With the election coming up, it's natural to wonder how the outcome will affect the markets. There is a belief that a Biden victory coupled with a Democratic Party Senate majority would be bad for the markets. This could tempt some investors to move to the sidelines for the time being.

It’s understandable why people think this. The market responded well to a round of tax cuts in Trumps first term.[i] With a Biden victory and blue wave in Congress, tax rates could rise. There is also a belief among conservatives that Democrats are bad for markets.

So, is one party better for the markets than another?

Retirement Researcher has done some good research in this area. Their research has shown that, in the last 90 years the S&P 500 has performed better under Democratic presidents by 5.8%.[ii]

Of course, drawing a conclusion on this data alone would be an oversimplification. Other factors should also be considered. Such as a lag time for the new president to implement his policies. We could also look at which party controls Congress. And we could consider the evolving of political parties over the years. All of these factors could impact any outcome.ii

When Retirement Researcher solved for a one-year lag, the difference was only 1%.

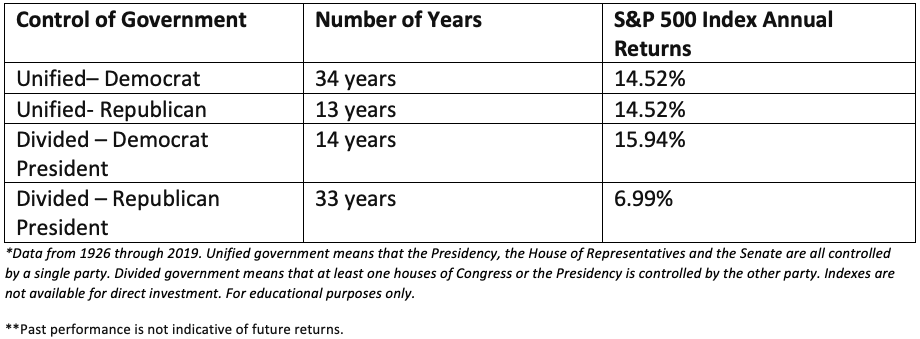

Congress is the body where fiscal policy originates. The party that controls Congress often impacts how effective the President will be in implementing his agenda. It would be meaningful to include this in the data. Retirement Researcher took this into account in the following chart.

A unified government under either party experienced an identical return of 14.52%.

The biggest difference was under a dividend government with a Democratic president. This arrangement outperformed the Republican President under divided government by 9%.

Political outcomes don’t always lineup neatly with party platforms and campaign rhetoric. Democrat Bill Clinton balanced the budget[i] and reformed welfare[ii]. Republican George W. Bush expanded government's role in health care[iii] and education.[iv] It's worth noting that investors have information showing Biden leading already.[v] If a Democratic victory were a detriment to markets, we would see evidence of this now.

This is not to say that there aren’t policies that can be harmful to markets. It's that there isn't evidence that one party is, by itself, to blame.

For investors, timing the markets isn’t a wise decision. Trying to reduce investment decisions to a single factor can lead to bad outcomes or missed opportunities.

However, there are practical actions investors can take. If you’d like to discuss ways to prepare, please email; andrew@thumannagency.com

CRN202210-272522

This article is educational and is not to be construed as advice. The views and opinions expressed are those of Andrew Eppes. Andrew Eppes's views are not necessarily those of Massachusetts Mutual Life Insurance Company, MMLIS or its subsidiaries.

Local firms are sales offices of Massachusetts Mutual Life Insurance Company (MassMutual), and are not subsidiaries of MassMutual or its affiliated companies. Registered representative of and offers securities and investment advisory services through MML Investors Services, LLC. Member SIPC. www.SIPC.org. [14241 Dallas Parkway Suite 1200, Dallas, TX 75254]

[i] https://www.wsj.com/articles/balanced-budgets-and-the-clinton-surplus-11565550697

[ii] https://en.wikipedia.org/wiki/Personal_Responsibility_and_Work_Opportunity_Act

[iii] https://www.cnn.com/2003/ALLPOLITICS/12/08/elec04.medicare/

[iv] https://www.history.com/this-day-in-history/george-bush-signs-no-child-left-behind-act-into-law