, size, staff, and the coverages you choose. On average, restaurant insurance in Texas ranges from $2,000 to $10,000 per year.

To give you a better idea, here’s what typical policies cost in Texas:

-

Business Owner’s Policy (BOP) – Around $2,500 per year

-

General Liability Insurance – Roughly $1,300 annually

-

Workers’ Compensation – About $1,450 annually

-

Liquor Liability – Around $570 annually

-

Commercial Auto Insurance – About $2,170 annually

-

Cyber Insurance – Roughly $1,740 annually

Keep in mind:

-

A small café with limited staff may fall on the lower end of the range.

-

Larger restaurants with delivery services, alcohol sales, or more employees will be toward the higher end.

-

Installing safety systems, training staff, and working with an experienced agency (like Thumann) can help reduce risks and potentially lower your premiums.

Our Comprehensive Approach

At the Thumann Agency, we turn your insurance needs into peace of mind. We guide you through every step of the insurance process, making sure you fully understand your coverage. Here’s how we do it:

-

We Listen First – By truly getting to know your risks and concerns, we create tailored solutions that work for you.

-

Proactive Protection – We help you identify potential risks early and implement strategies to keep your restaurant safe and compliant.

-

Guiding You Through Every Step – Our team makes the process simple, explains your options clearly, and is always here to answer your questions.

Client Testimonials For Our Insurance Services

What People Say About the Thuman Agency

⭐⭐⭐⭐⭐ 4.9 out of 5

-

They do a great job not only of keeping me informed of the best options to fit my needs, they are able to explain it in a way that is easy to understand. As confusing as the insurance world can be, it is great to have someone there to help you maneuver the complexities.

-

It was.a pleasure working with Haley. She was very helpful and courteous on getting us our commercial auto insurance. I will recommend Thumann agency to anyone who needs help with commercial insurance. Thank you!

Frequently Asked Questions

What insurance is needed for a restaurant?

Restaurants in Dallas, TX, typically require a Business Owner’s Policy (BOP), which includes liability, property, and income loss coverage. Employee coverage is mandatory with staff, per state regulations. Alcohol-serving restaurants or those with delivery may need additional policies. These protect against risks like:

-

Property damage: If a server spills soup on a client’s purse and phone, liability coverage can pay for replacements

-

Customer injuries: If a customer slips in your parking lot, liability coverage handles legal fees and damages

-

Alcohol-related incidents: If an intoxicated patron injures another, alcohol coverage addresses legal and medical costs

-

Staff errors: If a customer suffers an allergic reaction due to incorrect ingredient information, liability coverage aids defense

-

Employee injuries: If a cook is burned, employee coverage handles medical costs and wages, often required by law

-

Vehicle incidents: If an employee damages a car with your van, vehicle coverage pays for repairs

-

Facility damage: If a grease fire harms your kitchen, property coverage assists with repairs

How much does restaurant insurance cost per month?

Costs vary by restaurant type, Dallas location, payroll, and coverage. A small café may pay less than a large restaurant with delivery. Thumann Agency offers free quotes in under five minutes, with 24/7 purchase options.

Why is restaurant insurance so expensive?

Premiums reflect risks like customer injuries or alcohol-related incidents. High-traffic Dallas locations or specialized coverage can raise costs. Thumann Agency works with over 80 providers to find budget-friendly options.

What does restaurant insurance cover?

Coverage addresses customer injuries, property damage, and income loss. Additional policies like spoilage, alcohol, or data breach coverage protect against specific risks, ensuring full protection.

Why restaurant owners choose the Thumann Agency

Choosing the right insurance agency can make a significant difference in protecting your restaurant. Here's why the Thumann Agency stands out:

- Access to 80+ Top-Rated Providers – Enjoy the flexibility of choosing from the best in the industry.

- Customized Coverage – Find insurance that fits your unique needs perfectly.

- Expert Guidance – Our team provides personalized advice to help you understand your options.

- Client-Centered Approach – We focus on what matters to you, delivering solutions that make sense for your business.

- Trusted Reputation – Experience a seamless, stress-free insurance process backed by years of client satisfaction and loyalty.

For Your Reference

-

Texas Restaurant Association – A valuable resource for understanding the unique risks and compliance requirements of operating a restaurant in Texas.

(https://www.txrestaurant.org) -

Texas Department of Insurance – For information on business insurance laws and workers' compensation requirements in Texas.

(https://www.tdi.texas.gov) -

National Restaurant Association – Offers insights on industry-wide trends, risks, and best practices.

(https://www.restaurant.org)